Last Updated on June 16, 2025

If you’re considering setting up manufacturing in Mexico—or already knee-deep in the planning—there’s one thing you can’t afford to ignore: the Mexico-U.S. Tariff Cheat Sheet. With the Trump administration reviving tariffs across various sectors and tightening trade with China, understanding how Mexico fits into the picture isn’t just helpful—it’s survival mode. Tariffs can crush your margins, stall operations, or at worst, send your supply chain into a tailspin. But here’s the good news: USMCA gives you a way out. And yes, it’s legit duty-free entry into the U.S. ...if you follow the rules.

Wait, so Why Are Tariffs a Thing Again?

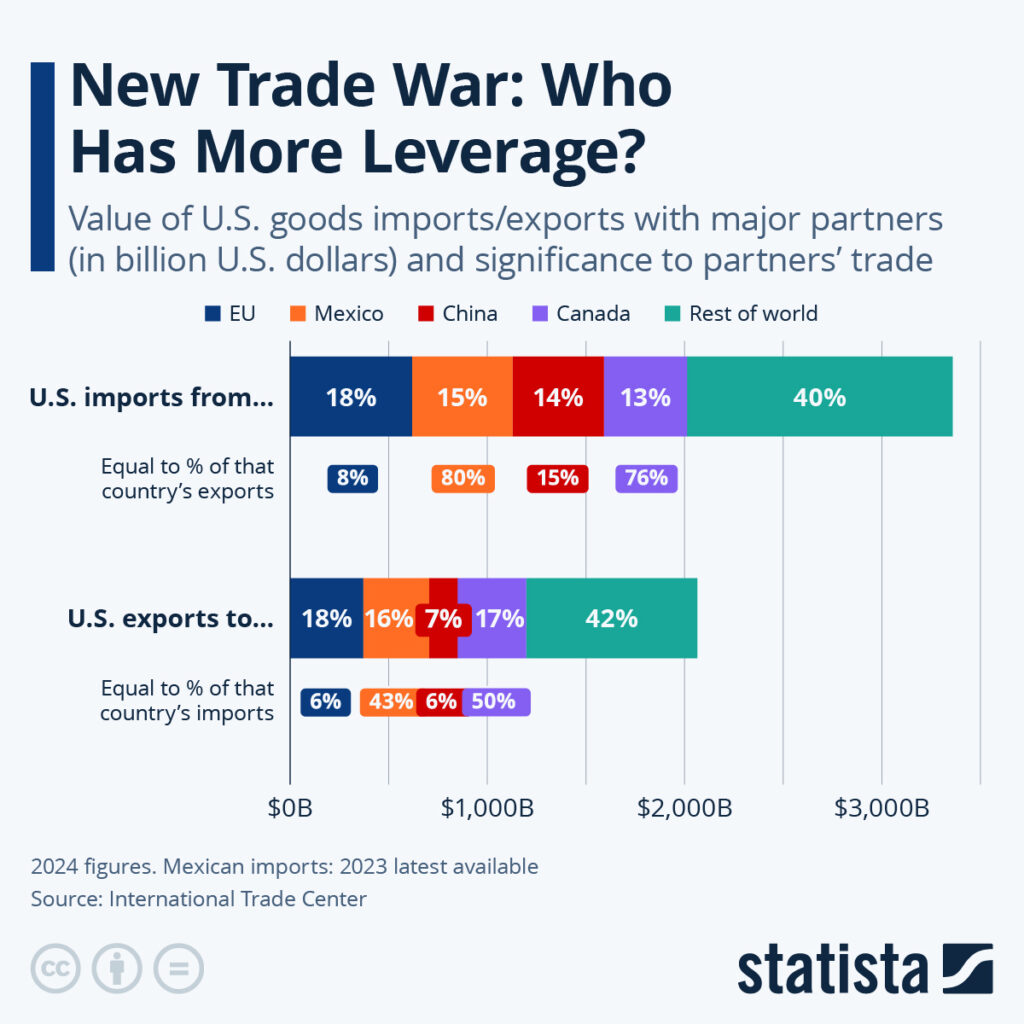

Short version? Trade wars never really end. In 2024, President Biden imposed a range of tariffs on China, including 100% tariffs on electric vehicles, 50% on solar cells, and 25% on aluminum, steel, and respirators. Under the Trump-era economic policies, tariffs are back in style—targeting almost all Chinese imports like steel, aluminum, EVs, semiconductors, and yes, even food and textiles. The goal? Reignite American manufacturing and pressure foreign competitors. The result? Higher costs, less predictability, and tighter margins for U.S.-based businesses.

