Last Updated on April 1, 2024

Mexico has become a manufacturing powerhouse. With its strategic location, competitive costs, and skilled workforce, Mexico offers numerous advantages for US companies investing in Mexico's manufacturing. This guide to investing in Mexico manufacturing explores everything you need to know about relocating or expanding manufacturing operations to Mexico for increased profitability and supply chain resilience.

A Manufacturing Boom South of the Border

Over the past decade, Mexico has established itself as a global manufacturing hub and a leading exporter. In fact, Mexico is now the seventh largest automaker worldwide, surpassing South Korea in 2020. With offerings spanning aerospace, electronics, medical devices, and automotive, Mexico manufactured and exported goods worth over $450 billion last year alone.

As production costs rise in China and other Asian countries, Mexico’s proximity, favorable trade agreements, and operational efficiencies make it the obvious choice for US firms seeking to bring manufacturing nearer home. Indeed, as supply chain disruptions exposed vulnerabilities for companies overly reliant on Asia, we’ve seen a surge in manufacturing reshoring and nearshoring activity. In 2021, Mexico was the top destination for companies moving their supply chains closer to the US.

This guide to investing in Mexico manufacturing explores everything you need to know about expanding or relocating manufacturing operations to Mexico. We’ll look at:

- Key advantages as a manufacturing destination

- Getting started with Mexico manufacturing

- Resources for support

Let’s explore why US firms looking to enhance supply chain resilience and boost bottom lines should consider Mexico manufacturing.

Strategic Location and Access to Major Markets

Over the past decade, Mexico has invested heavily in transportation infrastructure and now boasts an extensive highway system spanning over 366,095 km. Air travel is also well-developed, with Mexico City International Airport ranking as the busiest airport in Latin America.

Quick Time to Market

Most importantly for US firms, Mexico shares a 2000 mile border with the United States. Goods transported by truck from facilities in Northern Mexico can reach their destination in 1-3 days – much faster than the 3-5 weeks required when importing from China. This proximity translates to major cost savings, with ocean freight from China running over 5 times higher per container than overland transportation from Mexico.

Free Trade Agreements

Mexico also offers duty-free access to major world markets. With 12 free trade agreements covering over 50 countries, Mexican manufacturers enjoy duty-free exports across North, Central and South America. As an original member, Mexico exports tariff-free to the US under NAFTA’s successor agreement, the USMCA.

Duty-Free Imports

According to a cross-border guide to ecommerce in Mexico, import shipments valued at or below $50 are duty-free. Taxes and duties are not applied to low-value goods once they have been cleared by customs. Tobacco, tobacco products, and alcoholic beverages are not included in this exemption. Taxes and duties will be charged regardless of their value.

Under the United States-Mexico-Canada Agreement (USMCA), products made in the United States that meet the rules of origin requirements are not subject to tariffs. The overall pricing of U.S. exports may be affected by several exceptions and caveats, however.

Competitive Costs for Manufacturing Operations

Beyond its strategic location, Mexico’s affordable operational costs are a major selling point for manufacturers. Our guide to investing in Mexico manufacturing breaks the competitive costs:

