Last Updated on February 26, 2024

The automotive industry is a global powerhouse that plays a vital role in economies around the world. One country that has emerged as a significant player in automotive manufacturing is Mexico. With its strategic location, skilled labor force, and favorable business environment, Mexico has become an attractive destination for automotive companies looking to establish their manufacturing operations. In this article, we will explore the growth of automotive manufacturing in Mexico, its advantages, key players, challenges, government support, and the future outlook of the industry.

Automotive Manufacturing in Mexico

History and Growth of Automotive Manufacturing in Mexico

Mexico has a rich history in automotive manufacturing, dating back several decades. The industry gained momentum in the 1960s when foreign automakers started establishing assembly plants in the country. Over the years, Mexico has experienced significant growth in automotive production, attracting both domestic and international investment. Today, Mexico is one of the largest automotive manufacturing hubs globally.

According to figures from the Mexican Association of the Automotive Industry, Mexico manufactures 23% of the vehicles produced in North America.

Wisconsin Economic Development

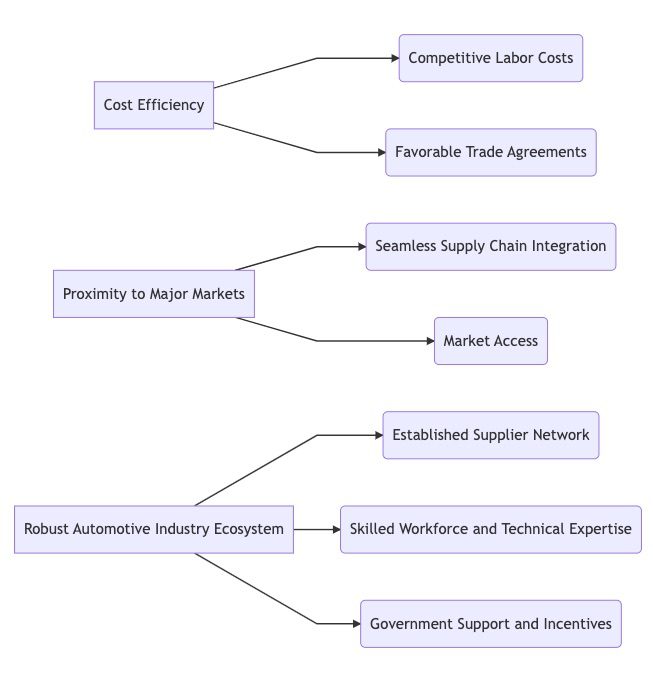

Factors Driving Automotive Manufacturing in Mexico

Several factors contribute to the success of automotive manufacturing in Mexico. One of the key drivers is the country's proximity to the United States, the world's largest automotive market. This geographical advantage allows for easy access to suppliers, customers, and distribution networks. Mexico has invested in building transportation infrastructure, ports, and highways to facilitate efficient autos supply chains and exports, especially across the US border. Developed supply chains also feed into production.

Additionally, Mexico boasts a skilled labor force with technical expertise, making it an attractive destination for automakers seeking cost-effective and high-quality production.

Key Statistics About Automotive Manufacturing in Mexico

- Mexico is the world's 6th largest vehicle producer and 4th largest exporter, after Germany, Japan, and South Korea (2020).

- Mexico's auto industry produced almost 3.6 million light vehicles in 2021, up 17% over 2020. Total vehicle production capacity reached 5 million vehicles per year.

- Over 80% of Mexico's vehicle production is exported, mostly to the United States (75% of total exports) but also to countries in South America and Europe.

- 20 global automotive companies from Asia, Europe, and the U.S. have manufacturing facilities in Mexico including GM, Nissan, Toyota, Honda, Volkswagen, Ford, Renault-Nissan, Fiat Chrysler, BMW and Mercedes.

- The auto industry is Mexico’s 2nd largest industry, accounting for over 5% of Mexico’s GDP and 20% of Mexican manufacturing GDP.

- The auto industry employs over 950,000 direct jobs with another 2+ million indirect jobs, contributing 9% of total national employment in Mexico.

