Last Updated on July 11, 2023

Mexico has become an important player in the global manufacturing industry, attracting significant foreign investment and contributing to the growth of the country's economy. As a result, the manufacturing sector in Mexico is constantly evolving, and businesses operating in the country need to stay up to date with the latest trends to remain competitive. Here are the five most important manufacturing trends in Mexico manufacturing.

Top 5 Manufacturing Trends in Mexico Manufacturing You Need to Know

Automation and Industry 4.0

Automation and Industry 4.0 technologies are rapidly transforming the manufacturing industry in Mexico. Businesses are increasingly adopting automation solutions to improve efficiency, reduce costs, and increase productivity. This trend is particularly evident in the automotive sector, which is one of the largest manufacturing industries in Mexico. Industry 4.0 technologies such as IoT, AI, and machine learning are also becoming more prevalent, enabling businesses to collect and analyze data to optimize their operations.

According to Mexico Business News:

Mexico is developing into an advanced manufacturing sector, focusing on certain technologies, such as robotics, the Internet of Things (IoT), artificial intelligence (AI), 3D printing or additive manufacturing, automation and digitalization, cyber-physical systems, fifth-generation wireless technologies, autonomous vehicles, cloud computing, and big data, quantum computing and nanotechnology.

Green Manufacturing and Sustainability

Mexico's manufacturers are increasingly focusing on green manufacturing and sustainability. This includes adopting eco-friendly practices such as energy efficiency, waste reduction, and the use of renewable materials. This trend is being driven by a combination of factors, including consumer demand for eco-friendly products, government regulations, and the need to reduce costs by optimizing resource usage. As a result, businesses are adopting sustainable manufacturing practices such as using renewable energy, reducing waste, and recycling materials. The practice of sustainability is being enforced by the U.S., Mexico, Canada Agreement (USMCA) treaty:

USMCA commits the United States, Canada and Mexico to take actions to combat and cooperate to prevent trafficking in timber and fish and other wildlife. For the first time in a U.S. trade agreement, the USMCA also addresses other pressing environmental issues such as air quality and marine litter.

Nearshoring

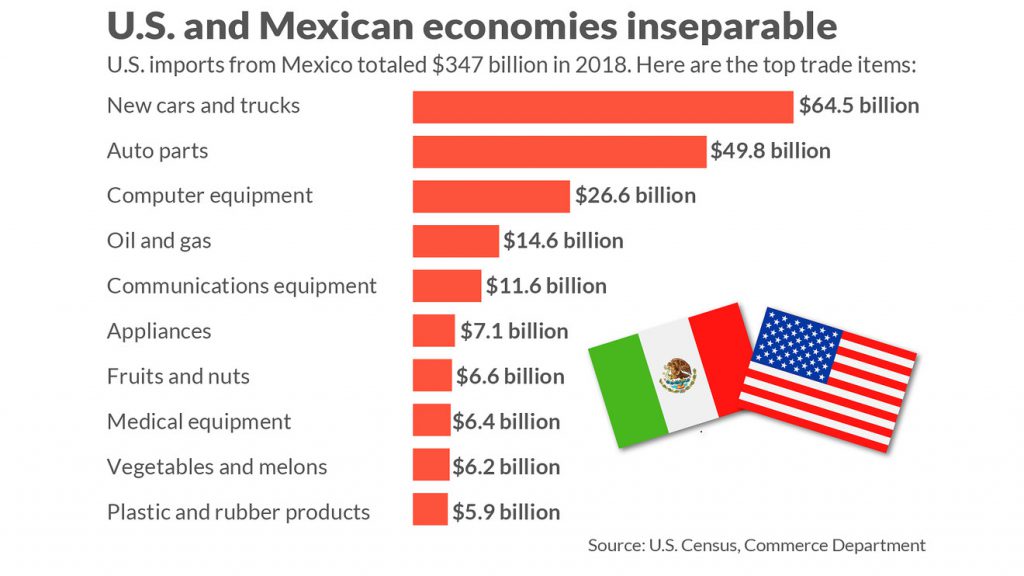

Nearshoring is the practice of moving manufacturing operations closer to the end market, rather than outsourcing to countries further afield. This shift is driven by factors such as shorter supply chains, lower shipping costs, and the desire to be closer to the US market. Mexico is an attractive location for nearshoring due to its proximity to the United States, which is the largest consumer market in the world.