Affordable Wages

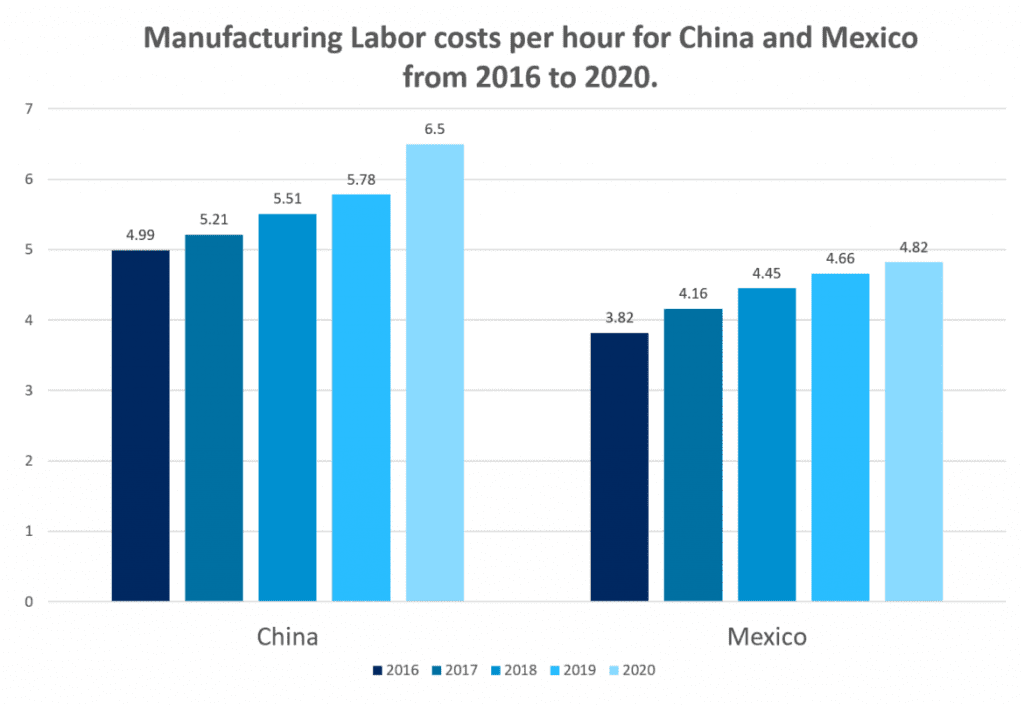

While Mexican wages have risen over the past decade, manufacturing wages remain significantly lower than in China and markedly below US rates. In 2020, average manufacturing labor costs were $4.82 per hour in Mexico – less than a quarter of the US average of $16.92 per hour.

Inexpensive Real Estate and Services

Mexico also offers very reasonable industrial real estate rents, construction, utilities access and auxiliary services compared to the US and Canada. Coupled with meaningful incentives like tax breaks for large investments and employer social security payment exemptions, operating in Mexico provides major cost savings for labor intensive manufacturing.

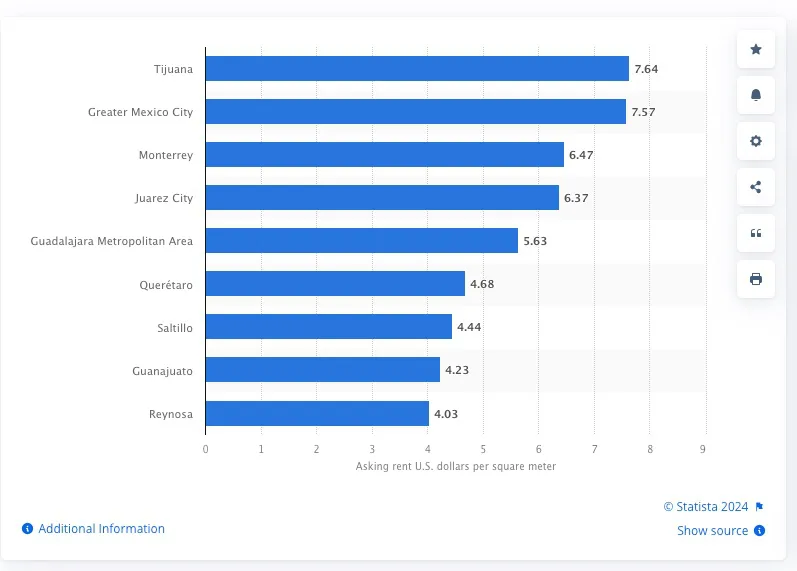

In 2023, China's average warehouse rent was $21 per square meter. Rents have increased in that country due to growing warehouse demand; overall rents rose 0.8% from Q4 2022. On the other hand, average industrial warehouse rental prices in Mexico are $6.47 per square meter.

Skilled and Growing Talent Pool

While wages are low, Mexican workers are far from unskilled. Decades of manufacturing foreign automobiles and other goods have produced an experienced talent pool totaling over 2.5 million strong. Engineers comprise 24% of this workforce – the highest proportion among leading exporting economies.

Recognizing the need for skilled talent as advanced manufacturing expands, both the federal and state governments actively promote technical education and workforce training. Government sponsored programs like Jóvenes Construyendo el Futuro (Youth Building the Future) offer scholarships and paid internships to develop vocational skills.

Shorter term, I believe that more companies can alleviate their talent gaps by thinking outside of borders and identifying great talent globally. From my perspective, it’s challenging to identify a better fit for U.S. time zones, cultural compatibility and relevant work experience than Mexico.

