Last Updated on April 16, 2025

Here’s the thing: when it comes to building resilient supply chains, most folks are looking at the flashy stuff—new tech, automation, faster shipping lanes. But you know what rarely makes headlines and probably should? Stability. And Mexico’s got it. Right now, in the thick of shifting trade policies and ongoing tariff drama, Mexico has emerged as a kind of quiet anchor. Not perfect, not flashy—but steady.

And for companies eyeing a move or expansion in manufacturing, that kind of steadiness matters more than ever. Especially when you're trying to dodge unpredictable tariffs and stay within the safe zone of the USMCA. So let’s break it down. Why is Mexico’s economic stability such a big deal—and what’s that mean for your supply chain?

The Pillars of Economic Stability

Mexico's economic stability is built on several crucial pillars. First and foremost, the country has a diverse and resilient economy. Its vast array of industries, from manufacturing to agriculture, mitigates the risks associated with over-reliance on a single sector. This diversity is a boon for businesses looking to establish long-term supply chain partnerships.

Mexico's stable macroeconomic framework, the economic dynamism of the United States, and its strong manufacturing base are key factors supporting growth. To accelerate sustainable growth and reduce poverty in the medium term, it is crucial to address structural limitations such as restricted access to finance, insecurity, informality, regulatory burdens, and infrastructure bottlenecks. - World Bank

Strategic Location and Trade Agreements

Mexico's geographical location is strategically advantageous for international trade. Its proximity to the United States, one of the largest consumer markets, makes it an ideal gateway for businesses looking to tap into North American demand. Additionally, Mexico has an extensive network of trade agreements, including the United States-Mexico-Canada Agreement (USMCA), ensuring preferential access to key markets.

Skilled and Cost-Effective Labor

Mexico boasts a young and rapidly growing workforce, equipped with a range of skills across various industries. Companies aiming to optimize their supply chains while keeping operational expenses in check need skilled labor at competitive costs.

Government Support and Infrastructure

The Mexican government has been proactive in fostering an environment conducive to business growth. Favorable policies, tax incentives, and infrastructure investment have laid a solid foundation for supply chain operations to thrive.

Government Incentives for Reshoring in Mexico

By strategically aligning with the global trend of reshoring, leveraging Mexico's proximity to the U.S., benefiting from favorable trade agreements like the USMCA, and tapping into cost advantages, companies can position themselves for sustained success. This white paper explores the nuanced details of government incentives in Mexico. It will provide a comprehensive guide for businesses navigating reshoring opportunities. Fill out the form to receive the white paper today.

USMCA Is the Real Hero of This Story

Let me explain. If you’re manufacturing in Mexico and you're playing by the rules—meeting local content requirements and sticking to the guidelines—the USMCA (that’s the United States–Mexico–Canada Agreement) has your back. That means your goods can move into the U.S. and Canada without tariffs. Zero. Nada.

Compare that to the headache of moving stuff out of China right now. With many new Trump tariffs now in place, companies are paying up to 125% more just to get the same goods across the border. That’s a massive drag on margins. Mexico, with its USMCA status, sidesteps all that mess. And for companies trying to rework their cost structures without gutting their operations? That’s a lifeline.

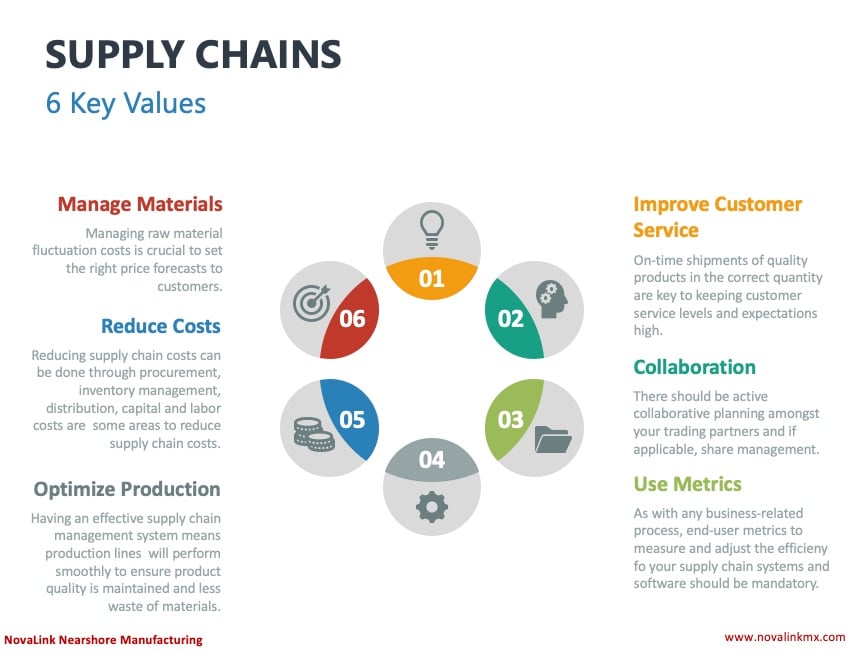

Mexico's Role in Strengthening Global Supply Chains

ou know what’s easy to overlook? The quiet players. The steady hands. The countries that aren’t shouting for attention but quietly keeping the wheels turning. That’s Mexico right now. While much of the world scrambles to patch up fragile supply networks, Mexico’s become something of a grounding force—especially for companies chasing more stable, tariff-proof operations.

