Last Updated on June 14, 2023

Manufacturing is a complex and competitive industry that constantly seeks ways to optimize costs, increase efficiency, and boost profitability. One of the strategies that has gained significant traction in recent years is IMMEX (Maquiladora Industry and Export Services) in Mexico. In this article, we will delve into the world of IMMEX and explore how it unlocks unparalleled savings for manufacturers. From the advantages of IMMEX and potential challenges, we'll cover it all. So, let's dive in!

The IMMEX program, also known as the Maquiladora program, was established in the 1960s to stimulate foreign investment in Mexico by offering preferential tariff agreements between Mexico and the United States. Let's explore what the Maquiladora program entails and how it benefits companies manufacturing in Mexico.

What Are a Maquiladoras?

Maquiladoras refer to factories or plants situated primarily near the Mexico/U.S. border. Typically, these manufacturing facilities are owned and operated by U.S. companies, although other countries like China also have their presence in Mexico through Maquiladoras.

The Benefits of IMMEX

- Duty and Tax Savings

One of the most significant advantages of IMMEX is the exemption or reduction of duties and taxes on imported goods. Manufacturers can import materials, machinery, and equipment without paying customs duties, value-added tax (VAT), or general import tax. This leads to substantial cost savings, allowing businesses to allocate their resources more efficiently.

- Supply Chain Optimization

By leveraging IMMEX, manufacturers can streamline their supply chain operations. Proximity to the United States, a major consumer market, enables faster delivery and reduced transportation costs is one of the most significant advantages of IMMEX. Additionally, the program enables just-in-time manufacturing, where components are imported precisely when they are needed, minimizing inventory costs and improving overall efficiency.

- Skilled Labor Force

Mexico boasts a well-educated and skilled labor force in the manufacturing sector. IMMEX allows businesses to tap into this talent pool, providing access to a skilled workforce at competitive wages. This ensures high-quality production and enhances the overall competitiveness of manufacturers operating under the program.

- Research and Development (R&D) Incentives

To foster innovation, IMMEX offers incentives for research and development activities. Manufacturers can deduct R&D expenses from their taxable income, encouraging investment in cutting-edge technologies, product development, and process improvements. The advantages of IMMEX creates a fertile environment for innovation and positions companies for long-term growth.

Mexico has remained consistent with costs and taxing, which allows companies to plan budgetary needs in advance and avoid any surprises that may set them back. It has also permitted U.S. companies to rely on Mexico as a manufacturing partner. As of 2015, 90% of Fortune 500 companies have investments in Mexico, making the maquiladora industry vital to the U.S. economy.

The Wall Street Journal

The IMMEX Process

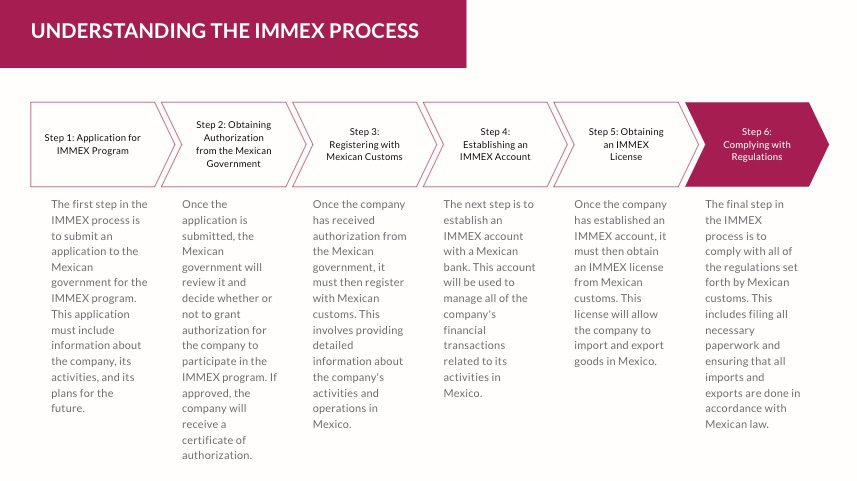

- IMMEX Certification

To participate in the program, manufacturers must obtain an IMMEX certification from the Mexican government. This certification grants them the authorization to import and export goods temporarily, along with the associated tax benefits. It is crucial to comply with the program's requirements and maintain accurate records to ensure smooth operations.

