Last Updated on July 9, 2025

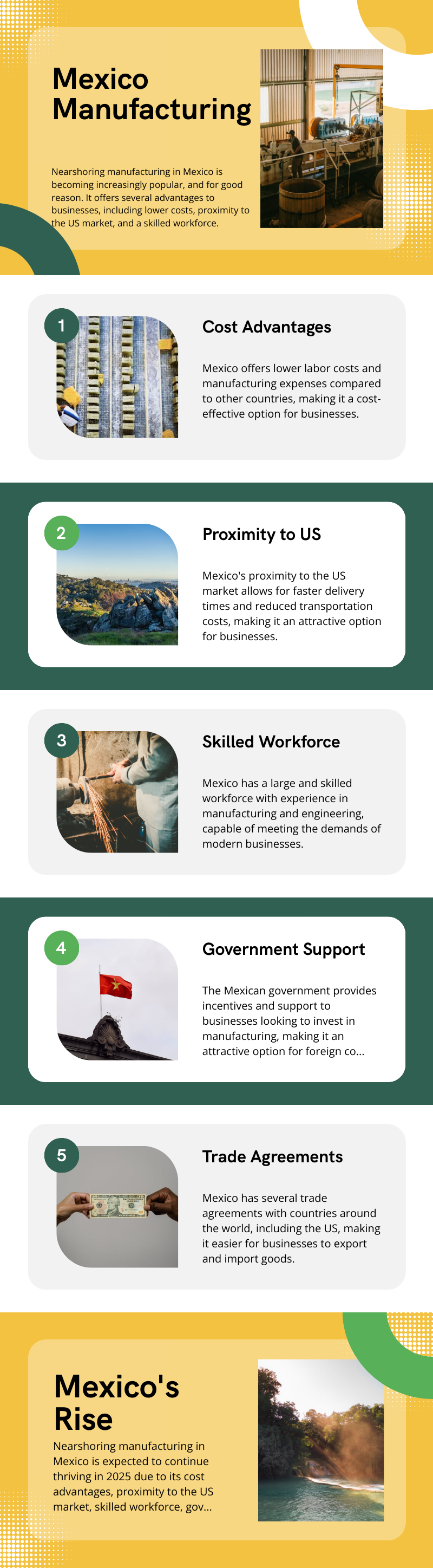

When it comes to manufacturing, Mexico has proven to be more than just a neighbor to the U.S.—it’s a strategic partner. But with ongoing tariff discussions, you might wonder: will the nearshoring manufacturing in Mexico lose steam in 2025? The short answer is no. In fact, it’s set to grow. Let’s unpack why companies will continue to flock south of the border despite trade tensions.

An Economic Boost: A Once-in-a-Generation Opportunity

These developments have been seen as a significant opportunity for Mexico—one that can supercharge the country’s economic growth across different sectors. In fact, nearshoring can help Mexico add an additional 3% to its GDP in the next five years. This isn’t just about incremental gains; it’s a transformational shift that positions Mexico as a major player in the global economy.

Proximity: The Power of Being Next Door

Let’s face it, distance matters. Whether you're shipping auto parts or textiles, cutting down transit time is a game-changer. With Mexico, U.S.-based companies enjoy same-day delivery options that aren't possible with overseas suppliers. And in an era of global supply chain unpredictability, isn't it better to have your production closer to home?

Sure, tariffs can increase costs, but they don’t cancel out Mexico’s geographical advantage. Think about the time saved in logistics, reduced carbon footprints, and quicker response times. For businesses chasing efficiency, Mexico is the go-to nearshoring destination.

What Disruptions to Logistics Have Occurred, and How Have They Impacted Transportation Costs?

The global logistics landscape has faced unprecedented challenges recently, significantly affecting transportation dynamics. Notably, there has been a severe shortage of shipping containers, hindering the seamless movement of goods internationally. Compounding this issue is the staggering rise in maritime shipping costs, which have surged dramatically—exceeding a 500% increase in some instances.

