Last Updated on April 3, 2025

Tariffs on Mexican goods may seem like a protective measure for the U.S. economy, but in reality, they do more harm than good. Businesses, workers, and consumers on both sides of the border suffer the consequences—higher prices, disrupted supply chains, and lost economic opportunities. NovaLink Nearshore Manufacturing oppose tariffs on Mexico, advocating for policies that strengthen trade, not restrict it.

Tariffs Hurt U.S. and Mexican Businesses Alike

1. Higher Costs, Less Competitiveness

Many U.S. companies rely on nearshore manufacturing in Mexico for efficiency and cost savings and oppose tariffs on Mexico. Tariffs drive up production costs, forcing businesses to pass these costs onto consumers or cut back on investment. That means fewer jobs, lower wages, and reduced economic growth.

2. More Expensive Essential Goods

From cars and medical devices to clothing and electronics, tariffs make everyday products more expensive. When companies pay more in import taxes, those costs trickle down to consumers, reducing purchasing power and straining household budgets.

3. Damaged Trade Relationships

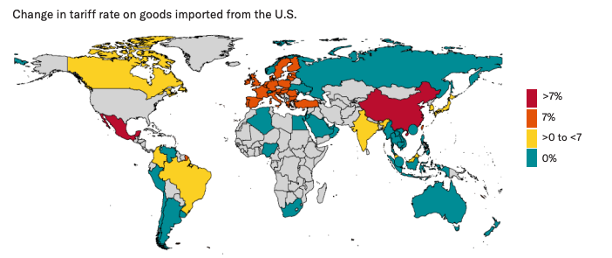

The U.S. and Mexico have built a strong economic partnership under agreements like the USMCA. Tariffs undo years of progress, leading to retaliatory measures that can escalate into trade wars—harming businesses in both countries.