Let’s call it like it is: supply chains are under pressure. Still. Whether it’s leftover pandemic ripple effects, geopolitical tensions, or tariffs that just won’t quit, global sourcing has turned into a maze. But here’s the kicker—Mexico, with its calm economic environment, strategic location, and the safety net of the USMCA, is playing a bigger role than most folks realize.

Tariffs Are the Tip of the Iceberg

If you think tariffs are just a line on a spreadsheet, think again. They ripple through every corner of an operation—costing time, killing margins, complicating forecasts.

When the Trump administration launched a wave of tariffs on imports—especially from China—it triggered a massive rethink across industries. Suddenly, supply chains that had been set in stone for decades weren’t looking so solid. For companies that stayed put, some absorbed the cost. Others passed it on to customers. But many looked south—and found something promising.

Mexico, unlike many low-cost regions, wasn’t caught in that storm. With the USMCA in place and trade relationships long established, it offered something increasingly rare: predictability. That’s gold in an industry where late shipments can burn millions and late pivots cost even more.

The tariffs are generally bad for global supply chains, as supply chains depend on collaboration and mutual benefit. In the short term, tariffs are particularly bad for cheap industrials and cheap apparels, which have low margins — these supply chains will suffer a lot of damage as these inventories will depreciate if consumption falls. Auto or industrial supply chains include many low-cost components that have very low margins. As costs for those go up, we will see price increases in the finished goods as well. - Wharton Business School

The Power of a Predictable Economy

You wouldn’t build your house on shifting sand, right? Same goes for manufacturing.

Mexico isn’t chasing headlines with wild growth rates or shocking reform. But that’s kind of the point. Inflation’s under control. Interest rates are within reason. Government debt is stable. And the peso, while it fluctuates like any currency, has avoided the kind of wild swings that can derail profit models.

This all adds up to a rare kind of calm—especially for companies coming from more volatile sourcing markets. When the economy is steady, you can plan. When you can plan, you can scale. And when you can scale? That’s when things get interesting.

Shorter Lead Times

With its proximity to major consumer markets, Mexico allows for shorter lead times in transporting goods, reducing inventory costs and increasing responsiveness to market demands. Agility is a key advantage for companies operating in fast-paced industries.

Lower Transportation Costs

Shipping products from Mexico is often more cost-effective than sourcing from distant overseas locations. This cost efficiency can lead to significant savings for businesses, enhancing their competitiveness on the global market.

Real Skills. Real People. Real Production.

Sometimes we talk about supply chains like they’re just machinery and containers. But behind every smooth delivery is a person—often many. And Mexico has the talent to back up its growing role.

From skilled textile workers in Matamoros to seasoned auto engineers in Guanajuato, Mexico’s workforce isn’t new to the game. They’re trained, experienced, and integrated into global production standards. And it’s not just low-cost labor, either. It’s capable, consistent labor.

Add to that a growing tech and logistics sector, and suddenly the ecosystem around your factory starts looking a lot like home—just more cost-effective.

Why U.S. Companies Are Moving Their Supply Chains From China to Mexico

Does Mexico have supply chain issues? In spite of the fact that all exporting companies face supply chain challenges, Mexico seems to face fewer challenges than other manufacturing countries, such as China. Supply Chain Brain has a list of reasons why companies are moving their supply chains from China to Mexico.

Ground Transport

Goods can be imported from Mexico via ground transport in a matter of days or even hours. This is never an option for goods manufactured in China, from which everything must come by ocean or air. The former is very time consuming (it can often take weeks), and the latter is very expensive.

"Trusted Partner" Status for Customs

The U.S. offers two programs that help facilitate faster and easier Customs processing for U.S.-Mexico trade: FAST and C-TPAT. Initiated after 9/11, FAST is a trusted traveler/trusted shipper program that allows expedited processing for commercial carriers who have completed background checks and fulfill certain eligibility requirements (much like TSA Precheck for air travelers). FAST certification is for drivers; C-TPAT is a broader program that shippers must apply for. Once a company is certified for C-TPAT, its drivers can then apply for FAST. There are no such programs for U.S.-China trade.

