Mexico Manufacturing Advantage

The Mexico Manufacturing Advantage represents manufacturing companies aiming to increase quality and production while reducing costs.

Get the Mexico Manufacturing Advantage with NovaLink

Mexico Manufacturing Advantage: This choice represents the best of both worlds for manufacturing companies who seek to increase quality and production while reducing costs. One large advantage to made in Mexico manufacturing is its proximity to the United States: thanks to treaties like USMCA, Mexico is the United States’ top trading partner. It ranked No. 1 in total trade value in 2019 with a total of $614.5 billion. Mexico industrial manufacturing is easy and seamless with us. Discover why NovaLink is the premier Mexico contract manufacturing partner.

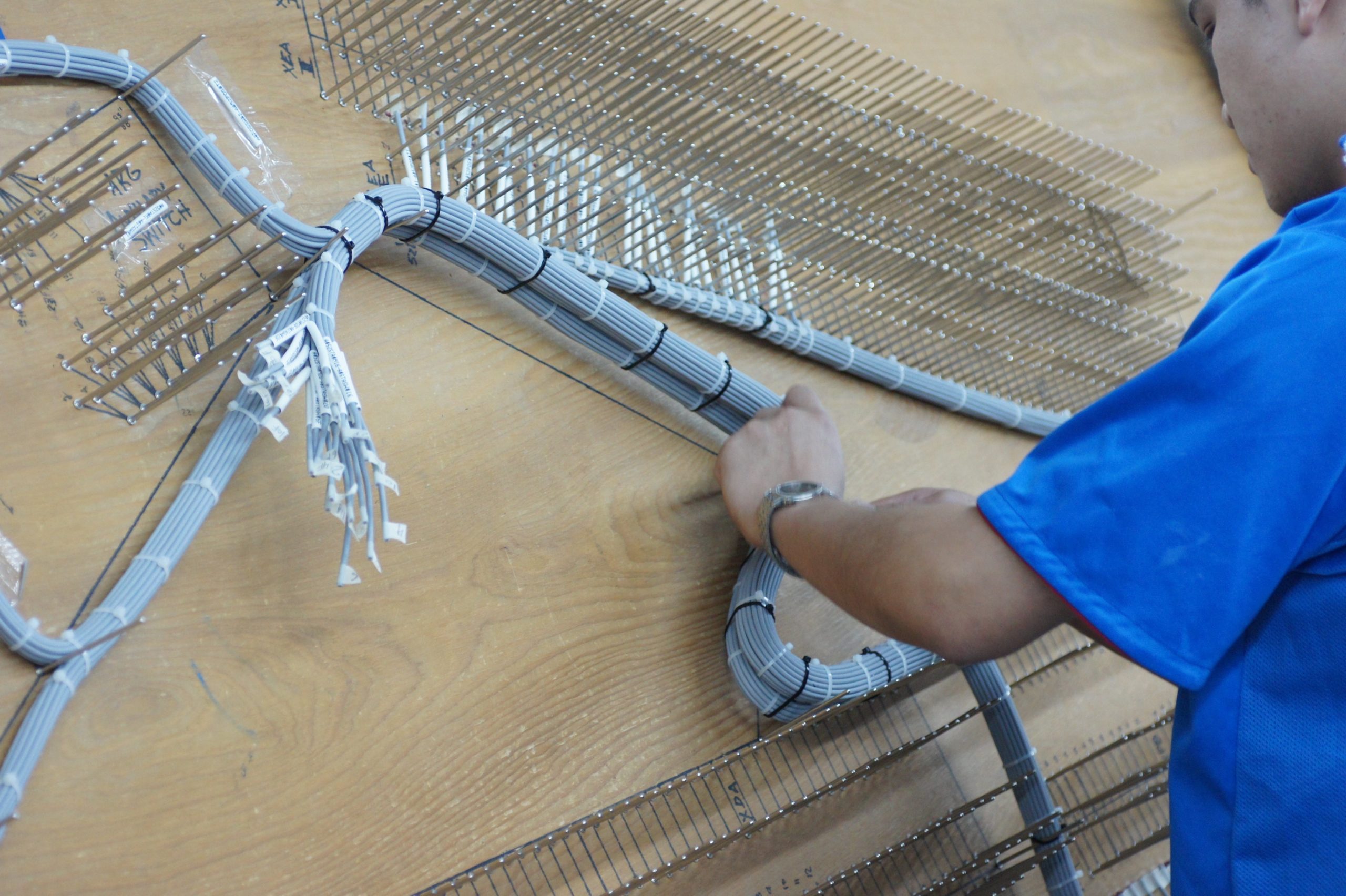

NovaLink Manufacturing Facility Video

NovaLink has released a new video highlighting the versatility of their manufacturing facility in Matamoros, Mexico. In this video, you will be able to see the factory and its associates in action. The video, which was filmed on the floor of the manufacturing facility, illustrates the variety of manufacturing operations and the wide range of skills represented by the workforce. As well as demonstrating NovaLink's commitment to first class manufacturing, the video also emphasizes its commitment to safety protocols for the health of its workers and clients.

Getting Started in Mexico

Our 30 years of experience will make getting started with Mexico manufacturing up and running efficiently and quickly.

Maquiladoras in Mexico

The Maquiladoras Industry in Mexico, is a manufacturing solution created to utilize preferential tariff agreements between the U.S. and Mexico.

