Last Updated on July 31, 2024

Low labor costs are one of the most appealing advantages of moving manufacturing to Mexico. As a result, many manufacturing companies use product assembly in Mexico, a labor-intensive process.

Some manufacturers choose to produce in other countries than Mexico, and then assemble the final product in Mexico's factories. A finished or semi-finished product is constructed by assembling, testing, and packaging these imported components.

What Does Product Assembly in Mexico Mean?

In essence, sub-assembly in Mexico factories refers to the processing of parts of a final product. Further, sub-assembly teams analyze the process to make the intended item in the most efficient manner: reducing idle time and maximizing throughput while enhancing efficiency.

Assemblies, or simple assemblies, commonly refer to the work carried out in the main assembly. In spite of this, those assembly tasks that may appear to be a very small part of the process may actually result in processes that are necessary for improving the final product production. By reducing waste, for example, one could expedite the product flow, which could result in a reduction in processing times.

“It’s much more involved than just getting the components for a product and putting them together; there’s a lot of analysis that goes into the flow of the assembly line and being able to see what processes work most efficiently. When you see the full picture of a Mexico manufacturing operation, you then have the ability to break it down to the smaller components to ensure that everything that you are adding to the product assembly is actually a value-added task.”

NovaLink Engineering and Information Systems Manager Manuel Campos

Why Do Companies Choose Product Assembly in Mexico?

An Inexpensive, yet Highly Qualified, Labor Force

Mexico offers a number of benefits when it comes to manufacturing, but when it comes to assembly, the main benefit is the availability and affordability of labor. The most attractive aspect of Mexico's manufacturing labor force is the availability of highly qualified and educated engineers. Especially in the aerospace, automotive, electronics, and medical device sectors, Mexico's manufacturing industries are known for their low costs, as well as their high quality.

“If you want to build 10,000 of something a month and it’s the exact same product and it doesn’t change, that’s an easy thing to do in China. But if you want to build only 100, make some changes and build 100 more, you’re better off “nearshoring” in Mexico. To be able to drive down there with your engineers, talk to the manufacturing folks, give feedback back and forth results in fast turnaround on design changes and prototypes.

NovaLink Engineering and Information Systems Manager Manuel Campos

Scalability and Flexibility: Meet Changing Demand with Ease

One of the biggest benefits of outsourcing product assembly to Mexico is the ability to scale your production up or down as needed. Whether you're dealing with fluctuating demand or seasonal fluctuations, outsourcing allows you to adapt quickly and efficiently. And with NovaLink's expertise, you can rest assured that your production process will be optimized for maximum efficiency.

Access New Markets and Expand Your Reach

Outsourcing product assembly to Mexico also opens up new opportunities for expansion into Latin America and beyond. With a strategic partner like NovaLink, you can tap into new markets and customers, increasing your revenue and growth potential.