These disruptions have effectively inflated overall transportation expenses, making it more costly for businesses to move products across oceans. This escalation impacts every level of the supply chain, from manufacturers to end consumers, and has prompted a re-evaluation of logistics strategies globally. Companies are now compelled to explore alternative shipping methods and routes, adapt to fluctuating freight costs, and even reconsider the placement of manufacturing sites closer to consumer markets to mitigate the effects of such logistical challenges.

Tariffs: A Speed Bump, Not a Roadblock

Are tariffs annoying? Definitely. Are they a dealbreaker? Hardly. Companies operating in Mexico have found clever ways to mitigate the impact. For instance, many strategically source materials locally or leverage Mexico’s trade agreements with countries worldwide. Plus, let’s not forget that tariffs shift with political winds. Betting on Mexico often proves a long-term win, regardless of short-term policy changes.

However, there's more to the story. One significant factor to consider is the rule of law in Mexico, which poses a challenge to fully capitalizing on nearshoring opportunities. According to a survey, almost 80% of business leaders see it as a major obstacle to attracting the desired levels of foreign direct investment (FDI). It's crucial to address these perceptions and work towards strengthening the legal framework to create a more favorable investment climate.

To maximize nearshoring benefits, Mexico might need to reinforce domestic growth sources and foster conditions that attract investors. By tackling these systemic issues, alongside managing tariffs, Mexico can solidify its position as a prime destination for international businesses looking to nearshore operations.

Trump's tariff threats will continue to generate market volatility, Romano said. However, he cautioned that they were likely a bargaining strategy by Trump to kick off trade negotiates and unlikely to actually be imposed. - Reuters News Service

Here’s the thing: even with tariffs, production costs in Mexico are typically lower than in the U.S. and many other countries. Add in skilled labor, robust infrastructure, and favorable exchange rates, and the scales tip even further in Mexico’s favor.

Navigating Regulatory and Compliance Standards

If you're eyeing Mexico as your manufacturing hub for U.S. exports, regulatory compliance isn't just a box to check—it's a critical part of the process. Manufacturers in Mexico frequently need to align with U.S. and international standards like UL (Underwriters Laboratories), ANSI (American National Standards Institute), and CSA (Canadian Standards Association) to ensure their products sail smoothly across the border.

For most companies, this means keeping tabs on shifting regulations, understanding the nuance between local and U.S. requirements, and partnering with certified labs for product testing and documentation. The good news? Mexico’s manufacturing sector has developed robust expertise in managing these standards, giving exporters a smoother path to U.S. shelves. With support from established certification bodies and experience navigating everything from product labeling to material sourcing, nearshoring to Mexico delivers compliance confidence alongside cost savings.

How Have US Tariffs on China Influenced Nearshoring?

The imposition of US tariffs on Chinese goods in 2018 marked a significant shift in global trade dynamics. Businesses that relied heavily on Chinese manufacturing were faced with increased costs, compelling them to seek alternative strategies to maintain profitability. One such strategy has been nearshoring.

Why Nearshoring?

- Cost Efficiency: With tariffs driving up expenses, many companies found that relocating production closer to home helped mitigate these costs. By nearshoring to countries like Mexico or Canada, businesses took advantage of reduced shipping expenses and labor costs, offsetting the financial strain imposed by the tariffs.

- Supply Chain Resilience: Beyond just cost, nearshoring has enhanced supply chain flexibility. By moving operations closer to the US, companies have managed to reduce lead times and improve response agility, allowing for quicker adaptation to market changes.

- Risk Mitigation: The tariffs highlighted the vulnerabilities of over-reliance on a single country for production. Nearshoring diversifies risk and reduces the geopolitical dependencies that can disrupt supply chains.

The Broader Impacts

- Economic Opportunities for Neighbors: The shift towards nearshoring has created significant economic opportunities for neighboring countries. Industries in these regions have seen a surge in demand, driving growth and fostering closer trade relationships.

