Last Updated on July 11, 2023

The U.S. tax reform legislation of 2017 provided companies with an opportunity to repatriate overseas cash at a reduced tax rate, which has prompted many businesses to reconsider their investment strategies. As they ponder over the allocation of this capital, some organizations are choosing to invest in U.S. manufacturing sites, while others are exploring alternative options to mitigate the potential impact of tariffs and penalties on their products. This article delves into the advantages of relocating manufacturing operations to Mexico, particularly with a manufacturing partner like Novalink, and highlights the importance of formulating a comprehensive U.S. manufacturing and tariff strategy.

The Changing Landscape: Tax Reform and Tariffs

The implementation of the 2017 U.S. tax reform legislation significantly lowered the tax rate for companies repatriating overseas cash. The one-time 15.5 percent tax rate, a substantial reduction from the previous 35 percent, has provided businesses with a significant influx of capital. While some organizations have opted to use these funds for stock buybacks, others recognize the value of reinvesting in domestic manufacturing operations.

Simultaneously, the ongoing trade tensions between the United States and China have raised concerns for companies heavily reliant on Chinese imports. With the identification of nearly 6,000 Harmonized Tariff Schedule (HTS) item classifications subject to penalty tariffs ranging from 10 percent to 25 percent, businesses must proactively explore alternative strategies. Although certain products, parts, and raw materials have escaped these penalties thus far, the uncertainty surrounding future tariffs necessitates a careful evaluation of U.S. manufacturing and tariff strategies.

Unlocking the Benefits of Mexico Manufacturing Partnerships

Mexico has emerged as an attractive destination for U.S. companies seeking to optimize their manufacturing operations. Establishing a manufacturing partnership with a reputable organization like Novalink offers numerous advantages that can bolster a company's growth and mitigate risks associated with tariffs.

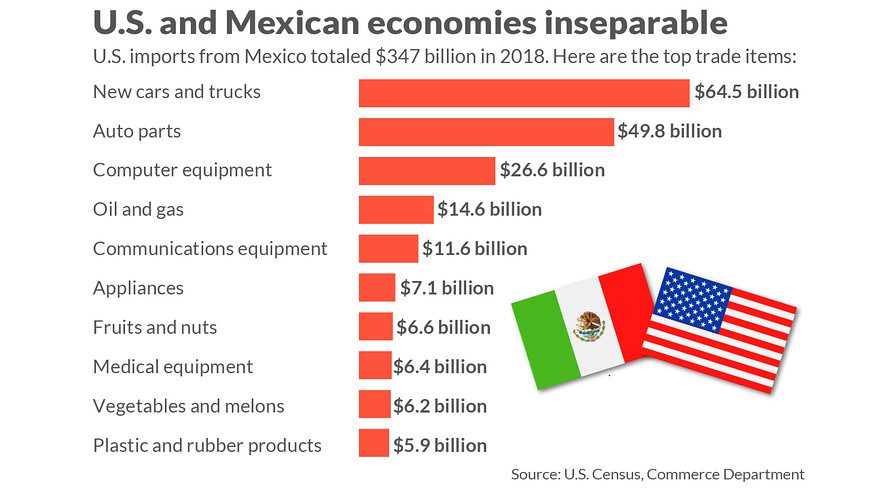

Source: Marketwatch

- Proximity and Supply Chain Efficiency: Mexico's close proximity to the United States allows for streamlined supply chain logistics. With shorter transportation times, companies can significantly reduce lead times and improve responsiveness to market demands. This proximity also facilitates efficient communication and collaboration between U.S. headquarters and Mexican manufacturing facilities.

- Cost-Effective Labor: Mexico offers a cost-effective labor market, with wages that are often lower than those in the United States. This cost advantage allows companies to reduce manufacturing expenses without compromising quality or operational efficiency. By leveraging skilled Mexican labor, businesses can optimize their production processes while simultaneously enhancing their bottom line.

- Skilled Workforce and Manufacturing Expertise: Mexico boasts a well-educated and skilled workforce, particularly in the manufacturing sector. Over the years, the country has developed a strong manufacturing ecosystem, fostering expertise in various industries such as automotive, aerospace, electronics, and medical devices. Collaborating with a manufacturing partner like Novalink allows companies to tap into this pool of talent and leverage their specialized knowledge and experience.

- Free Trade Agreements: Mexico has an extensive network of free trade agreements, including the United States-Mexico-Canada Agreement (USMCA) and agreements with over 50 other countries. These agreements provide companies with preferential access to markets around the world, enhancing their global competitiveness. By manufacturing in Mexico, businesses can take advantage of these trade agreements and expand their reach without incurring additional tariffs or trade barriers.

