Last Updated on February 27, 2024

In the ever-evolving landscape of industrial manufacturing, staying ahead of the curve is essential for businesses and investors alike. Mexico's industrial manufacturing sector has undergone significant changes in recent years, shaped by technological advancements, sustainability initiatives, and shifting global dynamics. In this article, we'll delve into the latest Industrial Manufacturing Trends in Mexico, providing insights into what's driving this dynamic industry forward.

Recent Developments in Mexican Manufacturing

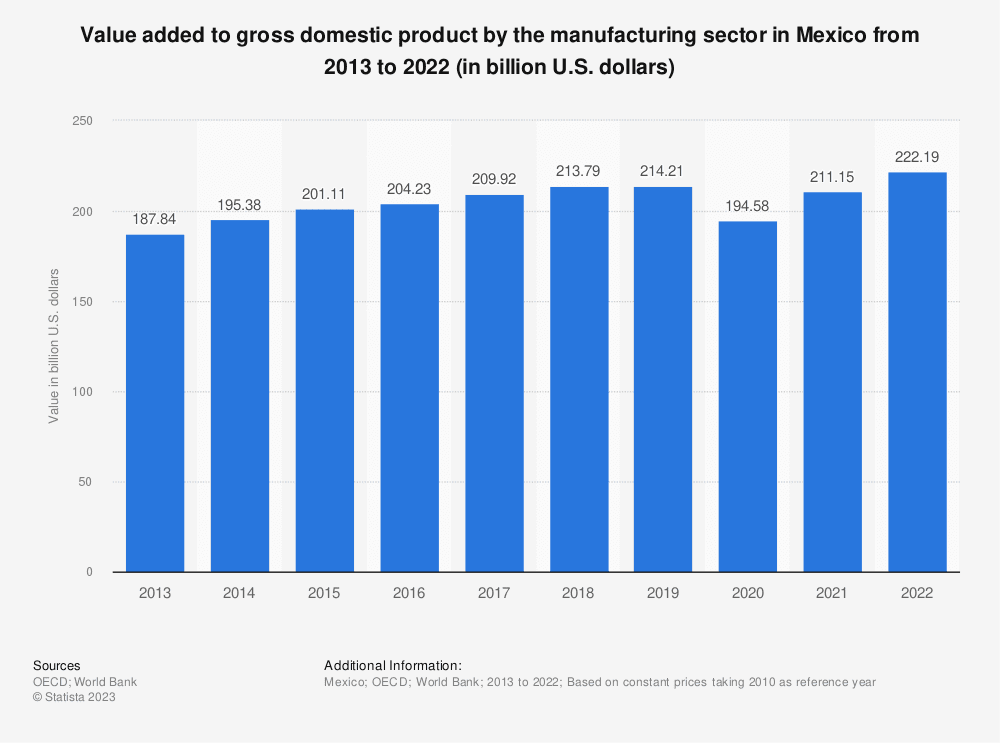

Mexico's manufacturing sector has seen substantial growth, with a GDP contribution of 16%. Recent developments reveal a resilient industry adapting to market demands and disruptions.

Recent statistics indicate an upward trajectory in manufacturing output, driven by increased exports and domestic demand. The sector has experienced 3.2% annual growth over the last decade.

Factors Influencing Recent Developments

Factors such as Mexico's strategic location, access to global markets, and favorable trade agreements have played pivotal roles in attracting foreign investment and fostering industry growth.

Advanced Manufacturing Technologies

In the era of Industry 4.0, Mexico is embracing advanced manufacturing technologies to enhance efficiency and competitiveness.

Automation and IoT Integration

The integration of automation and IoT (Internet of Things) technologies is revolutionizing production processes, improving quality control, and reducing operational costs.

AI and Predictive Analytics

AI-driven solutions are optimizing supply chains, predicting maintenance needs, and enabling data-driven decision-making in manufacturing facilities.

Mexico has recognized the importance of digital transformation in industry and has implemented policies to support the development of Industry 4.0. The government has introduced tax incentives for businesses that invest in research and development and has created centers of excellence to promote the adoption of advanced manufacturing technologies. These efforts are expected to drive continued investment in Industry 4.0 technologies in the Mexican supply chain.

Deloitte

Sustainable Manufacturing Practices

Sustainability is at the forefront of industrial manufacturing trends, with Mexico leading the way in eco-friendly initiatives.

Green Initiatives: Manufacturers in Mexico are progressively embracing renewable energy sources, waste reduction initiatives, and the adoption of circular economy practices to mitigate their environmental footprint.