- Innovation and Collaboration: As companies establish operations in closer proximity, the potential for innovation and collaboration rises, often resulting in more sustainable and tech-driven manufacturing processes.

In summary, the US tariffs on China have acted as a catalyst for businesses to reevaluate their production strategies, leading to a notable increase in nearshoring as firms strive to grow stronger, more adaptable, and cost-efficient supply chains.

Labor: Skilled, Affordable, and Abundant

Finding workers who know their stuff—without breaking the bank—can feel like striking gold. Mexico offers a deep talent pool, particularly in sectors like automotive, electronics, and textiles. Workers are not just skilled; they’re also familiar with U.S. markets. This alignment simplifies production and reduces errors.

But here’s a twist: it’s not just about saving money. Companies often rave about Mexican laborers' work ethic and adaptability. It’s a win-win, blending cost-effectiveness with quality output. Can tariffs really overshadow that? We think not.

Demographic Trends: Mexico’s Youth Advantage

Mexico’s workforce brings another ace up its sleeve: youth. With an average age of just 29—roughly a decade younger than in the U.S.—Mexico boasts a dynamic, growing labor force while the American workforce confronts mass retirements among Baby Boomers. This youthful demographic isn’t just about numbers; it creates a pipeline of motivated, tech-savvy workers eager to upskill and meet evolving manufacturing needs. For manufacturers, that’s a long-term advantage you simply can’t ignore.

The Bilingual Advantage: Smoother Cross-Border Operations

One often-overlooked superpower in cross-border manufacturing? Seamless communication. Bilingual support teams bridge the gap between the U.S. and Mexico, eliminating language barriers that might otherwise result in misunderstandings, delays, or costly errors. Whether you’re hashing out contract details, troubleshooting a production hiccup, or simply managing day-to-day workflow, teams that can effortlessly switch between languages keep everything running smoothly.

This linguistic fluency doesn’t just streamline operations—it fosters trust, minimizes confusion, and keeps projects on schedule. For manufacturers juggling regulations and market expectations on both sides of the border, it’s a quiet but powerful asset that amplifies both efficiency and reliability.

Trade Agreements: Mexico’s Secret Weapon

NAFTA’s successor, USMCA, is still strong. This trade pact makes it easier for goods to flow between Mexico, the U.S., and Canada. While tariffs on certain products may grab headlines, the broader framework supports robust trade. It is unlikely that the US will scrap the key aspects of the USMCA that benefit US companies when it is reviewed in 2026.

Duty-Free Perks and Tax Incentives

One key benefit of the USMCA for manufacturers? Qualified products can be imported into the U.S. from Mexico without incurring duties or taxes—a cost-savings that can change the economics of going to market in the U.S. When you combine these savings with the efficiencies gained through fast, ground-based transportation and the availability of skilled labor at lower hourly rates, the business case for nearshoring becomes even stronger.

The United States-Mexico-Canada Agreement (USMCA) brought about significant changes to supply chains by increasing regional value content requirements. This adjustment means that for products to be considered as made in North America, a higher proportion of their components must originate within the region. As a result, producers are incentivized to relocate their supply chains, ensuring more of their production processes occur within North America to meet these new standards.

To prevent expiration in 2036, the parties must submit notifications at or after the 2026 review approving the renewal of the USMCA for another 16-year term. For the United States, the Trump administration will likely withhold US renewal approval to compel a partial renegotiation of certain commitments through the joint review. The full scope of the US plan has not yet been developed, but initiatives under discussion in Washington include modifications to the automotive industry rules of origin, strengthened forced labor import prohibitions, new restrictions on Chinese companies in North America, and resolutions to ongoing USMCA implementation disputes. - White and Case

By reshaping the criteria for what constitutes a North American-made product, the USMCA not only fosters regional manufacturing but also strengthens economic ties among the three countries. This strategic move aims to bolster North American industries, particularly in sectors like automotive manufacturing, by encouraging companies to streamline their operations within the continent.

