Last Updated on April 1, 2024

In global economics, Special Economic Zones (SEZs) emerge as powerful instruments for fostering economic growth and development. Mexico, a country with a rich culture and history, strategically deploys SEZs to amplify its economic prowess. As we delve into the intricacies of SEZs within the Mexican economy, we unravel a narrative of innovation, investment, and opportunity.

What are Special Economic Zones?

SEZs, often hailed as engines of economic transformation, designate specific geographical areas within a country's borders for targeted economic activities. These zones operate under distinct regulatory frameworks, offering businesses a competitive edge through incentives such as tax breaks, streamlined customs procedures, and regulatory flexibility.

Mexico's SEZs play a pivotal role in driving economic diversification and regional development in the Mexican economy. By concentrating resources and infrastructure in designated zones, Mexico cultivates environments conducive to business expansion, foreign investment, and job creation.

Source: International Tax Review

Catalysts of Growth: SEZs in Mexico's Economic Landscape

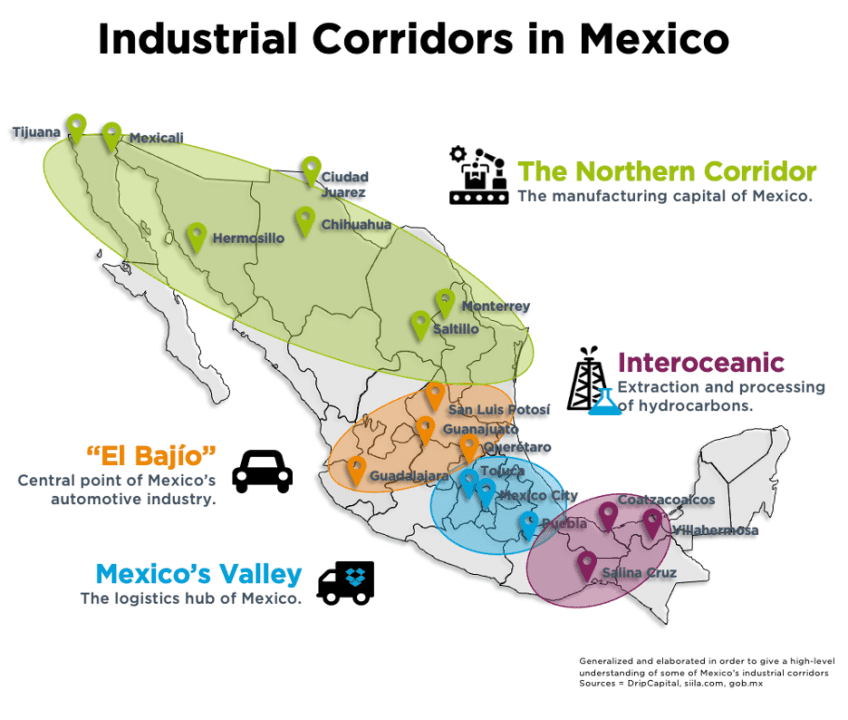

SEZs are driving growth within Mexico's vast economy, propelling various sectors to unprecedented heights. Mexico's economic evolution is reflected in SEZs, from manufacturing hubs on the northern border to burgeoning technology parks throughout the country.

The Northern Industrial Corridor in Mexico borders the United States, thus having a strategic position and advantage for international commerce. For this reason nearly 90% of the country’s maquiladoras are located within the Northern Industrial Corridor, and over 1 million Mexicans work in these 3,000+ maquiladora plants.

LinkedIn

Mexican SEZs serve as magnets for multinational corporations seeking to capitalize on strategic advantages. As a result of their proximity to North American markets and preferential trade agreements, Mexican SEZs become veritable export launchpads.

The Ideal Tax Haven

Consider operating in an aerospace-friendly region like Querétaro. As opposed to the standard 30% corporate income tax rate, here you can pay as little as 0%. Raw materials and machinery can be imported duty-free into Monterrey and Saltillo, hubs for auto parts manufacturing. Moreover, SEZs streamline administrative processes, removing bureaucratic roadblocks so you can focus on growing your business.

The Nexus of Trade and Investment: SEZs Driving Mexico's Export Economy

Trade and investment intersect at the crossroads of SEZs, which are the backbone of Mexico's export-driven economy. As a result of their strategic geographic positioning and robust infrastructure, these zones enable seamless trade flows, resulting in unprecedented export volumes.

Further, SEZs attract foreign direct investment from around the world, attracting capital inflows. As a result of offering incentives and assurances to investors, Mexico cements its position as a premier international investment destination, leading to economic expansion and job creation.

