Last Updated on May 17, 2024

The Rise of Mexico's Industrial Manufacturing Costs: A Viable Alternative to China

When considering international manufacturing options, Mexico's industrial manufacturing costs are becoming an increasingly attractive choice for companies looking to relocate or diversify their production. For decades, China has been the go-to destination for industrial manufacturing, but rising costs, trade tensions, and supply chain disruptions have prompted businesses to explore alternative options. Mexico, with its proximity to the US market, favorable trade agreements, and competitive labor costs, is emerging as a prime contender to challenge China's dominance in industrial manufacturing.

Labor Costs: The Key Differentiator

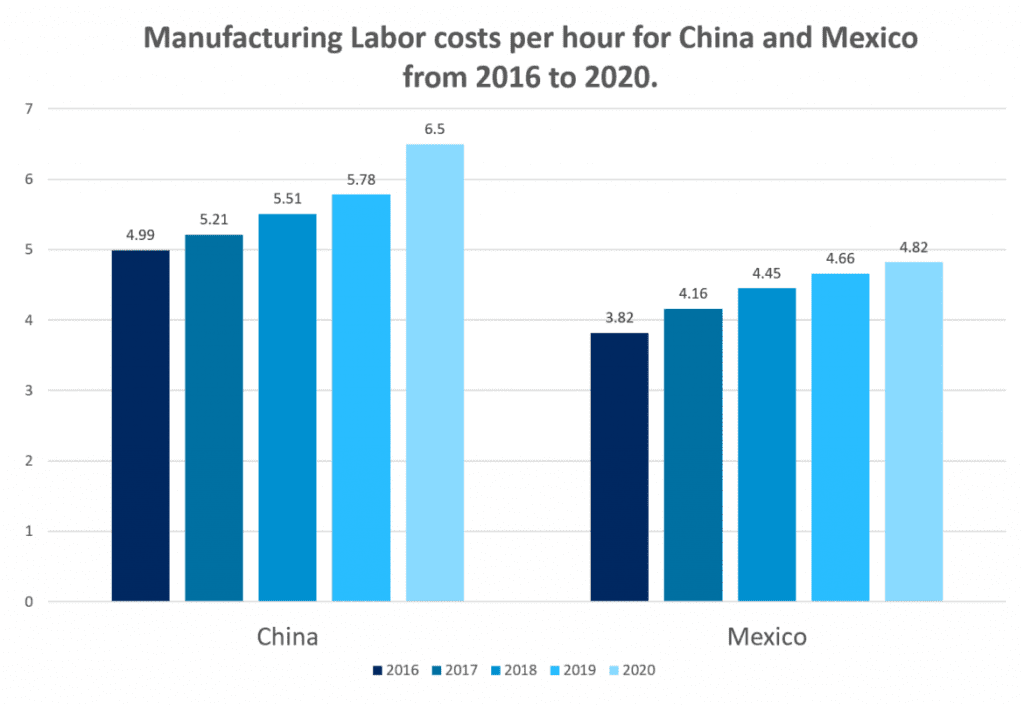

Labor costs are a significant factor in manufacturing competitiveness. While China's labor costs have increased significantly over the years, Mexico's labor costs have remained relatively low. According to a recent study, Mexico's average labor cost per hour is around $4.50, compared to China's $6.50. This cost difference can result in substantial savings for companies, especially those in labor-intensive industries.

Proximity and Logistics: Mexico's Strategic Advantage

Mexico's proximity to the US market is a significant advantage in logistics and transportation costs. With a shared border and established trade routes, shipping goods from Mexico to the US is faster and more cost-effective than from China. This reduced lead time and lower transportation costs can result in significant savings and improved supply chain efficiency.

Despite the challenges, there are numerous logistics benefits to nearshoring in Mexico. Proximity is one of the most significant advantages, as a shipper can move freight from Mexico to the US by truck in 48 to 72 hours. For instance, transit times from Monterrey to Chicago using LTL services will take, on average, 3 to 4 days, employing a transloading facility in Laredo, TX.