Forbes

Promising Growth Projections Across Sectors

Manufacturing currently accounts for over 18% of Mexico’s GDP. Automotive, aerospace, electronics, medical devices and the metallurgical industries have experienced remarkable expansion over the past 5 years. Even through the economic crisis caused by the pandemic, leading economic indicators like the Manufacturing PMI signal a strong recovery. Manufacturing activity surpassing pre-COVID levels since mid-2021.

- Automotive: After slight declines in 2020, automotive manufacturing has sharply rebounded, with output growing 16% in 2021. Nissan, Audi and Mazda will open new plants in 2021-2022, while legacy automakers like GM and Stellantis continue pouring billions into Mexican operations to serve the US market.

- Aerospace: Major firms like Boeing, Airbus, and Textron Aviation run significant operations in Mexico. While the pandemic temporarily disrupted demand, Estimates by the Mexican Federation of the Aerospace Industry (Femia) show that in 2023, it will have totaled US$10 billion in exports, which would surpass the US$9.7 billion recorded in 2019, its record year, prior to the COVID-19 pandemic.

- Electronics: Attracted by competitive costs and access to specialized engineering talent, electronics manufacturers like Foxconn and Flex employ over 250,000 Mexicans across TV, computer and device assembly plants concentrated along the US border.

- Medical Devices: During the past few years, Mexico's medical device manufacturing sector has experienced significant growth. Medical devices are well suited to the country's business environment, as well as its proximity to the United States. Latin America's second largest manufacturer of medical devices is Mexico. The most significant production occurs in Chihuahua, Tamaulipas, and Baja California.

Emerging Domestic Goods Market

Alongside manufacturing growth, increasing incomes have also boosted domestic consumption, with Mexico emerging as an attractive consumer market in its own right. With a population of almost 130 million and a rapidly expanding middle class, local demand for manufactured goods will continue to rise across sectors.

Supportive Business Environment and Investment Attraction Policies

The Mexican government actively courts foreign investors across industries, offering competitive incentives for manufacturing projects expected to contribute to export growth and job creation.

Incentives are provided at both the federal and state levels. These include:

- Tax breaks – full/partial Income Tax and VAT exemption over 5-10 years

- Subsidized utilities and land rates for new facilities

- Streamlined administrative processes and support services for investors through ProMexico

- Employer social security payment exemptions

- Technical training and hiring support

States compete aggressively to attract manufacturing FDI projects, providing additional incentives like free land transfers, worker training grants and facility upgrades.

Favorable Exchange Rate

Compared to China, Mexico has a 66% lower exchange rate for the US Dollar. The Mexican peso has become one of the strongest currencies on the global market thanks to conservative fiscal policies. Your money will go far wherever you are in Mexico because the peso is uniformly low against the dollar.

One significant barometer of increasing FDI is the growing demand by international investors buying the Mexican peso to pay for investments. The result is a surge in the rise of what is being called the “superpeso.” There has been a 15 percent increase in the peso’s value versus the U.S. dollar from June 2022 to June 2023. As of this writing, the peso is at a high exchange rate of 17.2 pesos to 1 US dollar. The weakened dollar has also seen a significant shift in some Latin American markets towards holding pesos. Mexico already accounts for 25 percent of FDI in Latin America and the Caribbean and the new shift could boost those numbers.

Is Mexico Nearshoring Its Way to Prosperity?

Taking advantage of Special Economic Zones: Savings and Efficiency

In addition to tax savings, Special Economic Zones (SEZs) offer additional benefits for companies reshoring to Mexico. A unique combination of benefits is available in these designated areas, designed to stimulate economic growth and attract foreign investment. Our guide to investing in Mexico manufacturing demonstrates the benefits of SEZs:

An Ideal Tax Haven

Imagine operating in a region like Querétaro, which is well known for its aerospace excellence. A corporate income tax rate as low as 0% is available here, a significant reduction from the standard 30%. The duty-free importation of raw materials and machinery further reduces production costs in Monterrey, a hub for auto parts manufacturing. Furthermore, SEZs streamline administrative processes, eliminating bureaucratic roadblocks so that you can focus on what matters most - growing your business.

A Sector-Specific Zone for Tailored Success

SEZs in Mexico cater to specific industries, ensuring infrastructure and resources seamlessly match your needs. If you specialize in medical devices, Guadalajara's SEZ, equipped with advanced logistics and quality control facilities, could be perfect for you. A similar reason is Matamoros in the state of Tamaulipas' proximity to the US and expertise in textile assembly and kitting operations and manufacturing.