- Since 2010, Mexico's light vehicle production capacity has doubled and new investments surpassed $20 billion USD between 2010 and 2020. Key production centers are in central Mexico's "auto corridor" and northern Mexico near the U.S. border.

- Source

Advantages of Automotive Manufacturing in Mexico

Manufacturing in Mexico offers numerous advantages for automotive companies. Let's explore some of the key benefits:

Cost-Effectiveness

Mexico provides cost advantages for automotive manufacturers compared to other regions. Factors such as lower labor costs, operational expenses, and favorable tax structures contribute to significant cost savings. Companies can leverage these advantages to enhance their competitiveness and profitability.

Proximity to the United States

Being in close proximity to the United States offers substantial benefits for automotive manufacturers. The just-in-time production model (JIT) is prevalent in the industry, and Mexico's proximity allows for efficient supply chain management. Reduced transportation costs, shorter lead times, and better inventory control are some of the advantages that come with this strategic location.

Skilled Labor Force

Mexico boasts a skilled and adaptable labor force, particularly in the automotive sector. The country has established educational and vocational programs to train individuals in manufacturing-related skills. This focus on developing technical expertise has resulted in a highly skilled workforce capable of meeting the demanding requirements of automotive manufacturing. The availability of skilled labor is a significant advantage for companies looking to establish or expand their operations in Mexico.

Trade Agreements and Market Access

Mexico has an extensive network of trade agreements, including the United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA). These agreements provide favorable market access and tariff reductions for automotive manufacturers. By operating in Mexico, companies can take advantage of these trade agreements to reach global markets more efficiently and expand their customer base.

Supportive Government

The Mexican government has implemented various measures to simplify regulations and create a more business-friendly environment for automotive manufacturers. In addition the Mexican government offers financial assistance programs and subsidies to attract foreign investment and support the growth of the automotive sector.

The Mexican government's efforts to create a more business-friendly environment, particularly in the automotive sector, are starting to show results.