Bonded warehouses near the border in the US for materials and replacement parts coming from Asia and then used for production in Mexico also offer significant benefits. Companies can take advantage of Foreign Trade Zones (FTZ) and avoid paying duties until the goods leave the zone, reducing costs.

Americas Market Intelligence

Trade Agreements and Incentives: A Favorable Business Environment

Mexico has a network of favorable trade agreements, including the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements provide tariff-free access to major markets, reducing international trade costs. Additionally, Mexico offers various incentives, such as tax breaks and investment subsidies, to attract foreign investment in the manufacturing sector.

Source: National Association of Manufacturers. NAM Releases USMCA State Data Sheets

USMCA

According to Investopedia, USMCA is “…a trade deal between the three nations which was signed on November 30, 2018. The USMCA replaced the North American Free Trade Agreement (NAFTA), which had been in effect since January of 1994. Under the terms of NAFTA, tariffs on many goods passing between North America’s three major economic powers were gradually phased out.”

There are many reasons why USMCA is significant, but the most important reason is the ability to save money for US businesses. Tariffs have been reduced between the nations; investments have been encouraged in North American industrial buildings, and international markets have been opened. The USMCA provides duty-free treatment for goods that qualify under its rules of origin, which avoid two percent tariffs.

The USMCA has also significantly strengthened U.S. supply chains. COVID-19 and increasing competition with China have highlighted the vulnerability of relying on Chinese supply chains. According to the Brookings Institute:

“The significance of USMCA is clear. Canada and Mexico are the United States’ largest export markets: 23 percent of U.S. exports go to Canada and Mexico (versus 5 percent to China), over 70 percent of Mexican exports are sent to the U.S. and Canada, and 62 percent of Canadian exports are to the U.S. and Mexico. Trade among the countries provides key inputs into regional supply chains’ value added (40 percent U.S. value add versus 5 percent China). “

Infrastructure and Skilled Workforce: A Solid Foundation for Industrial Manufacturing

Mexico has invested heavily in its infrastructure, including modern ports, airports, and transportation networks. This provides a solid foundation for industrial manufacturing, enabling efficient and cost-effective production and distribution. Additionally, Mexico has a large and skilled workforce, with a strong tradition of manufacturing expertise, particularly in the automotive and aerospace sectors.

Opportunities abound for specialized logistics service providers or cold chain service providers (those that transport, warehouse, and handle time and temperature-sensitive products). As firms that require these products proliferate throughout Mexico, they require a dependable and efficient supply chain. United States logistics firms that currently offer specialized supply chain services are well-positioned to take advantage of this niche market.

Additionally, most transportation entities are looking for the best technologies to improve their services, increase customer satisfaction, assure cargo security, and promote an efficient transportation system that supports Mexico’s competitiveness in a global economy. These trends have resulted in an important demand for all kinds of equipment and services that can help increase the efficiency of the transportation and logistical sector in Mexico.

International Trade Administration

Conclusion

In conclusion, Mexico's industrial manufacturing costs offer a competitive alternative to China's. With its favorable labor costs, proximity to the US market, and established trade agreements, Mexico is an attractive option for companies looking to relocate or diversify their production. As global production evolves, Mexico is well-positioned to become a leading destination for industrial manufacturing.

FAQs

1. What are the main advantages of Mexico's industrial manufacturing costs compared to China's?

Mexico's industrial manufacturing costs offer several advantages, including lower labor costs, proximity to the US market, and favorable trade agreements.

2. How do labor costs in Mexico compare to those in China?

Mexico's average labor cost per hour is around $4.50, compared to China's $6.50.

3. What trade agreements does Mexico have that benefit industrial manufacturing?

Mexico has the USMCA and CPTPP, which provide tariff-free access to major markets and reduce international trade costs.

4. What incentives does Mexico offer to attract foreign investment in manufacturing?

Mexico offers various incentives, including tax breaks and investment subsidies, to attract foreign investment in the manufacturing sector.

5. What industries are well-suited for manufacturing in Mexico?

Mexico has a strong tradition of manufacturing expertise in the automotive and aerospace sectors, but other industries, such as electronics and medical devices, can also benefit from the country's competitive manufacturing costs and favorable business environment.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.