Last Updated on August 23, 2023

In an era marked by global uncertainties and rapid disruptions, businesses are seeking resilient solutions to navigate the turbulent waters of supply chain management. One strategy that has gained significant traction is nearshoring manufacturing to Mexico. This proactive approach offers a host of benefits that not only enhance business continuity but also position companies to thrive in times of crisis. This article delves into the advantages, considerations, and strategic insights surrounding nearshoring manufacturing to Mexico.

Understanding Nearshoring in the Manufacturing Landscape

The Concept of Nearshoring

Nearshoring involves relocating manufacturing operations to a neighboring country with close geographical proximity to the home country. This approach seeks to balance cost-effectiveness with accessibility and reduced logistical complexities.

Mexico as a Nearshoring Hub

With its robust manufacturing infrastructure, skilled labor force, and trade agreements, Mexico has emerged as a prime destination for nearshoring. Proximity to the United States, coupled with cost advantages, makes it an appealing choice for businesses aiming to optimize their supply chains.

Nearshoring: Tidal Change

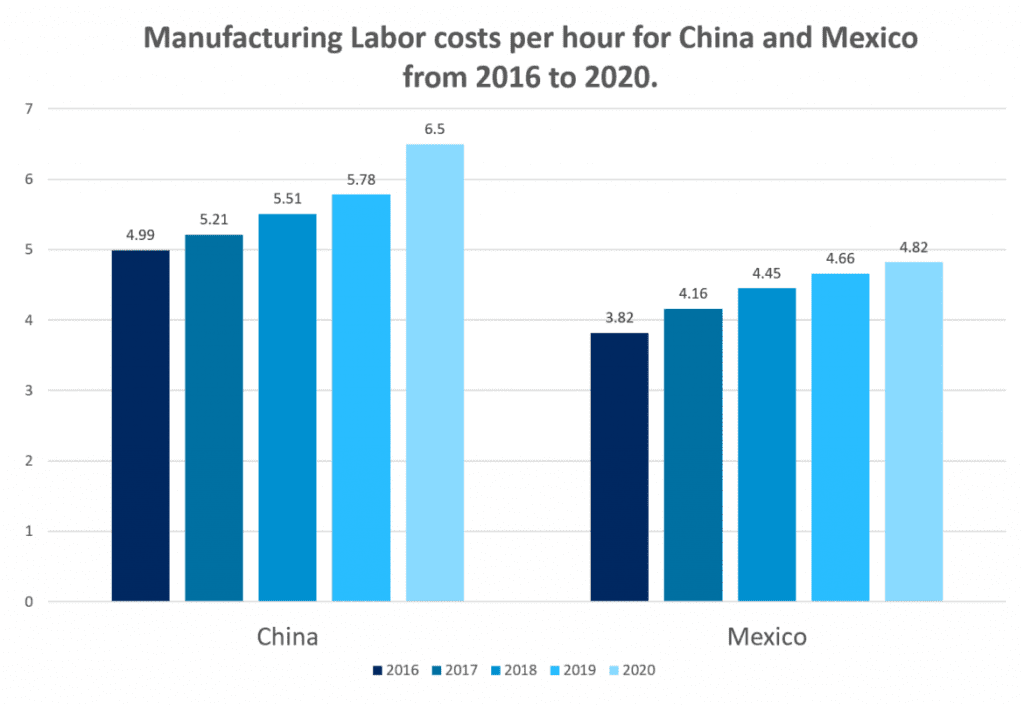

According to analysts, two main reasons companies stopped choosing China as the primary investment destination for manufacturing: the increase in costs, especially in labor, and the tariff war with the United States. In 2018, the Trump administration imposed $60 billion tariffs on Chinese products. This was done to counter the Asian country’s alleged illegal trade practices. For the most part, these tariffs still apply to Chinese products under the Biden administration.

Regarding the first point, according to data from the World Wage Report of the International Labor Organization, average real wages in China almost doubled between 2008 and 2017, far exceeding the pace of global growth in the same period.

Also, an analysis conducted by the brokerage agency Savills points out that, as the Asian giant developed its productive potential, its cost competitiveness eroded. To cite one piece of information, the unit labor cost of manufacturing (that is, the quotient between wages per unit produced) has increased by 285% in the last 20 years.)

Conflicts Cause Companies to Move to Mexico

A commercial conflict between the two economic superpowers began in 2018 and has resulted in reciprocal taxes of approximately five hundred billion dollars annually. As a result of this dispute, companies that had already detected significant cost increases decided to diversify, or even divest, their positions in China, which "accelerated" the decision. Many companies moved their manufacturing operations from China to Mexico as a result.

Added to this are conditions such as intellectual property piracy (with an annual loss of between 225 and 600 billion dollars in software and counterfeit merchandise). Intellectual property thieves in China steal foreign firms' technologies to advance their military and broader economic goals. Added to this were cases of labor exploitation (think the Uighurs in Northwest China), delays, or damage to supply due to environmental disasters (tsunamis, tropical storms) or health emergencies, as has recently happened with the Coronavirus COVID-19.

What are the losses due to “IP Theft” from China? On a recent trip to Washington, DC, I heard the range of $300 billion to $600 billion repeated from various sources without any critical gloss.

The 600 Billion Dollar China IP Echo Chamber

Why Nearshoring in Mexico?