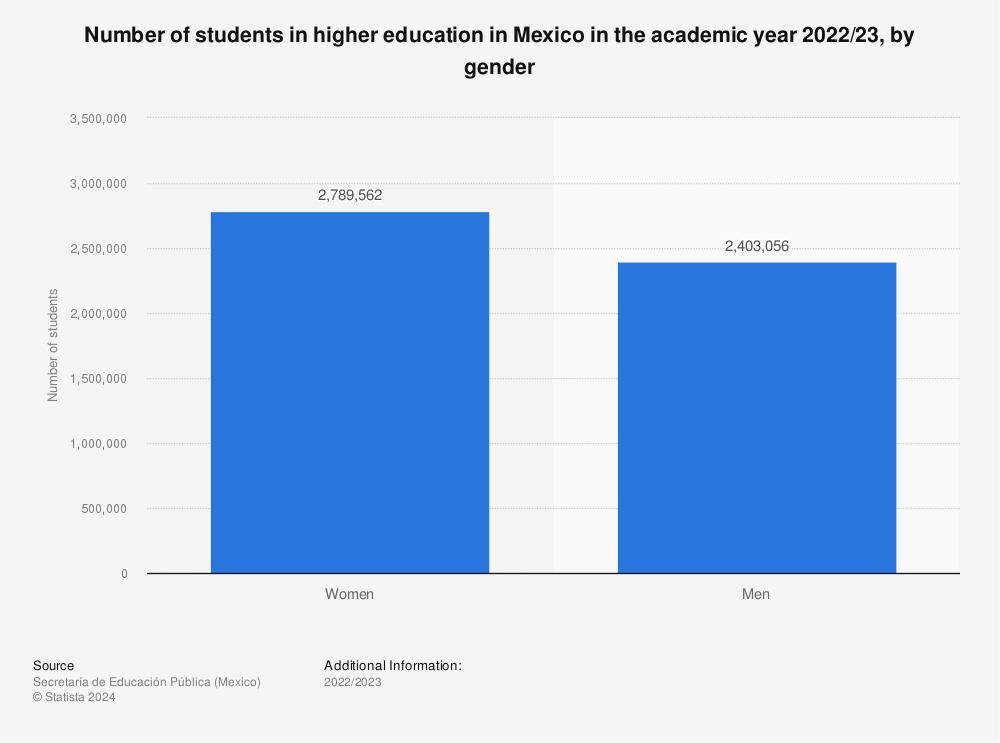

Mexico Has 855,731 Engineering Graduates as of 2022

Consequently, due to the skill level and education of the Mexican labor force, assembling complex products is not a problem. Mexico has 855,731 engineering graduates as of 2022, according to the National Association of Universities and Higher Education Institutions (ANUIES).

Women make up 463,352 of this number, while men make up 392,363. Among the total number of graduates, 7,170 are persons with disabilities, while 8,170 are indigenous speakers.

In addition to undergraduate students, these figures include postgraduates (master's and doctorate) and technical students.

Mexican public two-year colleges and universities have doubled in number in the past decade. In terms of undergraduate engineering degrees, Mexico now competes with the United States. The American Society for Engineering Education reports that the United States awarded 83,000 undergraduate degrees in engineering in 2011.

“Mexico is now one of the top producers of engineers in the world,” said Oscar Suchil, director of graduate affairs at the public National Polytechnic Institute, where 60 percent of its 163,000 students are studying engineering and paying just $12 a semester in tuition.”

Source: Statista, “Number of students in higher education in Mexico in the academic year 2022/23, by gender"

Free Trade Agreements and USMCA

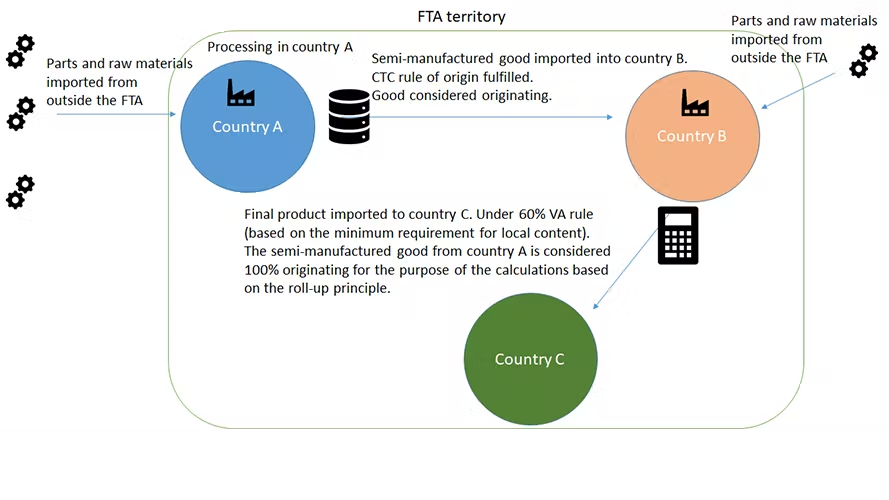

The majority of the savings (besides labor) that can be realized by doing product assembly in Mexico will be due to the materials that are used to make the final, assembled product.

It is possible to export duty free to the United States, Canada, and other countries if raw materials are imported in raw form and assembled into finished products in Mexico. A maquiladora operation offers this benefit, which is also one of the pillars of the United States–Mexico–Canada Agreement (USMCA).

Due to agreements outlined in the USMCA, a product with final assembly in Mexico may still qualify to be labeled "Made in the USA".

The phrase "Made in the USA" is proudly displayed on the packaging of many products, giving consumers a sense of confidence and satisfaction regarding their purchase. To qualify as "Made in the USA", a product must be entirely or nearly entirely manufactured within the United States.

In spite of this, it is still possible to market a product as made in the United States if 90% of its components are manufactured in the United States, but some assembly is performed in Mexico. As long as any details added to the final design provided by assembly in Mexico do not significantly affect the final product or account for less than 18 percent of the final product, the labeling remains the same.

