Last Updated on February 26, 2024

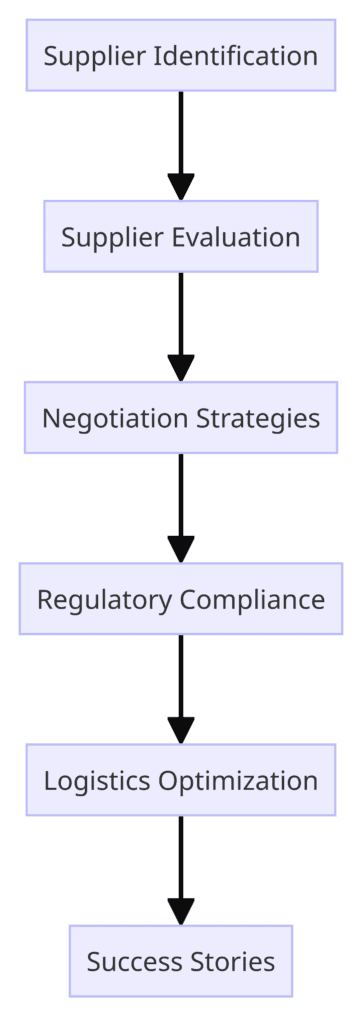

In the dynamic landscape of manufacturing, strategic sourcing plays a pivotal role in optimizing operations and ensuring sustainable growth. This comprehensive guide explores strategic sourcing for manufacturing in Mexico. Unraveling the intricacies, we delve into the key components that contribute to a successful sourcing strategy.

Understanding Strategic Sourcing

Defining Strategic Sourcing

Strategic sourcing extends beyond mere procurement; it involves a systematic and proactive approach to identifying, evaluating, and selecting suppliers. In strategic sourcing for manufacturing in Mexico, this approach is paramount for efficiency and cost-effectiveness.

Key Components of Strategic Sourcing

- Supplier Identification: Thoroughly researching and identifying potential suppliers is the first step. Supplier identification is critical to procurement and supply chain management. The process involves thoroughly researching and identifying potential suppliers. Leveraging local networks and global connections can enhance this process by ensuring a diverse pool of reliable partners.

- Supplier Evaluation: Implementing a robust evaluation process is crucial to effective supplier management. This process involves establishing clear criteria for assessing suppliers, covering various aspects such as quality standards, production capacity, and logistical capabilities.

- Negotiation Strategies: Negotiating terms is an art. Effectively negotiating terms in the Mexican manufacturing landscape requires a nuanced approach that considers cultural nuances and market dynamics.

Both procurement and supply chain management involve the sourcing and acquisition of goods and services. They both require sound supplier management practices, including supplier evaluation, selection, negotiation, and relationship management. Additionally, both functions aim to optimize costs and ensure the timely delivery of goods or services.

However, there are distinct differences between procurement and supply chain management. Procurement focuses primarily on the acquisition process, while supply chain management takes a holistic approach, encompassing various functions such as production, transportation, and customer service. Procurement is more transactional, while supply chain management is strategic and operational.

Tradogram

Streamlining the Sourcing Process in Mexico

Navigating the Regulatory Landscape

Mexico's regulatory environment can be intricate, and understanding the key components of the regulatory landscape is crucial for businesses involved in sourcing. Here's a breakdown of the legal aspects, including compliance requirements, tariffs, and trade agreements that impact strategic sourcing for manufacturing in Mexico:

- Compliance requirements:

- Legal Structure and Registration: Before engaging in sourcing activities, businesses must establish the appropriate legal structure and register with the relevant authorities. This includes obtaining a tax identification number (RFC) and complying with corporate governance regulations.

- Labor Laws: Compliance with Mexican labor laws is essential. This involves understanding regulations related to employment contracts, working hours, wages, benefits, and occupational health and safety standards.

- Environmental Regulations: Companies operating in Mexico must adhere to environmental regulations. This includes obtaining the necessary permits, managing waste responsibly, and complying with pollution control measures.

- Tariffs and Customs Duties:

- Import Duties: Mexico has a tariff system that imposes duties on imported goods. The Harmonized System (HS) is used to classify products, and businesses must know the applicable tariff rates for their imported goods.

- Valuation of Goods: Understanding valuation methods for imported goods is crucial. Mexican customs authorities set the rules for import duties.

- Free Trade Agreements (FTAs): Mexico has several FTAs in place, which impact tariff rates. For example, the United States-Mexico-Canada Agreement (USMCA) replaces the North American Free Trade Agreement (NAFTA) and has specific origin rules that affect duty-free access to markets.

- Trade agreements:

- USMCA (formerly NAFTA): USMCA is a significant trade agreement involving Mexico, the United States, and Canada. It outlines rules for trade, investment, and intellectual property, impacting sourcing strategies and supply chain decisions.

- Pacific Alliance: Mexico is part of the Pacific Alliance, a trade bloc that includes Chile, Colombia, and Peru. This agreement facilitates trade and economic integration among its member countries.

- European Union-Mexico Global Agreement: Negotiations for an updated trade agreement between the European Union and Mexico have taken place, impacting trade relations and market access.