If your supply chain still relies heavily on Asia, especially China, you’re probably already feeling the pinch. That’s where Mexico enters the chat.

The Loophole (That’s Actually Legal): Manufacturing in Mexico

You know what’s wild? You can legally sidestep many of these tariffs by moving your operations—or at least part of them—to Mexico. Thanks to the United States-Mexico-Canada Agreement (USMCA), goods produced in Mexico can enter the U.S. without duties… as long as they meet origin rules requirements.

It’s like having a backstage pass to the U.S. market—no markups, no funny business. But you’ve got to play by the rules. That’s where this tariff cheat sheet comes in.

Source: National Association of Manufacturers. NAM Releases USMCA State Data Sheets

USMCA

According to Investopedia, USMCA is “…a trade deal between the three nations which was signed on November 30, 2018. The USMCA replaced the North American Free Trade Agreement (NAFTA), which had been in effect since January of 1994. Under the terms of NAFTA, tariffs on many goods passing between North America’s three major economic powers were gradually phased out.”

There are many reasons why USMCA is significant, but the most important reason is the ability to save money for US businesses. Tariffs have been reduced between the nations; investments have been encouraged in North American industrial buildings, and international markets have been opened. The USMCA provides duty-free treatment for goods that qualify under its rules of origin, which avoid two percent tariffs.

The USMCA has also significantly strengthened U.S. supply chains. COVID-19 and increasing competition with China have highlighted the vulnerability of relying on Chinese supply chains. According to the Brookings Institute:

“The significance of USMCA is clear. Canada and Mexico are the United States’ largest export markets: 23 percent of U.S. exports go to Canada and Mexico (versus 5 percent to China), over 70 percent of Mexican exports are sent to the U.S. and Canada, and 62 percent of Canadian exports are to the U.S. and Mexico. Trade among the countries provides key inputs into regional supply chains’ value added (40 percent U.S. value add versus 5 percent China). “

The Mexico-U.S. Tariff Cheat Sheet

Think of this as your quick-reference manual when considering cross-border production:

1. Understand the Origin Rules

This is the fine print that matters. Under USMCA, a product must have a certain percentage of its content made in North America to qualify for tariff-free entry. For example,

- Automotive: 75% of components must be regionally sourced.

- Textiles: Must be produced from yarn forward in North America.

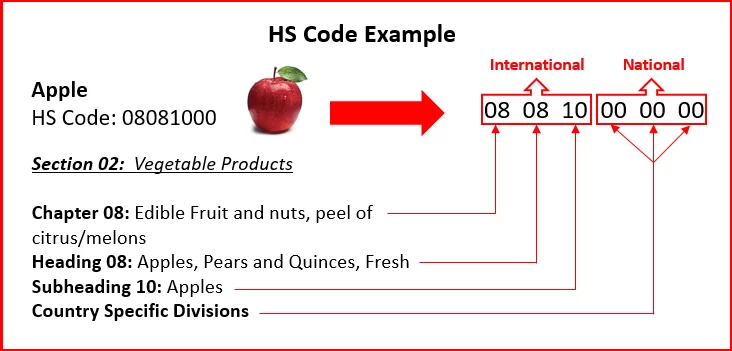

- Electronics and machinery: Component origin and value thresholds vary—check HS Codes.

Miss the threshold, and you’re paying taxes just like everyone else.

2. Get familiar with HS Codes

Every product has a code—the Harmonized System (HS) code-which determines the duty rate. If you misclassify your product? You could end up in hot water with U.S. Customs and Border Protection (CBP). This is not the time to guess. Use a customs broker or hire a trade compliance expert.

3. Beware of “Substantial Transformation”

Just slapping a "Made in Mexico" sticker on a Chinese import doesn't cut it. The product must undergo a substantial transformation in Mexico. That means significant manufacturing work—not just assembly or packaging.

Substantial transformation means that the good underwent a fundamental change in form, appearance, nature, or character. This fundamental change normally occurs as a result of processing or manufacturing in the country claiming origin. Additionally, this change adds to the good’s value at an amount or percentage that is significant, compared to the value which the good (or its components or materials) had when exported from the country where it was first made or grown. - International Trade Administration

4. Certify Everything (Yes, Everything)

If you want your shipment to qualify under the USMCA, you’ll need a valid Certificate of Origin. Without it, CBP will treat your product like it came from anywhere. And surprise! You’ll get slapped with a duty.