Financial Times

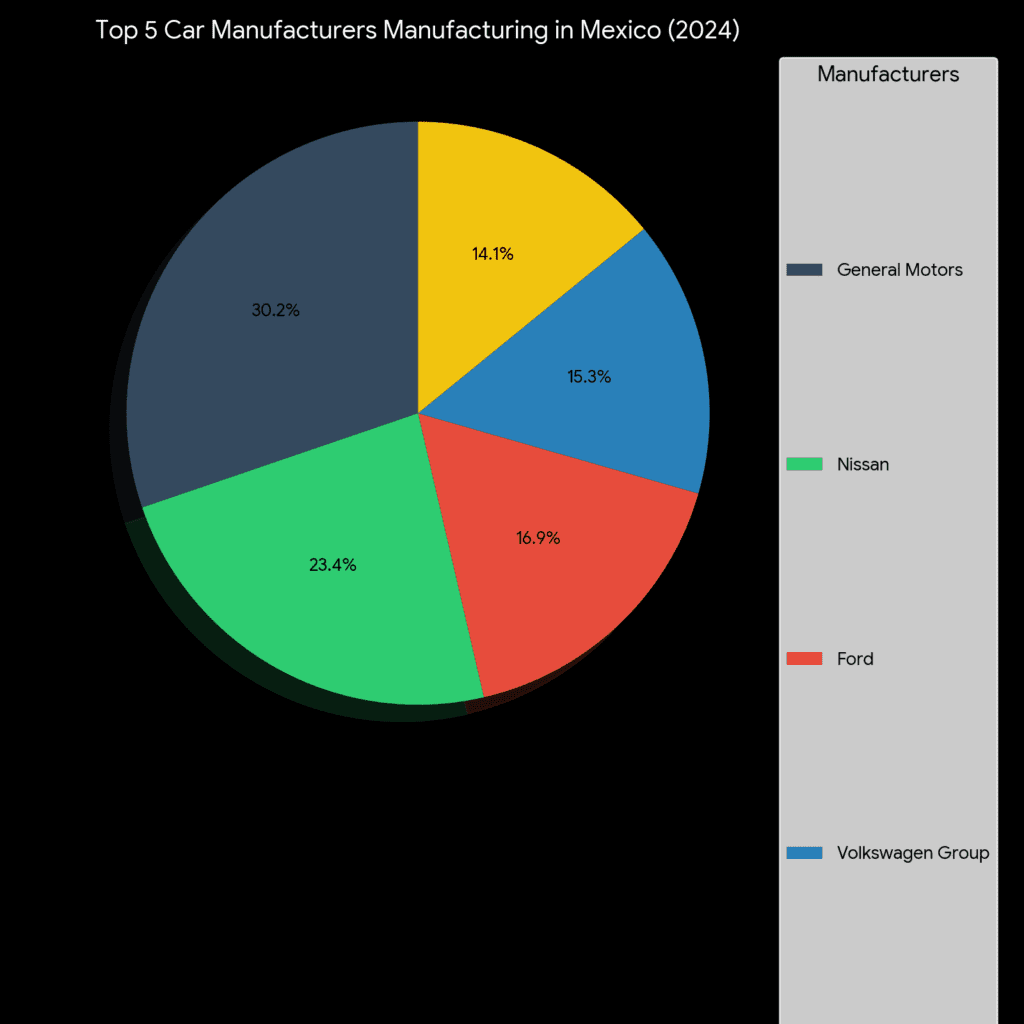

Key Players in the Mexican Automotive Industry

The Mexican automotive industry comprises various key players, including both Original Equipment Manufacturers (OEMs) and suppliers.

OEMs (Original Equipment Manufacturers)

Several global automotive OEMs have established manufacturing operations in Mexico. Companies such as General Motors, Ford, Volkswagen, Nissan, and Toyota have invested heavily in the country. These OEMs benefit from Mexico's favorable business environment, skilled labor force, and strategic location to serve both domestic and international markets.

Suppliers and Manufacturing Clusters

In addition to OEMs, Mexico is home to numerous suppliers and manufacturing clusters. These suppliers provide components, parts, and services to the automotive industry. The presence of suppliers in close proximity to OEMs promotes efficiency and collaboration within the supply chain. Manufacturing clusters, such as those in the states of Guanajuato, Nuevo Leon, and Puebla, have emerged, creating synergies among automotive companies and fostering innovation and competitiveness.

Challenges Faced in Automotive Manufacturing in Mexico

While Mexico offers numerous advantages for automotive manufacturing, there are also challenges that companies must navigate.

Infrastructure and Logistics

One of the primary challenges is the infrastructure and logistics network. Although significant investments have been made to improve transportation systems, there is still a need for further development. Enhancements in highways, railways, and ports are crucial to ensure efficient movement of goods and reduce transportation costs.

Infrastructure has been a priority for the government of President Andrés Manuel López Obrador (AMLO) since taking office in December 2018. The announcement of the Construction and Modernization Program (CMP) 2018-2024 included four priority projects worth over USD 20 billion

International Trade Association

Security Concerns

Another challenge is the issue of security. Certain regions in Mexico face security concerns, including organized crime and theft. While efforts have been made to address these issues, automotive manufacturers need to implement robust security measures to protect their assets and ensure the safety of their employees.

Labor Relations

Maintaining positive labor relations is essential in the automotive industry. Effective communication, fair wages, and safe working conditions are crucial for employee satisfaction and productivity. Building strong relationships with labor unions and implementing transparent policies can help mitigate labor-related challenges.

Government Support and Incentives

The Mexican government plays a significant role in supporting automotive manufacturing through various initiatives and incentives. Some of these initiatives and incentives are:

Mexican Government Initiatives

The Mexican government has implemented programs to attract and support investment in the automotive sector. Initiatives such as the Automotive Industry Promotion Program (PIA) aim to enhance competitiveness, stimulate research and development, and foster innovation in the industry. These initiatives demonstrate the government's commitment to creating a favorable business environment for automotive manufacturers.

