Last Updated on January 8, 2025

The ongoing trade war between the United States and China has had a significant impact on many manufacturers, who have been forced to pay higher tariffs on products imported from China. As a result, many companies are now exploring alternative options, such as reshoring their manufacturing operations to Mexico. In this blog post, we will explore why Mexico is an attractive option for manufacturers avoiding the China tariffs, and how they can make the move successfully.

What Are The China Tariffs?

US trade tariffs against China are a series of tariffs imposed by the United States government on a variety of Chinese goods. Here is a brief history of United States trade tariffs against China:

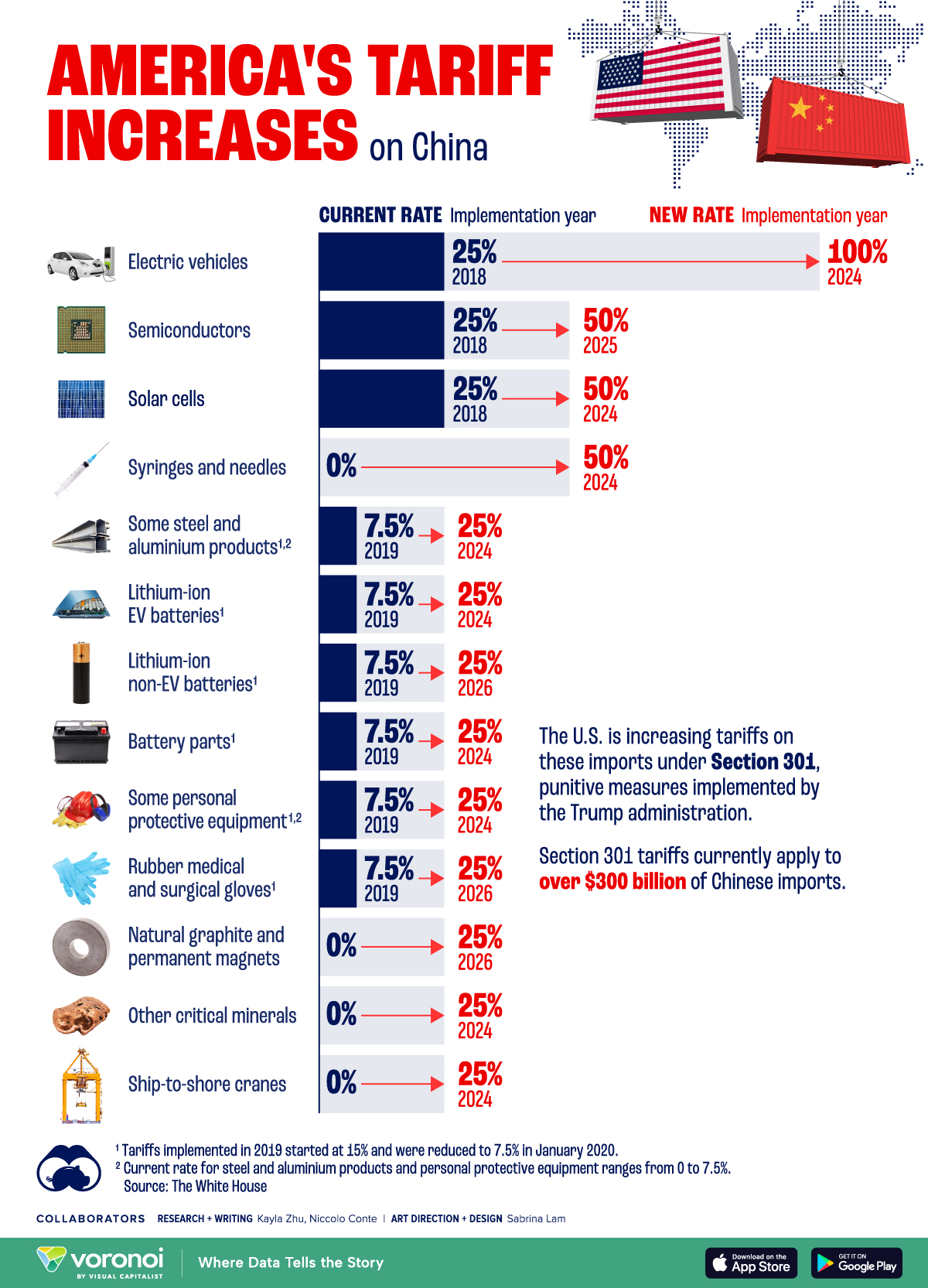

- In July 2018, as a response to the Trump administration's perception of unfair trade practices and intellectual property theft by China, tariffs were initially implemented.