The Mexican government has created an open and secure environment for foreign investors. The ‘Invest in Mexico’ Business Center was established in 2022 to facilitate investments. Land grants or discounts, tax deductions, and technology, innovation, and workforce development funding are commonly used incentives.

Other incentives to encourage foreign investment include:Special Economic Zones (SEZs) were created to attract investment to the economically underdeveloped areas in the southern states of the country. Companies setting up in these SEZs will receive various incentives, trade facilities, duty-free customs benefits, infrastructure development prerogatives and easier regulatory processes.

Santander

SEZs & Sustainable Development: Balancing Economic Prosperity and Environmental Stewardship

Mexico places significant emphasis on sustainable development within its SEZs. The country acknowledges the importance of balancing economic advancement with environmental protection and social equity. As such, Mexico has made a steadfast commitment to integrating sustainability principles into SEZ core operations.

Environmental Stewardship

This commitment is reflected in Mexico's embrace of environmental stewardship and social responsibility within SEZs. Environmental stewardship involves the responsible management and conservation of natural resources, as well as minimizing the ecological footprint of industrial activities within SEZ boundaries. Mexico implements stringent regulations and guidelines to ensure SEZ operations adhere to high safety standards, mitigating pollution, conserving biodiversity, and preserving ecosystems.

Social Responsibility Within SEZs

Moreover, Mexico recognizes the imperative of social responsibility within SEZs. This entails fostering inclusive and equitable development that benefits local communities, workers, and stakeholders. Mexico endeavors to create opportunities for social advancement within SEZs by promoting fair labor practices, investing in workforce development, and engaging with surrounding communities to address their needs and concerns.

The Federal Law on Special Economic Zones (SEZs) provides for the general guidelines for the establishment and operation of these special regions at underdeveloped areas of Mexico that need support and incentives to grow. The law establishes that the analysis would be made to select the regions that should be declared SEZs, and that such areas would have to be considered as an investing priority for the development within Mexico. Following this rationale, the establishment of Mexican SEZs would only be allowed in areas located within the 10 most underdeveloped states of Mexico, and provided such zones have a strategic location for the development of certain economic activities. As provided by the law, a SEZ may only be established within municipalities with less than 500,000 habitants.

Presidencia de la República EPN

Conclusion: Potential to Unlock Immense Growth in the Mexican Economy

Remember, the road to economic prosperity is rarely paved with shortcuts. Mexico's SEZs are an experiment with the potential to unlock immense growth, but only if implemented with careful consideration and unwavering commitment to inclusive development. The journey ahead may be long and winding, but with the right tools and a clear vision, these zones can transform the Mexican economy into a vibrant and sustainable haven for all.

FAQs on Special Economic Zones (SEZs) in Mexico

1. What are the primary objectives of Special Economic Zones (SEZs) in Mexico? SEZs in Mexico aim to stimulate economic growth, attract foreign investment, promote job creation, and foster regional development.

2. How do SEZs contribute to Mexico's export economy? SEZs facilitate streamlined trade processes, offer incentives for export-oriented industries, and attract foreign direct investment, thereby bolstering Mexico's export economy.

3. What measures does Mexico undertake to ensure sustainability within SEZs? Mexico implements policies promoting environmental conservation, renewable energy adoption, and sustainable resource management within SEZs to balance economic growth with environmental stewardship.

4. How do SEZs benefit multinational corporations operating in Mexico? SEZs provide multinational corporations with incentives such as tax breaks, regulatory flexibility, and access to skilled labor, fostering an environment conducive to business expansion and innovation.

5. How does Mexico ensure equitable development and inclusivity within SEZs? Mexico implements programs to promote social inclusion, workforce development, and community engagement within SEZs, ensuring that economic benefits are shared among diverse stakeholders.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about investing in Mexico manufacturing with our curated collection of related blog posts.

- Mexico Rewards Manufacturing Companies That Commit: Here’s Why

- Can Moving Manufacturing to Mexico Really Be Turnkey? Here’s What You Need to Know

- How U.S. Tariffs Are Reshaping Mexico’s Manufacturing Outlook

- 3 Key Benefits of Operating in Mexico’s Border Zone

- Mexico’s Infrastructure: A Key Factor in Outsourcing Decisions

- Tax Incentives and Economic Zones for Manufacturers in Mexico

- Mexico’s Industrial Manufacturing Sector Opportunities for Foreign Investment

- Setting Up an Industrial Manufacturing Facility in Mexico: A Smart Business Move