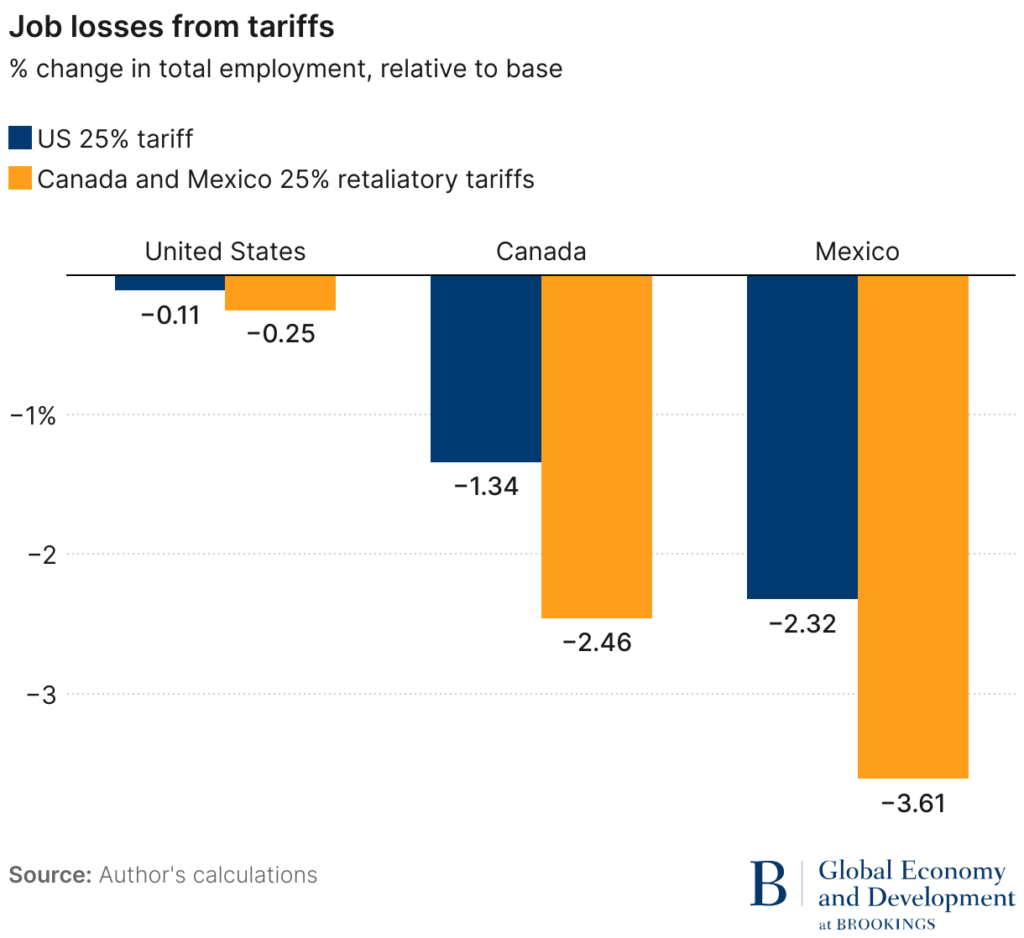

The U.S. tariff of 25% on imports from Canada and Mexico is going to reduce U.S. economic growth, reduce jobs, cause wages to fall, and prices to rise, and retaliation by Canada and Mexico will multiply the economic harms across the three countries. President Trump has said that these tariffs are in response to flows of fentanyl and illegal immigrants from Mexico and Canada. The problem with these tariffs is that they impose immediate costs on U.S. consumers, workers, and businesses without a clear link between these tariffs and how they will reduce flows of immigrants or fentanyl. - Brookings Institute

The Bigger Picture: Why Free Trade Matters

Trade isn’t just about numbers—it’s about economic stability and growth. As the Office of the U.S. Trade Representative points out, 75% of global purchasing power and 95% of consumers live outside the U.S. Expanding trade, not restricting it, is the key to long-term prosperity.

The Cost of Tariffs: A Closer Look

1️⃣ Increased Costs for U.S. Companies and Consumers – Businesses that rely on Mexican imports pay higher taxes, which means higher prices at the checkout line.

2️⃣ Disruptions in Cross-Border Trade & Manufacturing – The U.S. depends on Mexico for crucial supply chains in automotive, aerospace, textiles, and electronics. Tariffs force companies to scramble for alternatives, leading to production delays and inefficiencies.

3️⃣ Reduced Investment and Economic Uncertainty – Companies hesitate to invest in new facilities, equipment, and jobs when trade policies are unpredictable, potentially shifting production to other countries.

Retaliatory Tariffs: A Dangerous Domino Effect

Tariffs don’t just stop at the border—they trigger retaliation. In 2023, U.S. exports surpassed $3 trillion, making trade essential to the economy. If Mexico and other trade partners impose counter-tariffs, American businesses lose access to key markets, making exports less competitive.

Industries at Risk

Increased costs for raw materials and retaliatory tariffs on U.S. goods create instability.

Farmers depend on exports; tariffs can lead to plummeting revenues.

These industries thrive on global supply chains—tariffs make them less competitive internationally.

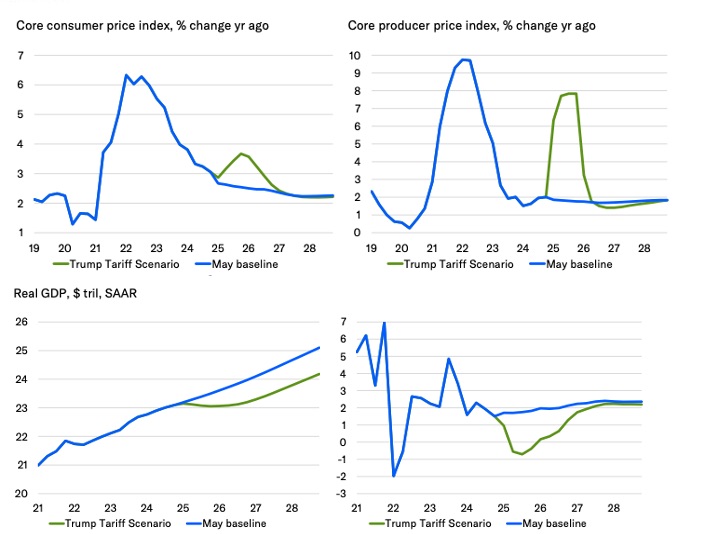

Source: The Macroeconomic Fallout of Trump’s Tariff Proposals: https://www.economy.com/getfile?q=A4D1A352-D306-49B0-8753-5D8498A68889&app=download

The Link Between Trade and American Jobs

More than 40 million American jobs depend on trade.