A Transparent Landscape

There are also new modern options for transport that make Mexico attractive. Companies can coordinate door-to-door transportation between the U.S. and Mexico, including procurement of trucks on both sides of the border, customs clearance, insurance, financing, and reporting. This allows manufacturers to focus on their core competency, rather than logistics, and can also reduce the need for big in-house shipping and logistics teams.

Small Language Barrier

Spanish is the second-most common language spoken in the U.S., making it relatively easy to communicate with partners in Mexico (and find bilingual staff and vendors).

Spanish is the second-most common language spoken in the U.S., making it relatively easy to communicate with partners in Mexico (and find bilingual staff and vendors).

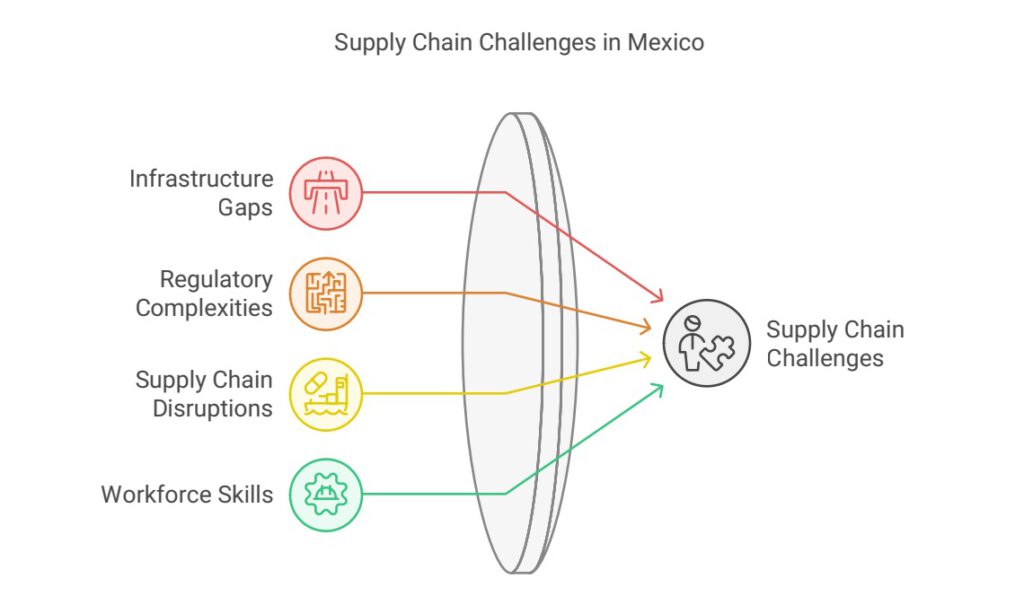

Navigating Challenges and Seizing Opportunities

Embracing Technological Advancements

Technological advancements globally demand that Mexican supply chains keep up with innovations. Investing in state-of-the-art technologies can optimize efficiency and strengthen the supply chain network.

Sustainable and Ethical Practices

In an increasingly conscious market, businesses are expected to prioritize sustainability and ethical practices throughout their supply chains. By adopting eco-friendly and socially responsible approaches, Mexico can attract businesses committed to making a positive impact.

The Bigger Picture: Global Supply Chains Are Changing

We’re not going back to “just-in-time” any time soon. The old model—super lean, super cheap, but fragile—just didn’t hold up. Now, companies want supply chains that can bend without breaking. That’s why regional diversification is the new mantra.

Mexico plays a key role in this shift—not as a backup plan, but as a central hub. With strong trade agreements, infrastructure investments (like the modernization of the Isthmus of Tehuantepec corridor), and a business culture closely aligned with the U.S., it’s not just an alternative to Asia—it’s an advantage.

And honestly, it’s not about abandoning China or other regions altogether. It’s about smart balancing. Mexico offers a way to keep operations grounded when the rest of the world feels anything but.

FAQs on How Mexico's Stable Economy Strengthens Supply Chains

Is Mexico's stable economy impacted by global economic fluctuations?

While Mexico is not immune to global economic fluctuations, its diversified economy and strong trade relationships help it navigate through challenges more effectively.

How does Mexico's proximity to the United States benefit supply chains?

Mexico's close proximity to the United States allows for shorter lead times, reducing transportation costs and ensuring quicker access to a vast consumer market.

What are the key factors that make Mexico's labor force attractive to businesses?

Mexico's labor force is young, skilled, and cost-effective, making it an appealing choice for businesses seeking quality talent at competitive rates.

How can companies address security concerns while operating in Mexico?

Implementing thorough risk management strategies, working with reputable partners, and staying informed about local conditions are essential steps to address security concerns.

What role does the Mexican government play in supporting supply chains?

The Mexican government offers favorable policies, tax incentives, and investments in infrastructure to create a business-friendly environment that supports supply chain growth.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.