Manufacturing in Mexico vs China

When faced with the choice of manufacturing in Mexico vs China, the most popular option may not be the most cost effective. Learn why Mexico is the better choice.

Is Mexico a good place to manufacture?

Mexico offers a competitive advantage for manufacturing due to its strategic location, low labor costs, skilled workforce, and established infrastructure. With its close proximity to the United States and Canada, Mexico is an ideal location for companies seeking to reduce transportation costs and improve supply chain efficiency. Additionally, Mexico's free trade agreements with over 40 countries, including the US and Canada, make it an attractive option for businesses looking to expand globally. Overall, Mexico is a great place to manufacture with a strong track record of success.

Industries That Benefit from the Mexico Manufacturing Advantage

The Mexico manufacturing advantage you get with NovaLink means our skilled workers in our manufacturing factories in Mexico are proficient in producing a wide variety of products for a vast array of industries. Please look at some of the growing manufacturing industries Mexico contract manufacturing serves.

Textiles

The Mexico manufacturing advantage is no more evident than in the textile industry. The textile industry benefits greatly from Maquiladoras, utilized by NovaLink for their textile manufacturing labor, simply because most textile products encompass the traits of a high demand, low automation model. NovaLink is able to skillfully and quickly manufacture the product for startup manufacturing in Mexico, in large volumes, or small custom driven quantities for such companies as Patagonia and Marine Accessories.

Electronics

The Mexico manufacturing advantage is ideal for Manufacturing electronics, which is why many companies manufacturing electronics are choosing to move manufacturing out of China in favor of Mexico. This industry typically requires a skilled, trainable workforce. When paired with a motivated, consistent workforce, Maquiladoras produce tangible, consistent and positive results for the electrical industry. Large operations such as Powell Electrical trust NovaLink to manufacture their products.

Aviation/Automotive

Mexico has success in the automotive and aviation industries. For companies dealing in large volumes in a highly competitive market, product assembly in Mexico is a perfect place to do business. Because the automotive and aviation industries deal in large volumes, the cost advantages coupled with a productive and trainable labor pool make the Maquilador ideal for these industries. NovaLink serves automotive and aviation companies such as Franklin, IMMI and Porter Engineered.

Why Outsourcing Manufacturing to Mexico Makes Sense

Modern businesses are constantly seeking ways to optimize their operations and gain a competitive edge. Mexico is one of the countries that have gained considerable traction in recent years when it comes to outsourcing manufacturing. As a result of its strategic location, skilled labor force, cost advantages, and favorable trade agreements, Mexico offers numerous advantages to companies looking to streamline their production processes.

Common Mexico Manufacturing Myths

There are many misconceptions about manufacturing in Mexico. Below are some common Mexico manufacturing myths; learn the facts and get the Mexico manufacturing advantage for your business.

Myth: Manufacturing in Mexico hurts U.S. workers

False. This is one of the most common manufacturing in Mexico myths. While conceding that many U.S. high-wage manufacturing jobs were relocated to Mexico, China and other foreign locations as a result of NAFTA, Morris Cohen, Wharton professor of operations and information management, argues that NAFTA has, on balance, been a good thing for the U.S. economy and U.S. corporations. “The sucking sound that Ross Perot predicted did not occur; many jobs were created in Canada and Mexico, and [the resulting] economic activity created a somewhat seamless supply chain — a North American supply chain that allowed North American auto companies to be more profitable and more competitive.”

Myth: Mexico is falling further behind China as a manufacturing base for U.S. markets

False. Mexico’s relative competitiveness with China, as a source for U.S. markets, has also received a boost from challenges in China. In recent years, China’s manufacturing wages have been rising absolutely and relative to increases in its productivity. Labor unrest has burst out across China, a phenomenon formerly unknown in the country. This has prompted shifts in manufacturing out of China to low-wage Southeast Asian nations and, for more sophisticated products, to Mexico. While China and other Asian exporting countries are benefiting from the collapse in ocean freight rates, Mexico continues to maintain strong logistical advantages: Geographic proximity, shorter transit time, time zone alignment, accessibility, free trade, cross-border logistics investments (particularly in road and rail), and strong political and social ties with the U.S.

Myth: Trade with Mexico mostly benefits southern and border states

False. While it’s true that Mexico does the most commerce with populous partners such as California and Texas, every single U.S. state participates. Statistics from the Wilson Center Mexico Institute indicate that South Dakota, New Hampshire, and Nebraska send more than 20 percent of their exports to Mexico. As of 2015, Mexico was the second-largest export market for northern states such as Pennsylvania, Michigan, Wisconsin, and Ohio. Detroit, in large part due to synergies in the auto manufacturing market, exports $10.9 billion in goods a year to Mexico, more than any other metropolitan area.

Myth: Mexican-manufactured goods are low quality

False. The Maquiladora, a young and talented worker population with a mean age of 26 years, has demonstrated the capacity to construct sophisticated products. As stated by the Organization for Economic Cooperation and Development (OECD), Mexico’s 3.5 rate in the “technological sophistication level of exported goods” is above the average of OECD exports, higher than Brazil and similar to Asian countries. Every year, 115,000 Mexican engineers are graduated in science and technology careers.

Are You Ready to Begin Manufacturing in Mexico? Contact Us for a Free Consultation

Contact us and let's start building something!

Use the details to the right to contact NovaLink.

Office

6665 Padre Island Highway

Suite B

Brownsville, Texas 78521

Hours

Mon-Fri: 8am - 5pm