Last Updated on April 3, 2025

Understanding the Tariff Debate

Trade between the U.S. and Mexico fuels industries on both sides of the border, but tariffs threaten to upend this delicate balance. While some argue tariffs protect domestic jobs, others warn they create more harm than good. The question is: do tariffs on Mexico actually help U.S. businesses, or do they just make things more expensive and complicated?

What Are Tariffs and Why Do They Exist?

A tariff is a tax on imported goods and services, making them more expensive compared to domestic products. Governments impose tariffs for several reasons:

- Protecting Domestic Industries – Higher import costs encourage consumers to buy local.

- Generating Revenue – Import taxes bring in government income.

- Influencing Trade Relationships – Tariffs can be used as leverage in trade negotiations.

While these sound beneficial in theory, the reality is often more complicated. Businesses that rely on global supply chains end up paying more, passing costs onto consumers. That’s where things start to break down.

The Impact of Tariffs on Trade and Manufacturing

If you manufacture in Mexico, you’ve probably felt the effects of tariff uncertainty. Here’s what happens when tariffs come into play:

- Higher Costs for Businesses and Consumers – Tariffs make raw materials and finished goods more expensive, shrinking profit margins.

- Disrupted Supply Chains – Many industries, including automotive and textiles, depend on seamless cross-border trade.

- Retaliation from Trade Partners – If the U.S. imposes tariffs, Mexico might do the same, hurting American exports.

- Slow Business Growth – Uncertainty around trade policy makes companies hesitant to invest in expansion.

For manufacturers, stability is everything. When tariffs are in play, long-term planning becomes a guessing game.

Are Tariffs on Mexico Helping or Hurting?

Supporters of tariffs argue they protect American jobs and reduce dependence on foreign suppliers. But is that really the case?

Job Protection – Higher import costs can push companies to manufacture in the U.S., preserving jobs.

Encouraging Local Investment – Tariffs could force businesses to build domestic factories.

Government Revenue – The U.S. collects money from imports, theoretically benefiting public programs.

Higher Prices – Businesses pass tariff costs onto consumers, making everyday goods more expensive.

Supply Chain Disruptions – Many U.S. industries rely on Mexican materials, and tariffs complicate production.

Trade Retaliation – Mexico is one of America’s biggest trading partners; tariff wars only damage both economies.

Why the Tariff Justifications Fall Short

The Trump administration pushed for tariffs on Mexico to address trade imbalances, boost domestic production, and influence political policies. But here’s the problem:

- Trade imbalances are normal – Global supply chains fluctuate, and no country maintains a perfect trade balance.

- Manufacturing can’t move overnight – Shifting production from Mexico to the U.S. is costly and time-consuming.

- Tariffs hurt American businesses too – Mexico is a key supplier to many U.S. industries; cutting off trade raises costs domestically.

In short, tariffs often miss their mark. Instead of boosting American manufacturing, they create uncertainty, raise costs, and disrupt well-established supply chains.

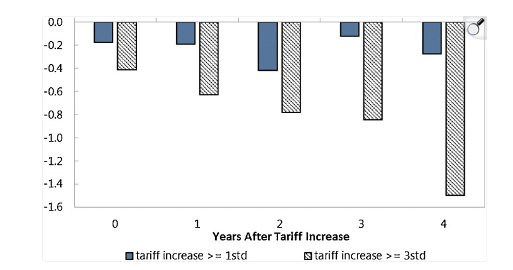

The findings suggest that tariffs have a detrimental effect on output, with the negative effect larger for higher tariff increases and persisting over time, at least over the next four years or so. The residualized growth tends to be in negative territory in all four years following an increase in protectionism - National Library of Medicine

Conclusion

Tariffs on Mexico may seem like a quick fix for economic concerns, but they come with long-term consequences. Instead of fostering growth, they add complexity and cost, making manufacturing more difficult for businesses in both countries. For companies looking to relocate or expand in Mexico, maintaining free and fair trade policies is critical to sustaining efficiency and profitability.

FAQs

1. How do tariffs on Mexico impact U.S. businesses?

Tariffs increase costs for U.S. manufacturers that rely on Mexican materials or components, leading to higher prices for consumers and disrupted supply chains.

2. Can tariffs help bring manufacturing jobs back to the U.S.?

While tariffs can encourage domestic production, shifting operations from Mexico to the U.S. is expensive and time-consuming, making it an impractical short-term solution.

3. Why do some companies oppose tariffs on Mexico?

Many businesses rely on Mexican manufacturing for cost-effective production. Tariffs disrupt supply chains, increase expenses, and create economic instability.

4. What industries are most affected by tariffs on Mexico?

The automotive, electronics, and textile industries are hit hardest, as they depend on Mexican imports for parts and materials.

5. Will tariffs on Mexico ever be removed?

Trade policies evolve with each administration. While tariffs can be lifted, businesses must stay agile and prepared for ongoing trade negotiations.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about Trade Tariffs with our curated collection of related blog posts.

- Tariffs in Mexico vs. Taxes: What’s the Real Difference, and Why Should You Care?

- Why Mexico Is Beating Asia for Fast Turnaround

- What You Need to Know About Sourcing Fabrics in Mexico for Clothing Production

- Bill of Lading Explained: Essential Guide to Types, Terms, and How It Impacts Your Manufacturing Operations in Mexico

- How U.S. Tariffs Are Reshaping Mexico’s Manufacturing Outlook

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.