Energy Efficiency: Investments in energy-efficient technologies reduce operational costs and position Mexican manufacturers as leaders in sustainable production.

Did you know that Mexico is a green manufacturing powerhouse? In 2013, Mexico embarked on a major energy reform plan. Since that time, growth in renewable energy output has been dramatic. By 2024, 35% of the electricity used in Mexico will be generated by renewable energy sources.

Outsourcing And Green Manufacturing In Mexico

Supply Chain Resilience and Diversification

The COVID-19 pandemic exposed vulnerabilities in global supply chains, prompting a strategy rethink.

Supply chain disruptions during the pandemic underscored the need for diversification, local sourcing, and resilient inventory management. Nearshoring supply chains became a priority for many manufacturing companies. Mexico's proximity to the U.S. makes it an attractive nearshoring destination, reducing lead times and mitigating risks associated with distant supply chains.

Mexico Labor

Mexico boasts a skilled labor force, a vital asset for manufacturers looking to thrive on the competitive market.

Skilled Labor Availability: With a strong emphasis on education and training, Mexico offers a pool of skilled workers proficient in various manufacturing processes.

Wage Considerations: Competitive wage structures make Mexico an appealing choice for manufacturers, ensuring cost-effectiveness without compromising quality.

International Trade Relations

Mexico's strategic trade agreements have a profound impact on its manufacturing landscape. The country's trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), open doors to significant export markets for Mexican goods, facilitating growth.

Trade Challenges and Solutions

In Mexico's manufacturing landscape, dealing with complex international trade regulations and tariffs continues to be a formidable challenge for businesses. Given Mexico's extensive trade relations, especially within the North American context, where it shares a vital economic partnership with the United States and Canada, manufacturers often rely on expert guidance and stringent trade compliance measures to ensure the smooth flow of goods across borders. This commitment to adherence not only safeguards their position in the global market but also underscores the importance of Mexico's role in facilitating cross-border trade, reinforcing its significance in the intricate web of international commerce.

Industry-Specific Trends

Different manufacturing sectors in Mexico experience unique trends and challenges.

Automotive Industry: The automotive sector is diversifying into electric vehicles, driving innovation and creating opportunities for suppliers in Mexico.

Aerospace Industry: Mexico's aerospace industry witnesses steady growth, buoyed by increased investments and technological advancements.

Electronics Industry: The electronics sector is embracing miniaturization and automation, making strides in consumer electronics and industrial equipment production. Mexico is one of the world leaders in electronics manufacturing and assembly.

Future Outlook and Predictions

Mexico's industrial manufacturing sector is promising, with several trends shaping its future.

Innovation and Competition: Innovation will continue to be a driving force, pushing Mexico to compete globally and attract further investment.

Sustainability as a Competitive Advantage: Sustainability will not only be a moral imperative but also a competitive advantage, influencing consumer preferences and regulatory standards.

Conclusion

Mexico's industrial manufacturing sector is on an exciting journey marked by innovation, sustainability, and resilience. As global dynamics evolve, staying informed about these Industrial Manufacturing Trends is crucial for businesses and investors looking to thrive in this ever-changing landscape.

FAQs (Frequently Asked Questions)

1. What are the key factors driving Mexico's manufacturing growth?

- Mexico's strategic location, favorable trade agreements, skilled labor force, and investments in advanced technologies are the primary drivers of manufacturing growth.

2. How is Mexico addressing environmental sustainability in manufacturing?

- Mexico is adopting green initiatives, renewable energy sources, and energy-efficient technologies to reduce its environmental footprint in manufacturing.

3. What lessons have been learned from supply chain disruptions during the pandemic?

- The pandemic has highlighted the importance of diversification, nearshoring, and resilient inventory management in supply chain strategies.

4. What are the key trends in the automotive industry in Mexico?

- The automotive sector is moving towards electric vehicles (EVs) and investing in EV-related technologies, making it a key trend in Mexico's manufacturing landscape.

5. How can businesses benefit from Mexico's nearshoring advantages?

- Nearshoring to Mexico can reduce lead times, lower transportation costs, and provide a strategic location for accessing the North American market, all of which benefit businesses looking to streamline their supply chains.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into Mexico Industrial Manufacturing with our curated collection of related blog posts.

- Why “Plan Mexico” Might Be the Wake-Up Call Manufacturers Didn’t Know They Needed

- Why Factories in Mexico Are the Preferred Choice for Nearshoring

- 5 Easy Steps to Move Your Production to a Mexican Factory

- 3 Key Benefits of Operating in Mexico’s Border Zone

- Shaping the Future: Innovations in Sustainable Manufacturing in Mexico