Supply Chain Brain writes:

Supply chain disruptions have brought a lot of talk of nearshoring and offshoring, and these are compelling propositions for many reasons. Shipping rates on transpacific routes increased six-fold or more in the last two years and show signs of remaining volatile. Wages have risen in China and other Southeast Asian countries favored by U.S. retailers and original equipment manufacturers. Add in tight transportation capacity overall, wild swings in consumer demand, a war in Ukraine and a pandemic that continues to close downwhole geographical regions, and a change in strategy seems inevitable.

Growth in Key Industries

Certain industries are experiencing significant growth in Mexico's manufacturing sector, including automotive, aerospace, electronics, and medical devices. This growth is driven by factors such as foreign investment, government support, and the country's strategic location. The automotive industry is one of the largest and most important manufacturing sectors in Mexico. The industry is expected to continue to grow in the coming years, driven by demand for Mexican-made vehicles in the United States and other countries.

Workforce Development

The Mexican government and private sector are investing in technical education and training programs to develop a skilled workforce for the manufacturing industry. This includes partnerships with universities and technical institutes, as well as on-the-job training and apprenticeship programs. A number of factors are driving this trend, including the need to adapt to new technologies, the need to attract and retain talent, and the need to comply with changing regulations. Increasingly, businesses are investing in training and development programs in order to upskill their employees and ensure they are prepared to meet the demands of the future.

A Rapid Transformation Is Taking Place in the Mexican Manufacturing Industry

In conclusion, the manufacturing industry in Mexico is evolving rapidly, and businesses need to stay up to date with the latest trends to remain competitive. Automation and Industry 4.0, sustainability, nearshoring, digital transformation, and workforce development are the five most important manufacturing trends in Mexico manufacturing. By adopting these trends, businesses can optimize their operations, reduce costs, and enhance their competitiveness in the global marketplace.

FAQs on The Five Most Important Manufacturing Trends in Mexico Manufacturing

Q1: What are the five most important manufacturing trends in Mexico?

A1: The five most important manufacturing trends in Mexico are:

- Industry 4.0 and Digital Transformation: The integration of advanced technologies like automation, artificial intelligence, and data analytics to optimize manufacturing processes and enhance productivity.

- Nearshoring and Reshoring: The shift of manufacturing operations closer to the target market, such as the United States, to benefit from reduced transportation costs, faster time-to-market, and increased flexibility.

- Supply Chain Resilience: A focus on building resilient supply chains through diversification, agility, and risk mitigation strategies to navigate global disruptions and ensure continuity.

- Sustainability and ESG Practices: Incorporating environmentally sustainable practices and meeting Environmental, Social, and Governance (ESG) standards to address growing consumer and regulatory demands for responsible manufacturing.

- Skilled Workforce Development: Investing in training programs and education initiatives to develop a highly skilled workforce capable of handling advanced technologies and meeting evolving industry demands.

Q2: How does Industry 4.0 and digital transformation impact manufacturing in Mexico?

A2: Industry 4.0 and digital transformation have a significant impact on manufacturing in Mexico. These technologies enhance efficiency, increase productivity, and enable advanced data analytics for better decision-making. They also improve quality control, reduce costs, and streamline operations. Adopting these technologies positions Mexican manufacturers at the forefront of innovation and competitiveness in the global market.

Q3: What are the advantages of nearshoring and reshoring in Mexico's manufacturing sector?

A3: Nearshoring and reshoring in Mexico offer several advantages. These include reduced transportation costs, shorter lead times, improved supply chain visibility, easier collaboration, and increased flexibility to adapt to changing market demands. Proximity to the United States, a skilled workforce, and favorable trade agreements further contribute to Mexico's attractiveness as a nearshoring and reshoring destination.

Q4: How does supply chain resilience impact manufacturing in Mexico?

A4: Supply chain resilience plays a crucial role in Mexico's manufacturing sector. By building resilient supply chains, manufacturers can effectively respond to disruptions, such as natural disasters or trade uncertainties. Diversifying sourcing, enhancing agility, and implementing risk mitigation strategies help ensure continuity of operations, minimize downtime, and maintain customer satisfaction.

Q5: Why is the development of a skilled workforce important for manufacturing in Mexico?

A5: The development of a skilled workforce is vital for manufacturing in Mexico. As the industry evolves, advanced technologies and automation require workers with specialized knowledge and expertise. Investing in workforce development programs ensures a talent pool capable of operating and maintaining complex machinery, implementing digital solutions, and driving innovation. A skilled workforce strengthens Mexico's manufacturing competitiveness and positions it as a leader in the global market.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.