- Risk Mitigation: Diversifying manufacturing operations by expanding into Mexico provides a strategic risk mitigation measure. By reducing dependence on a single manufacturing location, companies can navigate potential disruptions caused by geopolitical tensions, natural disasters, or trade disputes. Furthermore, with an agile and flexible supply chain, businesses can adapt quickly to changing market dynamics and ensure continuity of operations.

Crafting an Effective U.S. Manufacturing and Tariff Strategy

While moving manufacturing to Mexico offers numerous benefits, it is crucial for companies to develop a comprehensive U.S. manufacturing and tariff strategy to navigate the evolving trade landscape effectively. The following considerations are key to developing such a strategy:

- Tariff Impact Assessment: Conduct a thorough analysis of your product portfolio to identify items susceptible to potential tariff penalties. Evaluate the potential financial impact and consider alternative sourcing options, such as manufacturing in Mexico, to minimize the exposure to future tariffs and penalties.

- Partner Selection: When considering a manufacturing partnership in Mexico, it is imperative to choose a reliable and experienced partner like Novalink. Assess their capabilities, track record, quality control measures, and adherence to international standards. A trusted partner will ensure smooth operations, efficient production, and timely delivery.

- Supply Chain Optimization: Review and optimize your supply chain to accommodate the relocation of manufacturing operations. Identify potential bottlenecks, ensure uninterrupted flow of materials, and establish robust communication channels to facilitate collaboration between the U.S. headquarters and Mexican manufacturing facilities.

- Compliance and Regulatory Considerations: Understand and comply with all relevant regulations and legal requirements when expanding manufacturing operations to Mexico. Familiarize yourself with the customs procedures, trade regulations, and labor laws to ensure seamless cross-border operations.

- Continuous Improvement and Innovation: Leverage the manufacturing expertise and capabilities in Mexico to drive continuous improvement and innovation. Encourage collaboration between your U.S. and Mexican teams, foster knowledge sharing, and embrace best practices to enhance operational efficiency and product quality.

Conclusion

The U.S. tax reform legislation and the unpredictable landscape of tariffs have compelled companies to explore alternative manufacturing strategies. Relocating manufacturing operations to Mexico, in partnership with organizations like Novalink, presents a compelling solution. By leveraging the benefits of proximity, cost-effective labor, skilled workforce, free trade agreements, and risk mitigation, companies can enhance their competitiveness while minimizing the impact of tariffs and penalties. However, it is crucial to formulate a comprehensive U.S. manufacturing and tariff strategy to navigate the evolving trade environment successfully. By considering factors such as tariff impact assessment, partner selection, supply chain optimization, compliance, and continuous improvement, companies can maximize the benefits of Mexico manufacturing partnerships and secure a prosperous future in the global marketplace.

FAQ's on Relocating Manufacturing Operations to Mexico as a Tariff Strategy

Q1: What is the U.S. manufacturing tariff strategy?

A1: The U.S. manufacturing tariff strategy refers to the approach adopted by the United States government to impose tariffs on certain imported goods. The strategy aims to protect domestic industries, promote domestic manufacturing, and address trade imbalances with other countries.

Q2: How do tariffs impact U.S. manufacturers?

A2: Tariffs can impact U.S. manufacturers in several ways. They can increase the cost of imported raw materials, components, and finished goods used in production. This can lead to higher production costs, reduced competitiveness, and potential price increases for consumers. Additionally, tariffs may disrupt global supply chains, affecting the availability and affordability of essential inputs for manufacturing.

Q3: Are there any exemptions or exclusions available for U.S. manufacturers regarding tariffs?

A3: Yes, exemptions or exclusions may be available for U.S. manufacturers regarding tariffs. The U.S. government has implemented processes to allow companies to request exemptions or exclusions for certain products, particularly if they are not available domestically or if there are specific circumstances that warrant an exemption. Manufacturers can explore these options to mitigate the impact of tariffs on their operations.

Q4: How can U.S. manufacturers navigate the challenges posed by tariffs?

A4: U.S. manufacturers can navigate the challenges posed by tariffs by adopting various strategies. These include exploring alternative sourcing options from countries not subject to tariffs, seeking tariff exemptions when applicable, optimizing supply chain logistics to minimize tariff impacts, diversifying customer bases and markets, and investing in research and development to enhance competitiveness and innovation.

Q5: Can nearshoring to Mexico be a strategy for U.S. manufacturers to mitigate the impact of tariffs?

A5: Yes, nearshoring to Mexico can be a strategy for U.S. manufacturers to mitigate the impact of tariffs. By establishing manufacturing operations in Mexico, U.S. manufacturers can benefit from the proximity to their primary market while avoiding tariffs imposed on imports from other countries. Nearshoring to Mexico offers advantages such as reduced transportation costs, shorter lead times, and preferential trade agreements like the United States-Mexico-Canada Agreement (USMCA), contributing to cost savings and enhanced competitiveness.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.