Let’s put it this way: even if one door closes, Mexico has plenty of other windows wide open. It's resilience that appeals to companies looking for stability in a volatile global market.

Diversification: Don’t Put All Your Eggs in Asia

For years, Asia was the darling of global manufacturing. But the tides are shifting. From geopolitical tensions to rising wages in China, the drawbacks of depending too heavily on one region are clear. Nearshoring in Mexico offers a practical solution.

Here’s a question: why keep all your production halfway across the globe when you can have it just a border away? Mexico isn’t just an alternative; it’s an upgrade for many businesses aiming to balance cost, quality, and proximity.

The Impact of COVID-19 on Global Supply Chains and the Rise of Nearshoring

The COVID-19 pandemic had a seismic impact on global supply chains, revealing vulnerabilities that many companies had previously overlooked. As countries around the world implemented lockdowns and closed borders, the flow of goods was severely disrupted. This unprecedented situation resulted in significant delays and shortages, just as consumer demand surged for various essential products.

The Supply Chain Shock

One of the major challenges was the closure of manufacturing hubs and restrictions on transport, creating bottlenecks in the supply chain process. With factories halting production and ports operating at reduced capacities, delays became inevitable. Additionally, the workforce shortages and health-related safety measures further compounded these issues.

Enter Nearshoring

In response to these disruptions, businesses began exploring nearshoring as a strategic alternative. Nearshoring involves relocating production facilities closer to the consumer market. This approach not only reduces dependency on distant suppliers but also enables companies to respond more swiftly to demand fluctuations.

But what exactly is nearshoring? At its core, it’s the practice of moving manufacturing operations from far-flung countries to locations that are geographically closer to end consumers. Unlike reshoring—which brings manufacturing all the way back to the company’s home country—nearshoring means shifting operations to a nearby nation. For example, instead of bringing a factory from Asia back to the U.S., a company might move it to Mexico.

And it’s not just American companies making the move. Take Daewoo Electronics, for instance. Back in 1990, this Korean electronics giant set up factories in Mexico to produce TVs, VCRs, and PCs for the U.S. market. Many companies from Japan, China, and Europe have since followed suit, leveraging Mexico’s strategic proximity and robust manufacturing infrastructure to better serve their North American customers.

By opting for nearshoring, businesses can sidestep many of the logistical headaches exposed during the pandemic—while keeping their supply chains nimble, responsive, and resilient.

Benefits of Nearshoring

- Cost Efficiency: By cutting down on long-distance shipping and minimizing tariffs, companies can achieve significant cost savings.

- Improved Logistics: Proximity to consumer markets allows for faster delivery times and reduces the risk of delays.

- Resilient Supply Chains: Nearshoring enhances supply chain resilience by diversifying production locations and mitigating the risks associated with global disruptions.

By embracing nearshoring, companies aim to future-proof their operations against potential crises, ensuring that their supply chains remain robust and responsive.

The COVID-19 pandemic has therefore not only exposed the fragilities of traditional supply chains but also accelerated a shift towards more sustainable and adaptive business models.

Current Trends in Foreign Direct Investment (FDI) in Mexico

Foreign direct investment in Mexico has remained relatively stable through recent global disruptions, but certain shifts suggest potential growth in the near future.

Rise in New Investments

In 2022, Mexico saw a notable change: new investments composed 48% of total FDI, marking the highest share since 2013. This indicates a growing interest in fresh ventures within the country.

Sources of Investment

Two main groups are leading the charge toward Mexico:

- American-based Companies: These are enterprises already operating in Mexico, now expanding their reach and capabilities.

- Chinese Firms: Many are establishing operations in North America to benefit from reduced labor costs and minimized risks related to supply chain disruptions.

Sectoral Shifts

While transportation equipment remains a top recipient of manufacturing FDI, sectors such as electrical accessories, appliances, and communication and computer equipment are attracting increased investment. This shift may be driven by the reallocation of capital after pandemic-induced logistic challenges.