SEZ Success Guide: Navigating the Maze

There are a number of resources and support available to assist with navigating SEZ regulations. The process is guided by dedicated teams and online portals in each zone. The process involves establishing your company, obtaining permits, and complying with local regulations. In addition, SEZ specialists and consultants can assist you every step of the way.

Mexico Government Incentives

A Presidential Decree was published in Mexico's Federal Official Gazette on October 11, 2023, providing tax benefits for taxpayers engaged in key export industries. Under the Mexican Income Tax Law, business activities and professional services generating taxable income are subject to tax benefits under the Decree. Our guide to investing in Mexico manufacturing provides you with information on the following incentives:

Producers, manufacturers, and exporters of goods in the following categories would qualify for incentives:

- Products destined for human and animal consumption

- Fertilizers and agrochemical products

- Raw materials for the pharmaceutical industry

- Certain electronics components

- Machinery for watches, measurement control and navigation instruments and medical equipment

- Batteries and certain electricity components

- Petrol, hybrid and alternative-fuel engines for cars, vans and trucks

- Electricity and electronic equipment, steering, suspension, transmission and brake systems (among other components) for cars, vans, trucks, ships and aircraft

- Internal combustion engines, turbines and transmissions for aircraft

- Non-electronic equipment and devices for medical health and dental use, disposable medical material and optical products of ophthalmic use.

Tax Benefits

As announced in June 2023, the Mexican Government will continue to promote and develop the nearshoring phenomenon in Mexico following the release of the measures for developing the Istmo de Tehuantepec Free Trade Zone.

The Decree provides incentives to boost competitiveness, innovation, and technology investment in key export sectors of the Mexican economy in order to create jobs and increase direct foreign investment.

- Training expenses: 25% of the excess training expenses paid in 2023 to 2025 over the average training expense paid in 2020 to 2022;

- Depreciation deduction for new assets: 56% to 89%, depending on specific assets; and

- Depreciation deductions for new machinery and equipment range from 56% to 88%.

Instead of the straight-line depreciation mechanism currently outlined in the Income Tax Law, accelerated depreciation is applied at the rates described in items II and III.

VAT and IMMEX

All temporary imported equipment, tools, and materials used in a Mexican manufacturing facility are exempt from the 16% VAT tax under the USMCA treaty.

IMMEX may take several months before your company can take advantage of the deferred VAT tax benefit. There are several reasons for this, including the difficulty in meeting the criteria for IMMEX acceptance through the Mexican government.

Companies working with a nearshore manufacturing partner can also benefit from several operation cost savings through IMMEX:

- To reduce the customs fee (DTA) from 8% to 1.76% for machinery and to a flat fee of 179.00 pesos for goods

- Taxes on domestic purchases (which will be incorporated into exported goods) can be avoided

- Refund VAT when a company has a positive balance in its declarations, usually within 20 days

- Services companies are able to import machinery, equipment, and spare parts under the Sectoral Benefits Program (PROSEC)

Case Study: Tesla’s GIGAFACTORY

Tesla's decision to build a gigafactory near Monterrey, Nuevo León, illustrates the advantages of manufacturing in Mexico. The world's largest Gigafactory will be built by the global leader in electric vehicles, Elon Musk, investing over USD $5 billion and creating at least 5,000 new jobs. The state of Nuevo León has received more than USD $64 billion in Foreign Direct Investment (FDI) since 1999.

Getting Started with Manufacturing in Mexico

Interested in exploring if manufacturing in Mexico makes strategic and financial sense for your investment? In our guide to investing in Mexico manufacturing, we lay out the key steps to guide your market entry and expansion planning:

Have a Clear Plan

Clarify business objectives, target segments and output projections. Complete preliminary supply chain analyses weighing cost reductions against operational risks and lead time considerations.

If Mexico manufacturing presents advantages, undertake detailed feasibility modeling incorporating:

- Labor costs, facility expenses, tax incentives and specialty equipment needs

- Lead times related to transportation mode, distances and border restrictions

- Tariffs changes under current and prospective trade agreements

Site Selection for Your Manufacturing is Important

Research suitable manufacturing locations based on product specialization, labor supply, and access to target consumer markets. Weigh the pros and cons of various Mexican industrial parks and SEZs.