Special Economic Zones (SEZs)

Mexico has established Special Economic Zones (SEZs) that offer additional incentives to automotive companies. These zones provide tax benefits, streamlined administrative processes, and infrastructure development to attract investment and promote economic growth in specific regions. SEZs serve as strategic locations for automotive manufacturing, offering a competitive advantage for companies operating within them.

Tax Incentives and Trade Programs

Automotive manufacturers in Mexico can benefit from various tax incentives and trade programs. These include preferential tax rates, duty-free imports and exports, and customs facilitation programs. These incentives help reduce production costs and enhance the competitiveness of automotive companies in the global market.

Outlook of Automotive Manufacturing in Mexico for 2024

Despite potential challenges, the outlook for auto manufacturing in Mexico for 2024 remains optimistic. Strong production and export forecasts, favorable market conditions, and technological advancements point towards continued growth.

The automotive industry in Mexico is expected to recover to its pre-COVID-19 levels by 2024. In that year, production is forecast to reach 3.8 million units, the same figure reported in 2019. Meanwhile, in 2020, a year-on-year decrease of some 21.05 percent was recorded for the Mexican light vehicle output.

Statista

Technological Advancements

Advancements in technology, such as automation, robotics, and artificial intelligence, are transforming the automotive manufacturing landscape. Mexico is embracing these technologies to enhance efficiency, productivity, and product quality. Integration of smart manufacturing systems and the Internet of Things (IoT) is expected to further streamline operations and optimize supply chain management in the Mexican automotive industry.

Electric Vehicles and Sustainable Manufacturing

The global shift towards electric vehicles presents opportunities for automotive manufacturers in Mexico. With the increasing demand for eco-friendly and sustainable transportation, Mexico has the potential to become a hub for electric vehicle production. The country's skilled labor force and supportive government policies can drive the growth of electric vehicle manufacturing and contribute to a more sustainable automotive industry.

Strong Production and Export Levels

Industry experts foresee Mexican production exceeding 4.1 million vehicles in 2024, an 8% increase compared to 2023. Exports are also expected to climb, indicating strong demand and global competitiveness.

Source: Mexico's automotive industry outlook: what awaits us in 2023?

Conclusion: Mexico's Automotive Sector Continues to Thrive

Automotive manufacturing in Mexico has witnessed significant growth and transformation over the years. The country's strategic location, cost-effectiveness, skilled labor force, and supportive business environment have attracted major players in the industry. Despite challenges related to infrastructure, security, and labor relations, Mexico's automotive sector continues to thrive with the support of government initiatives, incentives, and trade agreements. With advancements in technology and the potential for electric vehicle production, the future outlook for automotive manufacturing in Mexico remains optimistic.

FAQs

Q: How did automotive manufacturing in Mexico start?

A: Automotive manufacturing in Mexico began in the 1960s when foreign automakers established assembly plants in the country to take advantage of its favorable business environment.

Q: What are the advantages of manufacturing in Mexico?

A: Manufacturing in Mexico offers cost-effectiveness, proximity to the United States market, access to a skilled labor force, and favorable trade agreements and incentives.

Q: Which companies have invested in automotive manufacturing in Mexico?

A: Major automotive companies such as General Motors, Ford, Volkswagen, Nissan, and Toyota have made significant investments in automotive manufacturing operations in Mexico.

Q: What are the challenges faced in automotive manufacturing in Mexico?

A: Challenges include infrastructure and logistics, security concerns, and maintaining positive labor relations.

Q: How does the Mexican government support automotive manufacturing?

A: The Mexican government supports automotive manufacturing through initiatives, special economic zones, tax incentives, and trade programs that foster a favorable business environment for companies in the industry.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into automotive manufacturing in Mexico with our curated collection of related blog posts.

- Car Brands Made in Mexico: A Look at Global Manufacturing Powerhouses

- Top 10 Well-Known American Companies in Mexico—Should You Be Next?

- 3 Key Benefits of Operating in Mexico’s Border Zone

- Shaping the Future: Innovations in Sustainable Manufacturing in Mexico

- Mexico’s Infrastructure: A Key Factor in Outsourcing Decisions