Manufacturing Momentum

Mexico's manufacturing industry is booming due to heightened global demand. In 2022, the sector grew by 5.2%, sharply above the previous decade's average of 2.3%. Northern cities, especially those close to the United States, are experiencing the most rapid growth, further fueling manufacturing and FDI synergy.

These trends highlight a dynamic investment landscape in Mexico, with key shifts in source countries, sectors, and geographic focus driving potential for future growth.

What’s Ahead for Nearshoring Manufacturing in Mexico 2025?

Mexico's manufacturing sector looks bright, even with tariff challenges. Companies are learning to navigate these hurdles with savvy strategies and a long-term view. Within five years, Bank of America expects to double its revenues and client volume in Mexico. The key drivers—proximity, skilled labor, and trade advantages—remain rock-solid. And as global supply chains evolve, Mexico’s importance will only grow.

Seizing Nearshoring Opportunities: A Catalyst for Growth

If Mexico fully embraces nearshoring opportunities, the economic benefits could be substantial:

- Foreign Direct Investment (FDI): FDI has the potential to contribute an additional 0.5 percentage point to Mexico's GDP.

- Manufacturing Output: This sector could see an increase of 2.4 percentage points in GDP, strengthening its role in the economy.

- Job Creation: Embracing these opportunities could lead to the creation of an additional 1.1 million jobs, bolstering employment levels significantly.

With these potential gains, Mexico is poised to cement its position as a vital hub in global trade networks, leveraging its strengths to overcome challenges and capitalize on new avenues for economic expansion.

What Long-Term Commitments Are Necessary for Mexico to Become an International Logistics Hub?

For Mexico to establish itself as a premier international logistics hub, a series of strategic, long-term commitments are crucial:

- Enhance the Business Environment: Mexico must prioritize creating a business-friendly atmosphere. This involves simplifying regulatory processes, ensuring transparency, and fostering innovations that can attract global enterprises.

- Infrastructure Investment: Substantial investment in infrastructure is vital. This covers upgrading transportation networks, expanding ports, and enhancing airports to efficiently handle increased cargo volumes. Modern logistics hubs require seamless integration of road, rail, and air systems.

- Address Utility Challenges: An uninterrupted supply of electricity and water is essential for operational efficiency. Hence, Mexico needs to focus on bolstering its utility services both in urban and rural areas where manufacturing and logistics activities are situated.

- Provide Investment Incentives: To encourage both domestic and international investments, Mexico should devise attractive incentives. Tax breaks, subsidies, and streamlined processes can make Mexico more appealing to foreign investors seeking a reliable logistics base.

- Foster Workforce Development: Investing in workforce training is paramount. Developing skilled labor through education and vocational training ensures that the country can meet the technical demands of logistics and manufacturing sectors. Likewise, a robust education system, technical training programs, and strong English proficiency create a workforce that is especially attractive to industries such as automotive, aerospace, and high-tech. Prioritizing these areas not only supports current economic growth but also positions the nation as a destination for innovative, global enterprises seeking a capable and adaptable labor pool.

By focusing on these commitments, Mexico can effectively position itself as a key player in global logistics, facilitating not only regional trade but also strengthening its role in the world market.

How Does the Rule of Law in Mexico Impact Foreign Direct Investment?

The rule of law in Mexico plays a critical role in shaping foreign direct investment (FDI) flows. A key concern among international investors is the consistency and enforcement of legal frameworks. When the legal environment is perceived as unstable or unreliable, it raises red flags for those looking to invest.

Investor Concerns

According to surveys, nearly 80% of business leaders view the current legal climate as a significant barrier to the levels of FDI Mexico aims to attract. This apprehension stems from issues such as unclear regulations, inconsistent application of laws, and perceived corruption in legal proceedings. These factors can create an environment of uncertainty, discouraging investors from committing capital.

The Impact on Nearshoring

As companies consider nearshoring—a strategy where businesses relocate operations closer to their primary markets—Mexico has a unique opportunity. However, to capitalize on this trend, it's essential that the country strengthens its legal infrastructure. Enhanced legal clarity and reliability can increase investor confidence, making Mexico a more enticing destination for FDI.