“Not only is there a substantive difference between “made in America” and “assembled in America,” that difference is clearly defined by the Federal Trade Commission (FTC). Here’s how the FTC distinguishes between items that were “made in the USA” vs. “assembled in the USA.” The term “assembled” has a different meaning altogether. This label simply means that the product is composed of parts and materials that were imported to the United States and then assembled into the final product.

r2 Logistics

However, the FTC still regulates this process. The FTC’s definition of “assembled” requires that items undergo a “substantive transformation” on U.S. soil.

This simply means that the parts and materials have been sufficiently altered to change their intended use or functionality, such as when a company imports leather that is transformed into a pair of shoes.”

Source: Capgemini: “Leveraging international trading relationships in automotive manufacturing”

Remember the Certificate of Origin

It is common for important details to be overlooked when getting started with product assembly in Mexico. People often overlook the fact that anything being imported into Mexico must be accompanied by appropriate documentation, such as a certificate of origin.

The International Chamber of Commerce defines a Certificate of Origin (CO) as a document that certifies that goods being exported are wholly produced, manufactured, or processed in a particular country. “This document serves to declare the 'nationality' of the product and to satisfy the requirements for customs clearance and trade."

This is the point at which it must be determined whether the material will be exported temporarily or permanently entered into the country. The duties are different if the materials of a product are permanently imported into the country.

When temporary imports are made, such as parts for a product assembly operation, the goods will be converted into finished products before leaving the country.

In addition to determining where the product was manufactured, the certificate of origin is also important. It is possible that the country of origin may change as a result of the new USMCA. It may not be possible to label a product as "made in Mexico" if it is being manufactured or converted in Mexico. This will depend upon the origin of its key components.

Industries and Goods That Are Suitable for Product Assembly in Mexico

In Mexico, skilled workers produce a wide variety of products for a wide range of industries. The following industries are suitable for Mexico product assembling.

Electronics: Mexico is an ideal location for assembling electronics, which may be why many electronics companies have relocated their manufacturing operations from China to Mexico. Maquiladoras provides the skilled, trained workforce needed in the electronics industry to produce products such as wire harnesses or appliances. The electrical industry gains tangible, consistent, and positive results from maquiladoras.

Automotive: The automotive industry is booming in Mexico. Forbes reports that for the first time, Mexico will account for 40% of vehicle parts exports. According to the International Trade Administration: “Mexico is the seventh-largest global passenger vehicle manufacturer, producing approximately three million vehicles annually. Ninety percent of vehicles produced in Mexico are exported, with 76 percent destined for the United States. “

Automobile manufacturers, such as Audi, BMW, Ford, General Motors, Honda, Mercedes Toyota, and Volkswagen, are shifting their automobile assembly operations south of the border to Mexico because of the complex components involved in automobile manufacturing and the skilled workers in Mexico, many of whom have engineering backgrounds.

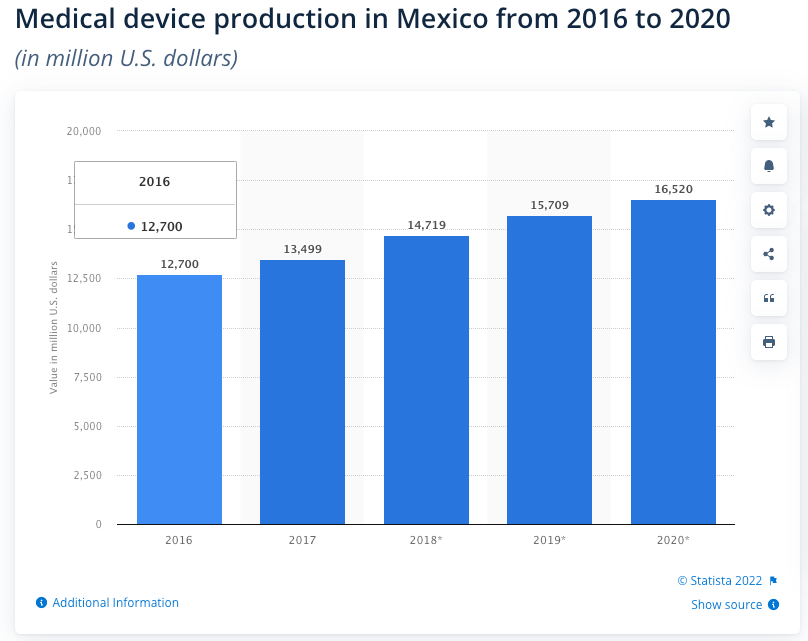

Medical: Mexico is a leader in the manufacturing of medical devices. According to Pro Mexico: “In the last few decades, over 641 medical device manufacturers have landed in nearshore Mexico and are now responsible for over $9.049 billion in annual exports.”