Mexican industrial facilities are numerous, but some have a stronger industrial background than others, making it easier for manufacturers to locate. The type of manufacturing and frequency of shipping back to the U.S. will both play a crucial role in the final location selection for Mexico shelter manufacturing.

Partner with Experts

The guide to investing in Mexico manufacturing recommends that you partner with legal experts, consultants and government agencies to assist foreign investors understand regulations and operational aspects across sectors. Leverage experience working on previous manufacturing projects.

- Visit shortlisted sites and meet stakeholders to experience conditions and capabilities first-hand.

- Clarify and finalize operational models – own vs. partner facilities, specialized equipment purchases, hiring and workforce training logistics.

- Incorporate contingencies and crisis response planning to make your Mexico manufacturing venture resilient and competitive.

Shelter manufacturers know Mexico and its society well, making them knowledgeable about the culture and legal landscape there. The complexity of Mexican business culture and laws can present significant challenges to companies venturing into Mexican manufacturing.

Unexpected surprises, delays, and unforeseen costs can result from unfamiliarity with the Mexican business environment. Having a shelter manufacturing partner on board can act as a buffer, bridging any gaps caused by cultural differences that may not be fully understood.

The process of manufacturing in Mexico may appear complicated at first, but with a well-designed strategy, thorough research, and a manufacturing partner's guidance, the journey can be greatly streamlined. Understanding Mexican regulations and laws, as well as those of the United States, while understanding customs and best practices, can help you avoid frustrations, save valuable time, and maximize your finances.

Reshoring and nearshoring are key trends for investors in global markets. As geopolitical tensions escalate and more businesses shift operations away from China, investors are considering the impacts of deglobalization. For many businesses and regions, we believe it could drive meaningful growth, with Mexico as one of the biggest beneficiaries.

In our view, Mexico stands to benefit from both reshoring — businesses moving their manufacturing back to their domestic markets, and nearshoring — businesses moving manufacturing to regions that are closer to their headquarters.

Putnam Investments

Conclusion: Mexico - Your Next Manufacturing Powerhouse

Mexico offers the optimal location for serving American consumer markets, with transportation access and operational costs unparalleled globally. As demonstrated in our guide to investing in Mexico manufacturing, US firms across industries should seriously consider Mexico manufacturing as a strategy for long-term resilience and profitability.

Reach Out for Tailored Guidance on Mexico Manufacturing

Still have questions about whether starting a business in Mexico is the right fit for your manufacturing offshoring or reshoring plans?

Reach out now to leverage specialized guidance and resources for investing in this burgeoning manufacturing nearshoring hotspot.

FAQs for Investing in Mexico Manufacturing:

1. What are the key benefits of investing in Mexico manufacturing? Investing in Mexico manufacturing offers advantages such as reduced costs, proximity to the US market, access to skilled labor, and government incentives.

2. How can I navigate the legal and regulatory landscape in Mexico? Navigating the legal and regulatory landscape in Mexico requires thorough research and understanding of key compliance requirements. Working with legal experts familiar with Mexican law can streamline the process.

3. What industries are thriving in Mexico's manufacturing sector? Mexico's manufacturing sector spans various industries, including automotive, aerospace, electronics, and medical devices. These industries benefit from Mexico's skilled workforce and strategic location.

4. What role do shelter companies play in Mexico manufacturing? Shelter companies provide support and infrastructure for foreign investors entering the Mexican market. They offer services such as site selection, HR management, legal compliance, and administrative support.

5. How can I access government incentives for investing in Mexico manufacturing? To access government incentives, investors should research available programs and consult with local authorities or investment promotion agencies. These incentives may include tax breaks, grants, and subsidies aimed at fostering economic development and foreign investment.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information about investing in Mexico manufacturing with our curated collection of related blog posts.

- Mexico Rewards Manufacturing Companies That Commit: Here’s Why

- Can Moving Manufacturing to Mexico Really Be Turnkey? Here’s What You Need to Know

- How U.S. Tariffs Are Reshaping Mexico’s Manufacturing Outlook

- 3 Key Benefits of Operating in Mexico’s Border Zone

- Mexico’s Infrastructure: A Key Factor in Outsourcing Decisions

- Tax Incentives and Economic Zones for Manufacturers in Mexico

- Mexico’s Industrial Manufacturing Sector Opportunities for Foreign Investment

- Setting Up an Industrial Manufacturing Facility in Mexico: A Smart Business Move