As with the North American Free Trade Agreement, the U.S. - Mexico - Canada Agreement (USMCA) does not require a specific certificate of origin. USMCA preferential treatment claims should contain nine minimum data elements. Listed in Annex 5-A (Minimum Data Elements), these data elements constitute a Certification of Origin under the USMCA. The goods claiming preferential treatment must meet the requirements of USMCA Chapter 5 and originate from there. Invoices or other documents may contain this information. - US Customs

5. Watch for Sector-Specific Tariff Updates

Not all products are treated equally. With Trump’s renewed focus on national security and reshoring, certain industries (like electronics, defense, and energy) are facing rapid policy shifts. Stay updated. Seriously. One day it’s zero duty, the next day it’s 45%.

Okay, So Why Mexico Over, Say, Vietnam?

Good question. Sure, Vietnam and other Asian countries offer low labor costs. But what they don’t offer:

- A shared border with the U.S. (hello, faster logistics).

- Tariff-free status under USMCA

- Easy cultural and legal compatibility for North American companies

And here’s the kicker -- goods imported from Vietnam are currently subject to U.S. tariffs as high as 46%, depending on the product category. That’s not a typo. Nearly half the value of your shipment could be eaten up before it clears customs. With Mexico, you can avoid that entirely—if you're compliant under USMCA.

You’re not just cutting costs in Mexico- you're gaining reliability and speed. Think of it like switching from a spotty overseas Wi-Fi connection to stable, wired connection. Less lag, more control.

Let’s be real for a moment: ignoring tariffs is like ignoring a roof leak. It doesn’t go away. It just gets more expensive. Here’s what’s at stake:

- Customs delays that stall your deliveries

- Fines or retroactive duties from CBP audits

- Lost customers because of higher prices

- Supply chain disruptions that knock out production

How Companies Already Use This Advantage

Smart manufacturers are already shifting production of textiles, electronics, furniture, and auto parts to Mexico. They’re not just chasing cheaper labor—they’re building agility into their supply chains. With USMCA compliance, they’re importing goods directly into the U.S., fast and duty-free.

Some are even partnering with nearshore service providers in places like Nuevo Laredo, Saltillo, and Monterrey to handle compliance and certifications. So they can focus on growth—not red tape.

Don’t Let Tariffs Run the Show—Use This Cheat Sheet to Stay in Control

If you’ve read this far, you’re already ahead of the game. The Mexico-U.S. Tariff Cheat Sheet isn’t just a handy resource—it’s a survival tool. With tariffs shifting faster than a Texas weather forecast, knowing your options in Mexico is more than smart—it’s strategic.

Use the tools you’ve got. Leverage the USMCA. And build a supply chain that doesn’t get rocked by the next round of trade wars. Because if there's one thing we can bet on, it's that tariffs aren’t going away anytime soon.

FAQs: The Mexico-U.S. Tariff Cheat Sheet

What is the USMCA and how does it help avoid tariffs?

The USMCA (United States-Mexico-Canada Agreement) allows goods produced in member countries to enter the U.S. duty-free—if they meet origin requirements.

How do I know if my product qualifies for USMCA tariff exemptions?

Check the rules of origin for your product's HS code and verify that the manufacturing process meets the regional content thresholds.

Can I just assemble products in Mexico and still qualify for tariff-free import?

Not always. The product must undergo substantial transformation—not just minor assembly or labeling—to be eligible.

What industries benefit most from manufacturing in Mexico under USMCA?

Auto parts, textiles, electronics, furniture, and aerospace are some of the top sectors taking advantage of tariff exemptions.

Do I need a broker or lawyer to navigate tariffs and compliance?

It’s strongly recommended. Missteps in classification or certification can lead to major fines and lost business. A trade expert pays for themselves.

Explore More: Discover Related Blog Posts

Expand your knowledge and delve deeper into more information found in our Manufacturing in Mexico Guide with our curated collection of related blog posts.

- Why Mexico Isn’t a Perfect Manufacturing Solution (and What That Really Means)

- Mexico Rewards Manufacturing Companies That Commit: Here’s Why

- Stop Waiting: Mexico Product Manufacturing Is Ready When You Are

- Mexico’s Customs Clearance: Why It’s Faster—and Smarter—for Manufacturers

- Setup Process for Manufacturing in Mexico: What You Should Know About Timelines, Permits, and Common Pitfalls

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.