Last Updated on June 9, 2024

The siren song of investing in Mexico is increasingly captivating manufacturers around the world. Mexico is now the leading source of goods imported to U.S. But why the sudden surge of interest in this vibrant Latin American nation?

With its close proximity to the massive United States consumer market, low labor costs, numerous free trade agreements, and attractive government incentives, Mexico offers compelling advantages that continue to draw investors in droves. Let's explore why investors flock to Mexico and what makes it a hotspot for manufacturing investment.

Favorable Location and Logistics

One of the key reasons domestic and foreign investors are investing in Mexico is its highly convenient logistics location. Mexico shares a nearly 2,000 mile border with the United States, which gives it easy overland access to the world’s largest economy. This allows for simpler transportation logistics and faster market speed.

Goods can often reach their U.S. destinations within a day or two by truck or rail from Mexico’s industrial regions. At the same time, Mexico offers sea access to Asian and European export markets through major ports on the Pacific Ocean and Gulf of Mexico. Its proximity makes trade simpler and quicker than manufacturing further away.

Nearly two-thirds of the containers reaching ocean ports on the West Coast of the United States are destined for the middle of the country and the East Coast — regions reached more easily by rail and truck from Laredo, Mr. Montemayor said.

Already, some American companies importing goods from Asia are bypassing the docks in Southern California and shipping instead to Manzanillo, on Mexico’s Pacific coast. From there, they move containers north to Laredo en route to destinations across North America.

The New York Times

Lower Manufacturing Costs

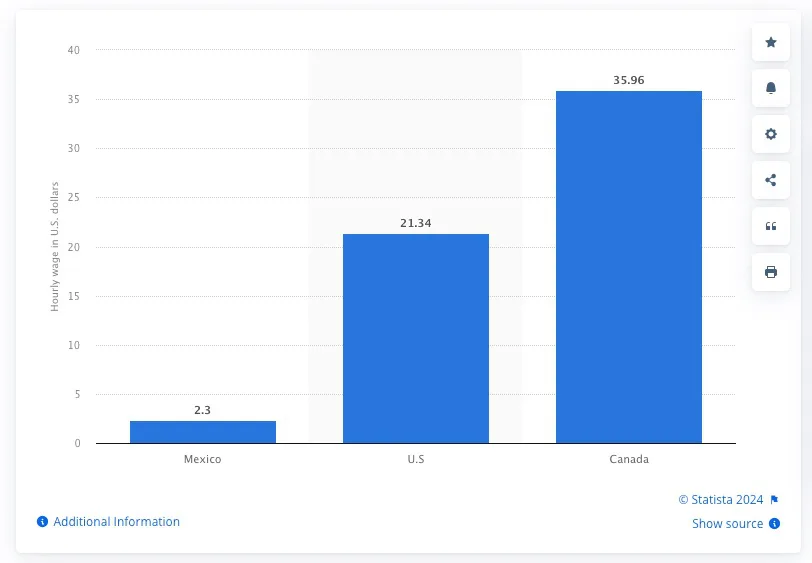

Another major attraction drawing investors’ to investing in Mexico is Mexico’s relatively low production costs, especially labor. While Mexico’s wages have increased gradually, manufacturing workers still earn far less than comparable U.S. employees. Everything from factory salaries to industrial electricity rates remains low in Mexico.

Source: Statistia

Cost Advantages Include:

This cost advantage allows investors to manufacture goods at substantially lower prices in Mexico versus the United States or other developed countries. Companies can then export the finished products duty-free to the U.S. market across the border.

Manufacturers estimate 15-25% production cost savings in Mexico over equivalent U.S. facilities. For labor-intensive industries in particular, this difference is even more significant. Hundreds of thousands of manufacturing jobs have shifted from the U.S. and other developed markets to Mexico over recent decades.

Investing in Mexico: Preferential Trade Agreements

Mexico also appeals to manufacturers thanks to its numerous free trade agreements with major economies globally. Most notably, it is a member of the United States-Mexico-Canada Agreement (USMCA, formerly NAFTA). This eliminates most tariffs on goods traded between Mexico, the United States, and Canada.

Given the size of the U.S. consumer economy next door, duty-free exports represent an enormous incentive. American demand accounts for over 70% of Mexican exports annually. Companies located in Mexico can ship finished products to U.S. customers without worrying about export taxes or quotas.

Beyond the USMCA free trade bloc, Mexico also has agreements with:

Taken together, these pacts give Mexico manufacturers barrier-free access to markets representing over 60% of global GDP. This trade advantage attracts export-oriented industries. Note: Mexico does not have a trade agreement with China.

Mexico decided to temporarily increase tariffs of between 5 and 25 percent on a total of 392 products for countries with which it does not have a free trade agreement, including China. The tariffs, which were put in place on August 16, impact around 90 percent of Chinese exports to Mexico, and will remain in effect until July 2025.

The Diplomat

Government Incentives

Mexico has emerged as a magnet for foreign direct investment (FDI) in manufacturing, particularly from neighboring US companies seeking to nearshore operations. This surge isn't without reason: Mexico offers a potent cocktail of attractive incentive programs at both federal and state levels, enticing manufacturers to set up shop south of the border.

Beyond the federal level, individual Mexican states offer additional sweeteners:

- Land Grants and Discounts: States may offer discounted or even free land for qualified investors, reducing setup costs.