- Temporary Importation

Once certified, manufacturers can begin importing goods temporarily without paying customs duties or taxes. They must submit a detailed inventory of the imported goods and their intended use to the Mexican authorities. Compliance with customs regulations, such as accurate record-keeping and timely reporting, is essential to avoid penalties and maintain program eligibility.

Mexico's IMMEX program is defined as an instrument to temporarily import goods and services that will be manufactured, transformed or repaired, and then re-exported without payment of taxes, compensatory quotas, and other specific benefits. In the past there used to be two separate programs in Mexico; Pitex for 'temporary' imports and exports, and the Maquila program for maquila-specific operations. The new IMMEX program consolidates the benefits of these legacy programs and facilitates interaction with government authorities to operate under the program.

The Maquila Handbook: Quick Tips for Understanding Mexico's IMMEX Program

- Manufacturing or Transformation Process

The imported goods are then used in the manufacturing or transformation process, where they are assembled, processed, or repaired. Mexico provides a favorable environment for this stage, with its skilled labor force, advanced infrastructure, and supportive business ecosystem.

- Exportation

After completing the manufacturing process, manufacturers can export the finished goods to their target markets. IMMEX allows for the return of foreign goods, as long as they are in the same condition or have undergone an authorized transformation. Compliance with export regulations and accurate documentation is vital to ensure a smooth export process.

Potential Challenges of IMMEX

- Compliance and Documentation

IMMEX involves strict compliance requirements and extensive documentation. Manufacturers must maintain accurate records, submit timely reports, and comply with customs regulations. Failure to do so can result in penalties, suspension of benefits, or even expulsion from the program. Implementing robust internal controls and dedicated compliance teams is crucial to navigate these challenges.

- Transfer Pricing

Given the intercompany nature of IMMEX operations, transfer pricing becomes a critical consideration. Manufacturers must ensure that the prices set for transactions between related entities comply with arm's length principles and are supported by appropriate documentation. Transfer pricing audits by tax authorities can be complex and time-consuming, underscoring the importance of proper planning and compliance.

Is Mexico's Labor Force Adequately Skilled for Co-Production Manufacturing?

According to The Washington Post, Mexico's labor force is indeed highly skilled. Mexico's universities graduate over 13,000 engineers annually, surpassing countries like Canada, Germany, and Brazil, despite having a smaller population. Forbes advocates tapping into Mexico's talent pool, highlighting its cultural compatibility, relevant work experience, and favorable time zones for U.S. companies:

Shorter term, I believe that more companies can alleviate their talent gaps by thinking outside of borders and identifying great talent globally. From my perspective, it’s challenging to identify a better fit for U.S. time zones, cultural compatibility, and relevant work experience than Mexico.

Conclusion: Advantages of IMMEX Present Exceptional Opportunities

IMMEX presents an exceptional opportunity for manufacturers to unlock unmatched savings and enhance their competitiveness. With its tax incentives, supply chain optimization, access to skilled labor, and support for innovation, the program has become a game-changer in the manufacturing landscape. However, it is crucial for businesses to carefully navigate the compliance requirements, maintain accurate documentation, and address potential challenges to reap the full benefits of IMMEX.

FAQs:

Q1: Can any manufacturer participate in the IMMEX program?

A1: Yes, any manufacturer, whether domestic or foreign, can participate in the IMMEX program by obtaining the necessary certification from the Mexican government.

Q2: Are there any restrictions on the types of goods that can be imported under IMMEX?

A2: Generally, most types of goods can be imported under the IMMEX program, including raw materials, components, machinery, and equipment. However, there may be specific regulations or restrictions for certain goods, such as hazardous materials or controlled substances.

Q3: Can IMMEX manufacturers sell their products in the Mexican market?

A3: While the primary focus of IMMEX is on manufacturing for export, manufacturers can also sell their products in the Mexican market, subject to applicable regulations and taxes.

Q4: How long does the IMMEX certification process take?

A4: The duration of the IMMEX certification process can vary depending on various factors, such as the complexity of the manufacturing operations and the completeness of the documentation. It is advisable to consult with experts or specialized consultants to navigate the certification process efficiently.

Q5: Can IMMEX companies import goods from countries other than their home country?

A5: Yes, IMMEX companies are allowed to import goods from countries other than their home country, as long as they comply with the applicable customs regulations and document the temporary importation properly.

Remember to consult with legal and tax professionals to ensure compliance with current regulations and requirements in Mexico and relevant jurisdictions.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.