- President Joe Biden announced in May 2024 that the White House was increasing tariffs on $18 billion of Chinese exports, including electric vehicles, in response to what it claims are unfair trade practices.

- During the first day of his presidency, Donald Trump plans to impose a 10% tariff on China in order to force them to crack down on drug smuggling.

What Does This Mean for Companies Manufacturing in China?

For many companies manufacturing goods in China, there are some implications related to the tariff: any of the $200 Billion worth of goods included on the tariff list (ranging from dishwashers to Fitbit fitness trackers to food seasonings) by the United States are subject to the 25 percent tariff tax. (In fact, some companies are even paying up to 40%, for goods such as garment materials.) This will inevitably place some companies in the unfortunate position of having to raise the price of their products to cover the cost of doing business in China.

Why Mexico Should Be Manufacturing Destination

Mexico has become an increasingly popular destination for manufacturers looking to move their operations out of China. The business case for reshoring your manufacturing operations from China to North America and avoiding the China tariffs is compelling for a number of reasons. A report by the Reshoring Institute indicates that companies reshore to Mexico primarily for the following reasons:

- Lead time

- Higher product quality and consistency

- Rising offshore wages

- Skilled workforce

- Lower inventory levels, better turns

- Better quality products

- Better responsiveness to changing customer demands

- Minimal intellectual property and regulatory compliance risks

- Improved innovation and product differentiation

- Intellectual Property Theft

Why Manufacturers Are Moving Away from China

- Impact of Tariffs on Profit Margins

The imposition of tariffs on Chinese goods has substantially increased production costs for U.S.-based manufacturers. Companies in industries such as electronics, automotive, and consumer goods have seen their profit margins shrink as a result. - Geopolitical Uncertainty

The ongoing nature of the trade war creates a volatile business environment, making long-term planning difficult for manufacturers reliant on Chinese supply chains. - Rising Labor Costs in China

Labor costs in China have steadily risen over the past decade, diminishing its attractiveness as a low-cost manufacturing hub.

Why Mexico Is a Viable Alternative

In addition to avoiding the China tariffs, it is also advantageous to have your manufacturing operations in Mexico rather than China:

- Proximity to the United States: Mexico’s geographic location is one of its most significant advantages. Shorter shipping times and reduced transportation costs make Mexico a practical choice for companies serving U.S. markets.

- Trade Agreements Favoring Mexico: The United States-Mexico-Canada Agreement (USMCA) eliminates tariffs on most goods traded between the three nations. This makes Mexico a cost-effective alternative to China for manufacturing and export to the U.S.

- Competitive Labor Costs: While labor costs in Mexico are higher than in China, they remain competitive compared to other regions, especially when factoring in reduced logistics and tariff costs.

- Skilled Workforce: Mexico has a growing pool of skilled labor, particularly in industries such as automotive and electronics manufacturing, which require technical expertise.

- Government Support for Foreign Investment: Mexico has implemented policies to attract foreign manufacturers, including tax incentives and streamlined regulatory processes.

Taking Advantage of USMCA Relief from China Tariffs

The U.S. – Mexico – Canada Agreement (USMCA) will provide lower tariff rates and reduced duty rates between the three nations, which in turn will allow manufacturing goods imported between them easier and cost effective. Some other benefits and points to consider:

- There are no tariffs for products made in Mexico and imported into the United States that meet USMCA rules of origin requirements.

- Manufacturing in Mexico vs China also means lower shipping time for goods to get into the United States, as well as lower average cost of shipping.

- For companies that are getting established, starting operations in Mexico is almost half the time it takes to begin manufacturing operations in China.

- Mexico, like China, has a highly-skilled and productive labor pool to scale up your operations as needed.