Path to Improvement

For Mexico to improve its attractiveness to investors, reinforcing domestic growth drivers is crucial. Policymakers need to focus on creating a stable legal climate that promotes investment. By addressing these legal hurdles, Mexico might better seize the economic opportunities presented by global shifts such as nearshoring.

Trade Between Mexico and the US Remains Strong

Trade between the U.S. and Mexico reached $72.5 billion in September 2024, a significant increase of 8% from the previous year. During the last 20 months, Mexico has been America's largest trading partner for the ninth consecutive month. During the first eight months of 2024, trade between the two countries totaled $632 billion, far exceeding trade with China, which was $437 billion.

Mexico’s Manufacturing Surge

This impressive trade growth is underpinned by a robust performance in Mexico's manufacturing sector. In 2022 alone, manufacturing production in Mexico surged by 5.2% annually, well above the previous decade's average growth of 2.3%. This acceleration highlights the sector's increasing capacity and competitiveness on the global stage.

The industries experiencing the most significant growth have been those attracting substantial foreign direct investment. This influx of investment has fueled advancements and expansions, particularly in regions close to the U.S. border, where cities are witnessing a rapid uptick in manufacturing activity. This geographical advantage facilitates easier access to the U.S. market, thereby driving further growth and integration into international supply chains.

Mexico's manufacturing boom doesn't just benefit trade figures; it also strengthens its position as a key player in global manufacturing, continuing to outpace traditional rivals and reshaping the dynamics of North American trade.

Mexican exports to the U.S. included auto parts ($2.3 billion), computers ($1.9 billion), and passenger vehicles ($1.58 million). Meanwhile, U.S. exports to Mexico focused on auto parts ($1.1 billion), electric storage batteries ($449 million), and passenger vehicles ($317 million).

Mexican suppliers play a critical role in U.S. Supply chains, especially in automotive and electronics sectors. Nearshoring activity in Mexico has seen significant growth, with the auto sector leading the charge. This activity is primarily concentrated in the northern region of the country, where proximity to the U.S. Border facilitates smoother logistics and trade.

Moreover, the demand for industrial space in these areas is soaring. Many industrial parks are operating at full capacity, a clear indicator of the robust investment and development occurring. This growth is not just a fleeting trend; it's a strategic shift that underscores Mexico's increasing importance in global supply chains.

As companies continue to recognize the benefits of nearshoring, particularly in the auto industry, we can expect this upward trajectory to persist, further solidifying Mexico's pivotal role in the future of international trade.

In a press briefing, Bank of America's Mexico head, Emilio Romano, said, “It will be very difficult for uncertainties, either internal or external effects to alter or modify the opportunities that we see in Mexico,” as Reuters reported. "We believe that the near-shoring or friend-shoring phenomenon will not be reversed.” He also said that the bank expects to double revenue, with client volume growing from 400 to 800, all over the next five years in Mexico. The bank focuses on institutional banking services and doesn’t serve individual clients. -Reuters News Service

In 2025, it won’t just be about saving money. It’ll be about building resilient, sustainable, and efficient operations. Mexico fits the bill perfectly, tariffs and all.

The Russia-Ukraine war has significantly impacted the global supply chain for raw materials. This conflict has disrupted trade routes traditionally used for the transportation of essential commodities such as metals, grains, and energy resources. As a result, businesses worldwide have been compelled to search for alternative sources to maintain their production lines.

Key Effects:

- Supply Chain Disruptions: The closure of key transit points has delayed shipments, causing bottlenecks and shortages in many industries. The scarcity of materials once easily accessible has increased costs and complexity for businesses.

- Search for Alternatives: Companies have been forced to diversify their supplier base. They are now seeking partnerships with producers in other regions to mitigate the risk of relying too heavily on any single source.

- Price Fluctuations: The decreased availability of certain raw materials has led to price volatility. Industries such as manufacturing and construction have been particularly hard hit, facing increased expenses and adjusting pricing strategies accordingly.