“For example, in building or creating a medical pump there are many, many components and a great amount of time is spent having to reverse-engineer the product, to break-down all the components: the hoses, the valves, the electrical components, etc., to get a clear understanding of what is involved in making the pumps. They can be very complex. In reality, almost all industries have, or benefit from, incorporating sub-assemblies into their final product.”

NovaLink Engineering and Information Systems Manager Manuel Campos

Mexico is one of the world's largest exporters of medical technology.

Estimates show the medical technology market will grow to nine billion dollars. More than 80 percent of the total revenue is accounted for by medical devices, while 20 percent is accounted for by in vitro diagnostics. Diagnostic imaging devices like x-ray systems, computed tomography (CT) scanners, and magnetic resonance imaging (MRI) systems generate the highest revenue among sub-segments.

Source: Statista, “Medical device production in Mexico from 2016 to 2020”

What Should You Know Before Starting Product Assembly in Mexico

There are a number of factors that need to be considered before beginning product assembly in Mexico. The time and money you will save if you plan your operation and ensure that it is a good fit will be well worth the effort.

- Is Your Product Complex and Labor-Intensive? The best candidates for product assembly in Mexico are usually complex products that require many assembly operators. There is a good chance that having an assembly operation in Mexico would not be the best fit if your product is simple to assemble or can be automated by a machine. Exceptions to this rule include simple products that must be assembled manually and have a high volume of production.

- Does Your Product Qualify for Benefits Under USMCA? Depending on where you source your materials for your product, assembling the product in Mexico may not be cost-effective. In the case of an electronic product with many parts originating from China, the product will be subject to tariffs of up to 20% when imported back into the United States. This will negate any savings gained from Mexican labor. A very important step before starting your assembly production is to ensure that your product is exempt from the tariffs.

- How Well Do You Understand Your Existing Supply Chain? A new company considering product assembly in Mexico should first determine how well it understands its current supply chain. Ensure that you have the answers to the following questions:

- What lead times do your vendors have?

- What capabilities do your vendors have?

- Do your vendors have minimum amounts for key materials?

When you can plan ahead for these questions and have the materials and availability in place, starting production at the factory is actually the easiest part. Your manufacturing partner can have the stock to maintain your production line. The lack of this knowledge may result in lines being shut down due to a shortage of materials.

Conclusion: Mexico Is the Best Fit for Product Assembly

Mexico has an extensive pool of talent with a wide range of skills. Mexico has had several industries established for many years, and its workers have experience in a variety of them. In the last 20 years, Mexico has developed industries that are not only labor intensive, but also possess a technical component that has proven to be successful in the country.

Mexican labor is extremely skilled and able to adapt to a variety of tasks, whether it is the assembly of computers, PCs, and main boards, or electronic equipment or high power, industrial equipment.

As well as the talented labor pool, there are many advantages associated with having the borders close for material transit, such as the availability of a variety of entry ports. The best benefit for clients is to have entry ports for moving parts and products within and outside the country.

FAQs - Outsourcing Product Assembly to Mexico

Q1: What is the significance of outsourcing product assembly, specifically to Mexico?

A1: Outsourcing product assembly to Mexico offers businesses a transformative strategy to enhance efficiency, reduce costs, and access a skilled labor force. Mexico's favorable manufacturing environment and proximity to major markets make it an appealing choice for such endeavors.

Q2: How can outsourcing product assembly to Mexico lead to cost savings for businesses?

A2: Mexico's lower labor and operational costs enable businesses to achieve substantial cost savings when outsourcing product assembly. This cost advantage, coupled with streamlined processes, contributes to increased profitability.

Q3: What advantages does Mexico's skilled labor force bring to outsourced product assembly?

A3: Mexico boasts a well-educated and skilled labor force with expertise in various industries. Outsourcing product assembly to Mexico ensures high-quality workmanship, precision, and adherence to industry standards.

Q4: How does outsourcing product assembly to Mexico impact supply chain efficiency?

A4: Outsourcing to Mexico reduces lead times and logistical complexities due to geographical proximity. This proximity allows for faster response times, efficient communication, and optimized supply chain management.

Q5: Can outsourcing product assembly to Mexico drive innovation and product quality?

A5: Yes, indeed. Mexico's manufacturing ecosystem fosters innovation through collaboration with skilled professionals. Outsourcing product assembly to Mexico enables companies to tap into diverse talent pools, resulting in improved product quality and innovation.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.