- Regulatory agencies:

- Federal Commission for Protection Against Sanitary Risks (COFEPRIS): Responsible for regulating and approving health products, including pharmaceuticals and medical devices.

- National Water Commission (CONAGUA): Regulates water usage and environmental impact related to water resources.

- National Institute of Copyright (INDAUTOR): Manages intellectual property rights, including patents and trademarks.

- Intellectual Property Rights:

- Protection of Intellectual Property: Businesses must know intellectual property laws in Mexico to protect trademarks, patents, copyrights, and trade secrets.

- National Institute of Copyright (INDAUTOR): This agency oversees copyright matters in Mexico.

- Regulatory Changes and Updates:

- Monitoring Regulatory Changes: Mexico's regulatory environment may change. Businesses should regularly monitor updates, amendments, and updated regulations to ensure ongoing compliance.

Logistics and Supply Chain Optimization

Efficient logistics are crucial to sourcing operations, and optimizing supply chain logistics in Mexico involves addressing various intricacies. Here, the emphasis is placed on factors such as proximity, transportation modes, and distribution channels.

Proximity and Regional Considerations:

- Local Sourcing: Proximity to suppliers is a key consideration. Locating suppliers in close proximity can reduce lead times, transportation costs, and logistical complexities.

- Regional Clusters: Identify regional industrial clusters in Mexico. Clusters often emerge due to geographical advantages, specialized labor pools, and access to resources, making them strategic for sourcing.

- Transportation Modes:

- Multimodal Transport: Mexico has a well-developed transportation infrastructure, including road, rail, and sea routes. Utilize multimodal transport solutions to optimize cost and efficiency.

- Cross-border transportation: Given Mexico's proximity to the United States, cross-border transportation is common. Understand the requirements and challenges of transporting goods across borders, including customs procedures and documentation.

- Distribution Channels:

- Strategic Distribution Centers: Establish strategic distribution centers in key locations. These centers can serve as hubs for efficient storage, sorting, and distribution of products.

- Last-Mile Delivery: Consider last-mile delivery options for timely and cost-effective distribution to end consumers. Collaborate with local logistics partners to navigate urban and rural delivery challenges.

- Customs Compliance:

- Customs Brokerage Services: Engage with experienced customs brokerage services to navigate customs procedures. Efficient customs clearance is critical to avoiding delays and smooth goods flow.

- Understanding Trade Agreements: Leverage knowledge of trade agreements, such as the USMCA, to benefit from preferential tariff rates and streamlined customs processes.

- Technology Integration:

- Advanced Tracking Systems: Implement advanced tracking systems for real-time visibility into goods movement. This enhances decision-making and allows proactive issue resolution.

- Supply Chain Management Software: Utilize supply chain management software to optimize inventory levels, streamline order fulfillment, and improve overall visibility across the supply chain.

- Collaboration with Local Partners:

- Local Logistics Providers: Partner with local logistics providers with in-depth Mexican market knowledge. Local expertise can be invaluable in navigating regulatory requirements and understanding regional nuances.

- Collaboration with Third-Party Logistics (3PL) Providers: Engage with 3PL providers to benefit from their expertise in managing logistics operations. This can include outsourcing warehousing, transportation, and distribution functions.

- Infrastructure Assessment:

- Evaluate Infrastructure: Assess potential sourcing locations' infrastructure capabilities. Access to well-maintained roads, ports, and railways smooths logistics operations.

- Warehousing Facilities: Ensure adequate warehousing facilities with modern technology for efficient storage and inventory management.

Conclusion

In conclusion, mastering strategic sourcing for manufacturing in Mexico is a game changer. This guide equips businesses with actionable insights, empowering them to navigate the complexities and unlock success in the dynamic landscape of Mexican manufacturing.

Frequently Asked Questions

- What is the significance of strategic sourcing in Mexican manufacturing?

- Strategic sourcing is crucial in Mexico as it ensures operational efficiency and cost-effectiveness by systematically identifying and selecting reliable suppliers.

- How do you navigate the complex regulatory landscape in Mexico?

- Our guide breaks down the regulatory environment, providing a clear understanding of compliance requirements, tariffs, and trade agreements affecting the sourcing process.

- What criteria should be considered during supplier evaluation?

- Supplier evaluation should cover aspects like quality standards, production capacity, and logistical capabilities, ensuring a comprehensive assessment.

- Why is negotiation strategy important in the Mexican manufacturing landscape?

- Effective negotiation strategies, tailored to cultural nuances and market dynamics, are essential for securing favorable terms with suppliers.

- How can businesses optimize logistics and supply chains in Mexican manufacturing?

- The guide explores the intricacies of logistics optimization, emphasizing factors like proximity, transportation modes, and distribution channels for success in Mexican manufacturing.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about reshoring to Mexico with our curated collection of related blog posts.

- Can Moving Manufacturing to Mexico Really Be Turnkey? Here’s What You Need to Know

- What Type of Company Should Not Move to Mexico?

- Stop Waiting: Mexico Product Manufacturing Is Ready When You Are

- 3 Hidden Costs You’re Avoiding by Manufacturing in Mexico (And Why It Matters)

- What Your CFO Needs to See Before Approving a Move: Why Moving Manufacturing from China to Mexico Makes Dollars and Sense