Global Economic Ripple Effects:

The instability has not just affected immediate trade relationships but also triggered a broader reevaluation of global supply chain strategies. Industries are becoming more agile, investing in supply chain resilience to withstand future geopolitical disruptions.

FAQs on Nearshoring Manufacturing in Mexico 2025

1. What industries benefit most from nearshoring in Mexico?

Automotive, electronics, textiles, and medical devices are leading sectors. Mexico’s skilled labor and established infrastructure make it ideal for these industries. In recent years, other sectors have also begun to attract foreign direct investment, diversifying the economic landscape. Notably, electrical accessories and appliances, along with communications and computer equipment, have seen increased investor interest. This shift is particularly intriguing given that these sectors faced logistical challenges during the pandemic.

Beyond just manufacturing prowess, Mexico’s appeal lies in a robust ecosystem that supports these industries end-to-end:

- Advanced Production Capabilities: Facilities in industrial hubs like Monterrey and Tijuana offer state-of-the-art digital and flexographic printing, technical literature production, inventory management, and process enhancement—mirroring technologies readily found in the U.S.

- Regulatory & Compliance Expertise: Manufacturers operating in Mexico benefit from comprehensive knowledge of both U.S. and Mexican standards, including UL, ANSI, and CSA, bolstered by internationally recognized certifications like ISO 9001:2015, IATF 16949, and ISO 14001:2015.

- Bilingual Support & Seamless Operations: Bilingual teams and cross-border warehousing in strategic locations such as Cd. Juarez, Mexicali, San Luis Potosí, and Tijuana help ensure a smooth experience for companies navigating North American markets.

With this blend of skilled talent, regulatory know-how, and operational flexibility, Mexico continues to position itself as a go-to destination for companies looking to nearshore manufacturing and tap into resilient North American supply chains.

The surge in foreign direct investment in these areas may be attributed to capital being strategically relocated to leverage Mexico's robust supply chain resilience and its proximity to major markets. By tapping into these emerging opportunities, investors are positioning themselves to benefit from Mexico's growing role in global manufacturing and technology supply chains.

2. How do tariffs impact nearshoring in Mexico?

While tariffs can increase costs, companies often offset them through lower labor costs, reduced shipping times, and local sourcing strategies.

3. What role does the USMCA play in nearshoring?

The USMCA facilitates trade between Mexico, the U.S., and Canada, making it easier for nearshored goods to move across borders with minimal friction.

4. Is nearshoring in Mexico more sustainable than offshoring to Asia?

Yes. Shorter transit times reduce carbon emissions, and Mexico’s focus on renewable energy supports sustainability goals.

5. Will nearshoring in Mexico remain competitive in 2025?

Absolutely. Proximity, cost advantages, and a skilled workforce ensure Mexico’s nearshoring appeal remains strong despite external challenges.

6. Where do the investments related to nearshoring in Mexico primarily come from?

Investments related to nearshoring in Mexico primarily originate from two distinct sources. The first source is American companies that already have a presence in Mexico and are now increasing their operations to maximize efficiency and cost-effectiveness. These companies are taking advantage of existing infrastructures to expand their capacities and streamline production.

The second source of investment comes from Chinese enterprises eager to produce goods in North America. By shifting operations to Mexico, these companies aim to benefit from lower labor costs compared to other North American regions and reduce potential disruptions in their supply chains. This strategy helps them navigate challenges associated with high operational costs and logistical uncertainties.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about Nearshoring Manufacturing to Mexico with our curated collection of related blog posts.

- Can Moving Manufacturing to Mexico Really Be Turnkey? Here’s What You Need to Know

- What Type of Company Should Not Move to Mexico?

- Stop Overpaying Overseas: Move Your to Manufacturing Mexico and Save Big

- Why Mexico Is Beating Asia for Fast Turnaround

- Stop Waiting: Mexico Product Manufacturing Is Ready When You Are

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.