How to Move China Manufacturing to Mexico

Although the concept of reshoring is simple: move your manufacturing operations from China back to North America, in practice it is much more complex. Besides finding a manufacturing partner or facilities, you must find material sourcing, labor, establish new supply chains, secure equipment and then transition your operation out of the former country where it previously ran. This is not an easy nor quick feat: Even if you are able to solve all the problems listed previously, it may take as long as 2 years before your Mexico industrial manufacturing operation is moved and fully working again.

Here are some tips for making the move successfully:

- Conduct a thorough analysis: Before making the move, it's important to conduct a thorough analysis of the costs and benefits. This should include a comparison of labor costs, transportation costs, and the cost of setting up operations in Mexico. According to the China Law Blog, the location decision should be made well in advance of leaving China, and scrutinized to ensure the new location will be right for your business.

- Find the right location: Mexico is a large country, and there are many different regions to choose from. Factors to consider include proximity to the United States, availability of labor, and the cost of real estate.

- Work with a trusted partner: Moving manufacturing operations to a new country can be complicated, so it's important to work with a trusted partner who has experience in the region. This could include a logistics company or a local manufacturing association.

- Invest in training: While there are many similarities between manufacturing operations in China and Mexico, there are also some key differences. It's important to invest in training for employees to ensure a smooth transition.

- Be patient: Moving manufacturing operations to a new country takes time and patience. It's important to have a long-term plan in place and to be prepared for some challenges along the way. According to the Harvard Business Review:

A manufacturer not only has to source all of the components of a product, it also has to scale up production. This task is often taken for granted, but it is part of the really hard work of taking a product to market. The process includes setting up the supply chain for all of the raw materials, designing an assembly process with the appropriate tooling and fixtures, building or securing test equipment, establishing testing and quality procedures, and working through materials handling, staffing, and countless other details.”

China Tariffs Have Affected Many Manufacturers but There Are Alternatives

In conclusion, while the China tariffs have had a significant impact on many manufacturers, there are alternatives available. Avoiding the China tariffs by moving manufacturing operations to Mexico can be a smart move for companies looking to save on costs and avoid the tariffs. By conducting a thorough analysis, finding the right location, working with a trusted partner, investing in training, and being patient, manufacturers can successfully make the move to Mexico.

FAQ's on The China Tariffs

Q1: What are the China tariffs, and how do they impact businesses?

A1: The China tariffs refer to the additional import duties imposed by the United States on certain goods originating from China. These tariffs were implemented as part of a trade dispute between the two countries. The tariffs impact businesses by increasing the cost of imported Chinese goods, which can lead to higher prices for consumers and potential disruptions to supply chains.

Q2: Which industries are most affected by the China tariffs?

A2: The China tariffs impact a wide range of industries. Some of the sectors most affected include technology and electronics, automotive, manufacturing, agriculture, and consumer goods. These industries heavily rely on imports from China, making them particularly vulnerable to the increased tariffs and trade tensions between the two countries.

Q3: How can businesses mitigate the impact of China tariffs?

A3: Businesses can employ several strategies to mitigate the impact of China tariffs. These include diversifying their supply chains by sourcing from other countries, renegotiating contracts and prices with Chinese suppliers, exploring alternative sourcing options, applying for tariff exemptions when applicable, and reviewing product classifications to ensure accurate tariff calculations.

Q4: Is nearshore manufacturing in Mexico a viable alternative to mitigate the impact of China tariffs?

A4: Yes, nearshore manufacturing in Mexico is considered a viable alternative to mitigate the impact of China tariffs. By relocating manufacturing operations to Mexico, companies can benefit from lower transportation costs, reduced lead times, and preferential trade agreements such as the United States-Mexico-Canada Agreement (USMCA). Nearshoring to Mexico provides a strategic advantage, as it allows businesses to maintain proximity to the U.S. market while avoiding the tariffs imposed on Chinese imports.

Q5: What are the advantages of nearshore manufacturing in Mexico in light of the China tariffs?

A5: Nearshore manufacturing in Mexico offers several advantages in the context of the China tariffs. These include reduced exposure to trade disputes and tariffs, improved supply chain resilience and flexibility, enhanced collaboration and communication due to geographical proximity, access to a highly skilled workforce, and the benefit of preferential trade agreements like the USMCA. These factors make nearshore manufacturing in Mexico an attractive option for businesses seeking to mitigate the impact of China tariffs.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.