With nearshoring, companies can increase their ability to respond to their customers' needs with shorter delivery times and increased flexibility in the face of potential crises that interrupt the supply chain. A shorter supply chain also creates opportunities for manufacturers to implement a “just in time” production model.

Circumventing disruption is one of the biggest reasons why supply chain leaders will opt for nearshoring. With geopolitical instability, unexpected weather events and pathway blockages threatening shipments that are coming from farther away destinations, many supply chain leaders have started looking at countries such as Mexico for a more stable and close-to-home sourcing option.

Redesigning Your Supply Chain For Nearshoring

Free Trade Agreements Aid in Nearshoring

Additionally, with the entry into force of the new Free Trade Agreement between Mexico, the United States, and Canada (USMCA, formerly NAFTA), Mexico became a key player for global companies seeking to maintain a competitive position in the North American market. Nearshoring to Mexico has gained considerable popularity in recent years.

The clearest example of this phenomenon is in the automotive sector. For instance, the inauguration of the new BMW plant in San Luis Potosí attracted the German automaker’s suppliers, including Chinese companies, to establish themselves in Mexico in anticipation of a rise of 62.5 to 75% regional content per vehicle manufactured, according to the new commercial agreement.

Likewise, Mexican manufacturing has grown in specialization, capacity, and experience so that large companies in the automotive, aerospace, electronics, and medical device industries now have a presence in the country’s territory. Among them are the following companies:

- General Motors

- Ford

- FCA (Fiat-Chrysler)

- Honda

- Nissan

- Mazda

- BMW

- AUDI

- Safran

- Airbus

- Bombardier

- Siemens

- Philips

- LG

- Medtronic

- GE

- Becton Dickinson

Industrial Market Opportunities in Mexico

The advantages of the Mexican industrial market cover various areas, from demographic factors to investment promotion policies. Some of the most important are:

Lower labor costs

In 2019, the average wage in Mexico was $3.95 per hour, compared to $4.50/per hour in China. Even with salary protection measures (such as the increase to 40-45% of automotive labor value content produced by employees earning 16 USD/ per hour, to which Mexico committed with the USMCA), labor costs are competitive, both at the operational, specialized, and managerial levels.

Skilled Workforce and Technical Expertise

Mexico boasts a skilled workforce with expertise in various manufacturing sectors. The proximity allows companies to tap into this talent pool, fostering innovation and efficient knowledge transfer.

Fast and secure supply chains

Instead of waiting three to four weeks for a transpacific shipment, overland delivery from Mexico to the US typically takes 3-4 days. This reduces the risk level of the entire chain and the transportation and storage costs of handling smaller inventories.

Accessibility and direct contacts

A maximum time difference of up to 3 hours facilitates communication and supervision visits. Additionally, production or design processes can be quickly modified to keep pace with changing market preferences.

Increased productivity and quality control

The Mexican workforce is surpassing the Chinese not only in productivity rates but also in quality. In addition, each year, more than 110 thousand engineering students graduate. The entry of these individuals into the workforce guarantees the flow of specialized human talent.

Intellectual property protection

The risks of trade secret theft are lower due to intellectual property laws in Mexico that are modeled on those in the US. They are strictly enforced by the Mexican authorities.

Lower tariffs and a robust network of free trade agreements

Due to the status of "most favored nation" due to the recent signing of the new North American free trade agreement T-MEC and the free trade agreements signed with more than forty nations around the world, Mexico is favored by the reduction of tariffs and taxes for import and export inputs and products.

Strategies for Successful Nearshoring

Comprehensive Risk Management

Diversification of manufacturing locations is a core risk management strategy. By distributing production across borders, companies can mitigate risks associated with single-point disruptions.

Collaborative Supplier Relationships

Building strong partnerships with local suppliers fosters reliability and flexibility. These relationships contribute to agility and rapid response during crises.

Technological Integration

Integrating technology like IoT, AI, and data analytics enhances visibility and traceability throughout the supply chain. Real-time insights enable informed decision-making even in challenging times.

Conclusion: Nearshoring to Mexico Offers a Viable Option

In conclusion, nearshoring manufacturing to Mexico stands as a strategic move that empowers businesses to thrive amid global crises. The proximity, combined with cost-efficiency, skilled labor, and trade advantages, positions Mexico as a hub for resilient and prosperous supply chain management.

FAQs on Nearshoring

Q1: Is nearshoring only about reducing costs?

A1: No, nearshoring also focuses on improving supply chain resilience, accessing skilled labor, and minimizing logistical complexities.

Q2: Are there risks associated with nearshoring to Mexico?

A2: While there are risks like regulatory compliance and cultural differences, careful planning and collaboration can mitigate these challenges.

Q3: How does nearshoring to Mexico compare to offshoring to other countries?

A3: Nearshoring to Mexico offers the advantage of geographical proximity, shorter lead times, and shared time zones, making communication and coordination easier.

Q4: Can small businesses benefit from nearshoring as well?

A4: Absolutely, nearshoring provides small businesses access to cost-effective manufacturing, skilled labor, and trade advantages, leveling the playing field.

Q5: What role does technology play in successful nearshoring?

A5: Technology enhances visibility, traceability, and decision-making. Integrating IoT, AI, and data analytics optimizes operations and responsiveness.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.