Why Trade Supports Employment

- Diverse Industries – From tech to retail, countless jobs rely on international trade.

- Economic Growth – Businesses expand, generate revenue, and hire more workers when trade is strong.

- Supply Chain Resilience – U.S. companies depend on nearshore suppliers, especially in Mexico, to stay competitive.

- Affordable Goods – Free trade ensures access to a variety of products at lower prices.

The Job-Killing Impact of Tariffs

- Increased costs force businesses to downsize or relocate.

- Retaliatory tariffs shrink U.S. export markets.

- Rising prices reduce consumer spending, leading to lower demand and job cuts.

U.S. Manufacturers Need Free Trade, Not Barriers

Half of all U.S. imports are raw materials and components vital for manufacturing. Many of these aren’t available domestically in the right quantity or at a competitive price. Tariffs make it more expensive to produce goods in the U.S., forcing companies to either absorb costs or look elsewhere for cheaper production options.

States Most Affected by Tariffs on Mexico

- Michigan – Auto and machinery manufacturing

- Wisconsin – Industrial equipment and food processing

- Texas – Aerospace, electronics, and energy manufacturing

- Indiana – Automotive and steel production

- Georgia – Heavy equipment and textile manufacturing

Strengthening Trade, Not Restricting It

NovaLink supports free trade policies that drive growth and innovation. We Oppose Tariffs on Mexico. Tariffs on Mexico pose a significant threat to businesses, consumers, and long-term economic stability. Instead of imposing barriers, we should focus on policies that promote nearshore manufacturing and economic collaboration.

Key Takeaways

- Tariffs increase costs, disrupt manufacturing, and create uncertainty.

- The U.S.-Mexico trade relationship is essential for economic stability.

- Free trade fosters job creation and strengthens supply chains.

- Policymakers should prioritize economic cooperation over restrictive tariffs.

Support policies that encourage trade and economic growth. Oppose tariffs on Mexico.

FAQs

1. How do tariffs on Mexico affect U.S. businesses? Tariffs raise the cost of imports, leading to higher production expenses for U.S. companies. This reduces competitiveness and forces businesses to increase prices or cut jobs.

2. Why do tariffs make goods more expensive for consumers? When businesses pay higher import taxes, they pass those costs onto consumers. Everything from cars to clothing to electronics becomes more expensive.

3. What industries are most at risk from tariffs on Mexico? Manufacturing, agriculture, automotive, aerospace, and technology are among the industries that suffer the most from increased costs and disrupted supply chains.

4. Can tariffs actually protect American jobs? No. While they may provide short-term relief for some industries, tariffs ultimately hurt job growth by making U.S. companies less competitive and encouraging businesses to move operations elsewhere.

5. What’s a better alternative to tariffs? Strengthening trade agreements, reducing regulatory barriers, and investing in nearshore manufacturing partnerships with Mexico offer more sustainable economic benefits without the negative impact of tariffs.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about Trade Tariffs with our curated collection of related blog posts.

- Tariffs in Mexico vs. Taxes: What’s the Real Difference, and Why Should You Care?

- Why Mexico Is Beating Asia for Fast Turnaround

- What You Need to Know About Sourcing Fabrics in Mexico for Clothing Production

- Bill of Lading Explained: Essential Guide to Types, Terms, and How It Impacts Your Manufacturing Operations in Mexico

- How U.S. Tariffs Are Reshaping Mexico’s Manufacturing Outlook

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.