Last Updated on March 13, 2025

Mexico has long been a strategic location for manufacturing, offering cost-effective labor and proximity to major markets like the United States. As of 2025, it's crucial to assess whether Mexico's manufacturing labor rates remain competitive in the global landscape.

Current Manufacturing Labor Rates in Mexico

As of December 2024, the nominal hourly wage in Mexico's manufacturing sector stood at $5.10 USD per hour, reflecting an increase from $3.70 USD in November 2024.

The daily minimum wage in Mexico was raised by 12% for 2025, reaching MXN $278.80 (approximately $13.76 USD) nationwide and MXN $419.88 (approximately $20.72 USD) in the Free Zone of the Northern Border.

Despite these increases, Mexico's labor costs remain significantly lower than those in the United States, where similar positions often command higher wages.

Mexico’s low labor expenses are a significant draw for U.S. businesses. The average wage in Mexico is lower than in the U.S. because of Mexico’s much lower cost of living (one reason why so many people are moving from California to Mexico). - Nomad Capitalist

Factors Influencing Labor Cost Competitiveness

Several factors contribute to the competitiveness of Mexico's manufacturing labor rates:

Economic Policies

The administration of President Claudia Sheinbaum has maintained fiscal conservatism while increasing social spending. Investments in infrastructure projects and efforts to reduce reliance on imports have bolstered economic stability.

Nearshoring Trends

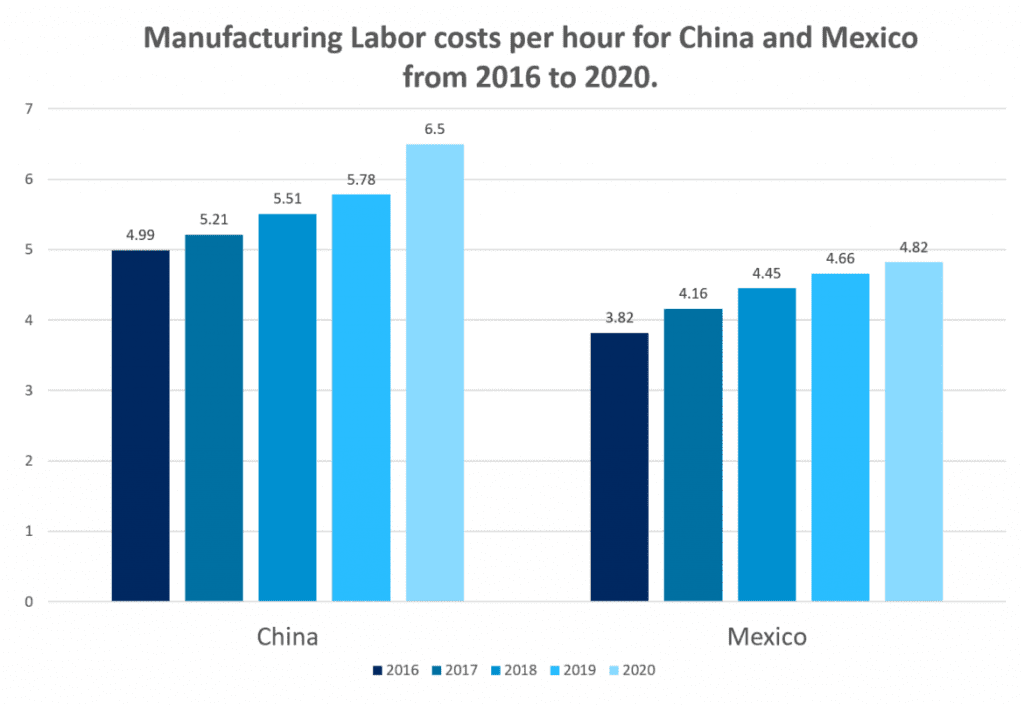

Geopolitical shifts, such as the China–United States trade war, have prompted companies to consider nearshoring to Mexico. Mexico has surpassed China as the top exporter to the U.S., driven by lower production costs and a skilled labor force.

Labor Law Reforms

Recent amendments to Mexico's labor laws have led to increased costs for companies. Businesses are adapting to these changes to balance worker rights with operational efficiency.

Projected Trends

Forecasts indicate that Mexico's nominal hourly wages in manufacturing are expected to reach $5.90 USD per hour by the end of the current quarter and trend around $6.10 USD per hour in 2025.

Conclusion: Mexico's Manufacturing Labor Rates Remain Competitive

Mexico's manufacturing labor rates in 2025 remain competitive, offering cost advantages over countries like the United States. Factors such as favorable economic policies, nearshoring trends, and a skilled workforce contribute to this competitiveness. While labor costs have risen, they are still lower compared to other manufacturing hubs, making Mexico an attractive destination for manufacturers seeking efficiency and proximity to key markets.

Frequently Asked Questions: Mexico's Manufacturing Labor Rates

1. Why are manufacturing labor rates in Mexico lower than in the U.S.?

Mexico's lower labor rates are primarily due to a lower cost of living, different economic structures, and government incentives aimed at attracting foreign manufacturers. Additionally, the country's strong industrial base allows for competitive wages while maintaining high productivity.

2. How do labor rates vary across different regions in Mexico?

Labor rates in Mexico differ based on location, with northern border states typically having higher wages due to proximity to the U.S. and greater industrial activity. Central and southern regions, such as Bajío, generally offer lower wages while still maintaining skilled labor availability.

3. Are labor rates in Mexico expected to rise in the coming years?

Yes, labor rates in Mexico have been gradually increasing due to economic growth, inflation, and rising demand for skilled labor. However, they remain significantly lower than those in the U.S. and other manufacturing hubs, keeping Mexico competitive for production.

4. What industries benefit the most from Mexico’s labor cost advantages?

Industries such as automotive, aerospace, medical devices, electronics, and textile manufacturing greatly benefit from Mexico's affordable and skilled labor force. The country’s well-developed supply chain infrastructure further enhances its attractiveness for these industries.

5. How do tariffs impact the cost advantages of manufacturing in Mexico?

While tariffs on Mexican imports can affect cost structures, manufacturers often mitigate these effects through trade agreements like the USMCA, strategic sourcing, and optimizing supply chain logistics. Despite tariffs, Mexico remains a cost-effective option due to its lower labor costs and geographical proximity to the U.S.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.