- Tax Incentives: States can supplement federal tax breaks with their own programs, further lowering the tax burden.

- Training Programs: Some states provide workforce training programs, helping manufacturers find skilled labor.

- Cash Grants: In specific cases, states may offer direct cash grants to attract large and impactful investments.

Specific incentives depend upon the industry, type of facility, and location chosen in Mexico. Additional perks are provided to investors meeting certain minimum investment and job creation thresholds. This further lowers startup costs for manufacturers and improves returns on invested capital.

Booming Border Region Manufacturing

One particular area that has become exceptionally popular for new plants is the Mexico side of the U.S.-Mexico border. Major border cities like Matamoros, Tijuana and Ciudad Juarez have seen massive manufacturing base expansions catering to export-focused industries.

Border zones appeal due to:

Dubbed the “Factory of the World”, Matamoros alone has attracted over 150 manufacturing facilities within competitive sectors like automotive, electronics, medical devices, and aerospace products. With new high-tech plants opening each year, the momentum of the economy remains strong.

In particular, Northern Mexico has benefited from its proximity to the US. The region already enjoys strong economic links with US border states, and these ties will only strengthen if the US ramp up nearshoring. Investments data of companies planning to shift their supply chains to Mexico suggest this is already happening.

ABRDN Investments

Investing in Mexico: Promising Long-Term Outlook

International corporations and Mexican domestic firms will likely ramp up investing in Mexico's industrial capacity for years. Despite the uncertainty created by the COVID pandemic, manufacturing conditions remain extremely positive.

Mexico’s large youth population ensures an abundant worker pipeline even as costs rise. Its proximity to key North American and global trade powers makes it impossible for competitors across Asia to physically replicate. Generous incentives also appear politically sustainable regardless of election outcomes.

Though risks like security, corruption, and potential U.S. policy shifts exist, manufacturers regard Mexico’s advantages as outweighing these concerns. With most industry metrics pointing upwards into 2030, the country seems primed for another decade of surging foreign direct investment inflows seeking a dependable export platform to lucrative markets.

So far, the nearshoring trend has seemingly resulted in higher foreign direct investment in the Latin American region. For example, Mexico reported a 12 percent increase in FDI for 2022, and the highest investment figure of the past seven years.

This has resulted in higher demand for industrial space in the region. The Mexican Central Bank reports that the view among large corporations is that the greater impact of nearshoring is yet to be seen. Most industrial companies expect the increase in demand to be reflected between 2024 and 2025, and a large number of survey participants expected the benefits to be observed after 2026.

White and Case

Conclusion: The Future Beckons: Investing in Mexico's Potential

So, is investing in Mexico a surefire bet? Not necessarily. But for manufacturers seeking a strategic location, competitive costs, and a skilled workforce, it presents a compelling opportunity. By carefully considering the challenges and leveraging available resources, companies can tap into Mexico's vast potential. They can also reap the rewards of a thriving manufacturing ecosystem.

Frequently Asked Questions on Investing in Mexico

What are the main benefits making Mexico attractive for manufacturers?

The key advantages include Mexico's close proximity to the massive U.S. consumer market, low labor costs due to its developing economy status, numerous free trade agreements with leading economies globally, attractive government incentives, and a shared border with the U.S. that simplifies logistics.

What Mexican border cities are seeing the fastest manufacturing growth today?

Cities along the U.S.-Mexico border like Tijuana and Ciudad Juarez are experiencing booming expansions of their manufacturing bases thanks to benefits like efficient just-in-time logistics, easy U.S. market access, and ability to tap cross-border infrastructure. These cities have attracted hundreds of new plants catering to NAFTA-linked industries.

How much cost savings does manufacturing in Mexico offer versus the United States?

Manufacturing cost savings in Mexico compared to equivalent U.S. facilities are estimated to range from 15-25% on average. For labor-intensive industries where wages account for a bigger share of expenses, this difference can be even larger due to Mexico's lower-cost workforce.

What are Mexico’s biggest risks perceived by manufacturers today?

Major risks seen by manufacturers include personal security issues, government corruption and bureaucracy, potential changes to U.S. trade policies that could impact duty-free exports, and other political uncertainties that could reduce incentives. However, Mexico's overall advantageous conditions are viewed as compensating for these issues currently.

Will Mexico's positive momentum for attracting manufacturing foreign direct investment continue through 2030?

Yes, analysts broadly agree Mexico is primed for at least another decade of rising FDI inflows into its industrial sector thanks to favorable demographics, trade access, low costs, and evidence suggesting government export subsidies will remain durable regardless of specific election outcomes going forward. The 2020s appear very constructive for manufacturers targeting access to North American customers.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about investing in Mexico manufacturing with our curated collection of related blog posts.

- Mexico Rewards Manufacturing Companies That Commit: Here’s Why

- Can Moving Manufacturing to Mexico Really Be Turnkey? Here’s What You Need to Know

- How U.S. Tariffs Are Reshaping Mexico’s Manufacturing Outlook

- 3 Key Benefits of Operating in Mexico’s Border Zone

- Mexico’s Infrastructure: A Key Factor in Outsourcing Decisions

- Tax Incentives and Economic Zones for Manufacturers in Mexico

- Mexico’s Industrial Manufacturing Sector Opportunities for Foreign Investment

- Setting Up an Industrial Manufacturing Facility in Mexico: A Smart Business Move