Last Updated on August 7, 2025

Tariffs in Mexico—three words that tend to set off alarms or at least a few legal-sized headaches for companies eyeing a move south of the border. And we get it. You’ve probably heard the terms “taxes” and “tariffs” tossed around like interchangeable puzzle pieces. But they’re not the same thing—not even close.

So, what is the difference between taxes and tariffs in Mexico? And more importantly, why does it actually matter for your manufacturing operation?

Let’s break it down in plain English.

First off, what even are tariffs?

Think of tariffs as tollbooths at the border. You want to bring your goods into Mexico (or take them out)? Cool—but you might have to pay a fee. That fee is the tariff. It’s not about running your business inside Mexico—it’s about crossing the border.

Tariffs in Mexico usually show up when you:

- Import raw materials or finished goods

- Export products to the U.S. or other countries

- Bring in machinery or equipment

And here's the kicker: tariffs aren’t set in stone. They depend on where the goods are coming from, what they are, and how they’re classified under the Harmonized Tariff Schedule (HTS). Even the smallest error in classification could mean you’re paying more than you should—or worse, facing penalties.

And taxes? That’s a whole different bucket.

Now, taxes are what you pay to operate within Mexico—on the daily. We’re talking:

- IVA (Value-Added Tax) – Similar to sales tax, usually 16%

- ISR (Income Tax) – Paid on net income (about 30%)

- Payroll and social security taxes – If you hire labor in Mexico

- Municipal taxes – Depending on your location

These aren’t about moving goods across borders. They’re about how you do business on the ground.

Imagine it this way: tariffs are the cover charge at the door, and taxes are the bar tab once you're inside. Both cost money—but for different reasons.

Why the mix-up happens (and why it’s a problem)

Let’s be honest—businesses don’t move to Mexico for the paperwork. They move for the labor savings, the shorter lead times, and the proximity to the U.S. But if you don’t know what’s a tax and what’s a tariff, you risk miscalculating your total landed costs.

Say you’re budgeting for import duties when your goods are actually tariff-exempt under a trade agreement like USMCA—you’re leaving money on the table. Or maybe you forgot about Mexico’s 16% VAT on some imports, and now you’re behind schedule and over budget.

One word: headache.

Where IMMEX flips the script

Now here’s where things get interesting. If you're manufacturing in Mexico under an IMMEX (Maquiladora) program, the whole game changes.

Under IMMEX:

- You can temporarily import materials and equipment tariff-free

- You’re exempt from VAT on imports

- You must export finished goods within a set timeframe

Translation? IMMEX is the golden ticket if you’re assembling in Mexico and shipping back to the U.S. It softens both the tariff and tax burden—but only if you’re set up properly.

But wait—what about USMCA?

Glad you asked. The United States–Mexico–Canada Agreement (USMCA) replaced NAFTA and has a big role here.

If your goods meet “rules of origin” (meaning enough of the product was made in North America), you may not owe any tariffs at all when shipping between the three countries.

But that depends on the details—like where your materials come from, how your product is assembled, and whether you’ve kept your documentation squeaky clean.

See the pattern? It all comes down to how you set things up.

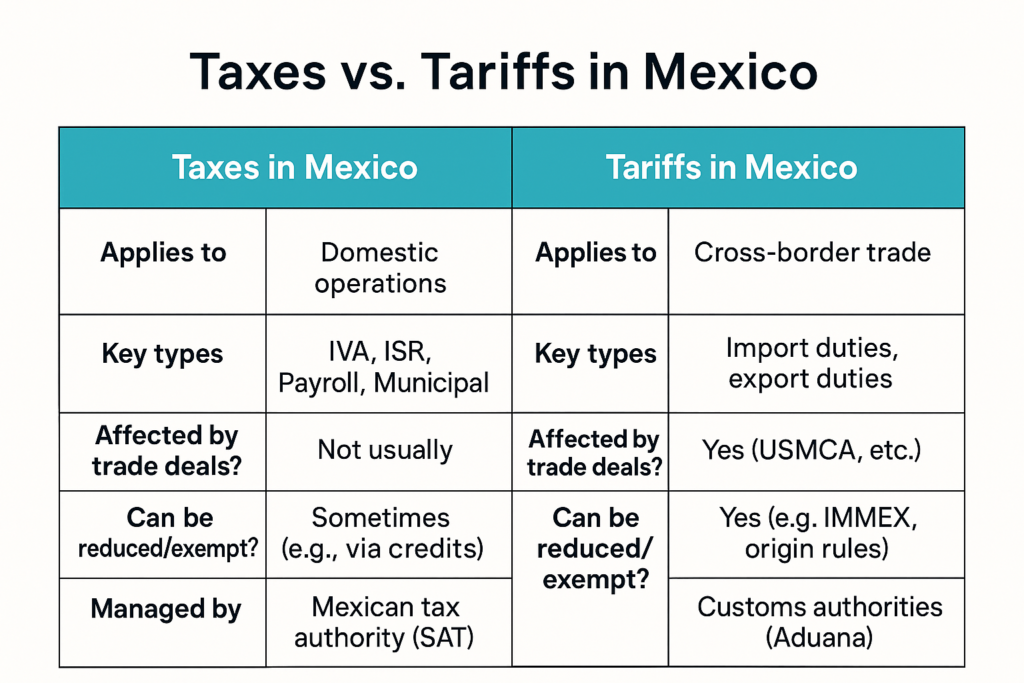

A quick look: taxes vs. tariffs at a glance

| Element | Taxes in Mexico | Tariffs in Mexico |

|---|---|---|

| Applies to | Domestic operations | Cross-border trade |

| Key types | IVA, ISR, Payroll, Municipal | Import duties, export duties |

| Affected by trade deals? | Not usually | Yes (USMCA, etc.) |

| Can be reduced/exempt? | Sometimes (e.g., via credits) | Yes (e.g., IMMEX, origin rules) |

| Managed by | Mexican tax authority (SAT) | Customs authorities (Aduana) |

So what should you actually do?

If you're a company exploring manufacturing in Mexico, the first thing you should do is get clear on:

- What you’ll be importing and exporting

- How much value-add will happen in Mexico

- Whether you qualify for IMMEX or USMCA benefits

Then—seriously—talk to a qualified customs broker or trade compliance expert who understands the Mexican system. Don’t try to guess your way through it.

And don't assume a U.S. tax accountant knows Mexico’s tariff structure—they probably don’t.

Bottom line

Tariffs in Mexico and taxes in Mexico aren’t just two sides of the same coin—they’re two different currencies. One controls your border costs, the other governs your internal operations. Misunderstand them, and you’re flying blind.

But get it right? You could lower your total costs, reduce delays, and gain a competitive edge your competitors are too confused to chase.

So ask yourself: are you ready to stop guessing—and start optimizing?

FAQs

What is the main difference between taxes and tariffs in Mexico?

Taxes apply to domestic business operations like income and sales, while tariffs are fees for importing or exporting goods across borders.

How does the IMMEX program affect tariffs in Mexico?

It allows manufacturers to import goods temporarily without paying tariffs or VAT, provided they export the finished product within a certain time.

Are all goods imported into Mexico subject to tariffs?

No. Some are exempt under trade agreements like USMCA, especially if they meet specific origin and assembly requirements.

Do I still pay taxes in Mexico if I qualify for IMMEX?

Yes. IMMEX reduces or eliminates certain tariffs and VAT on imports, but you'll still be responsible for standard business taxes like payroll and income.

Can I avoid tariffs entirely when manufacturing in Mexico?

Not always—but with the right trade structure, such as USMCA qualification or IMMEX, you can often reduce or eliminate them.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.