Last Updated on May 9, 2025

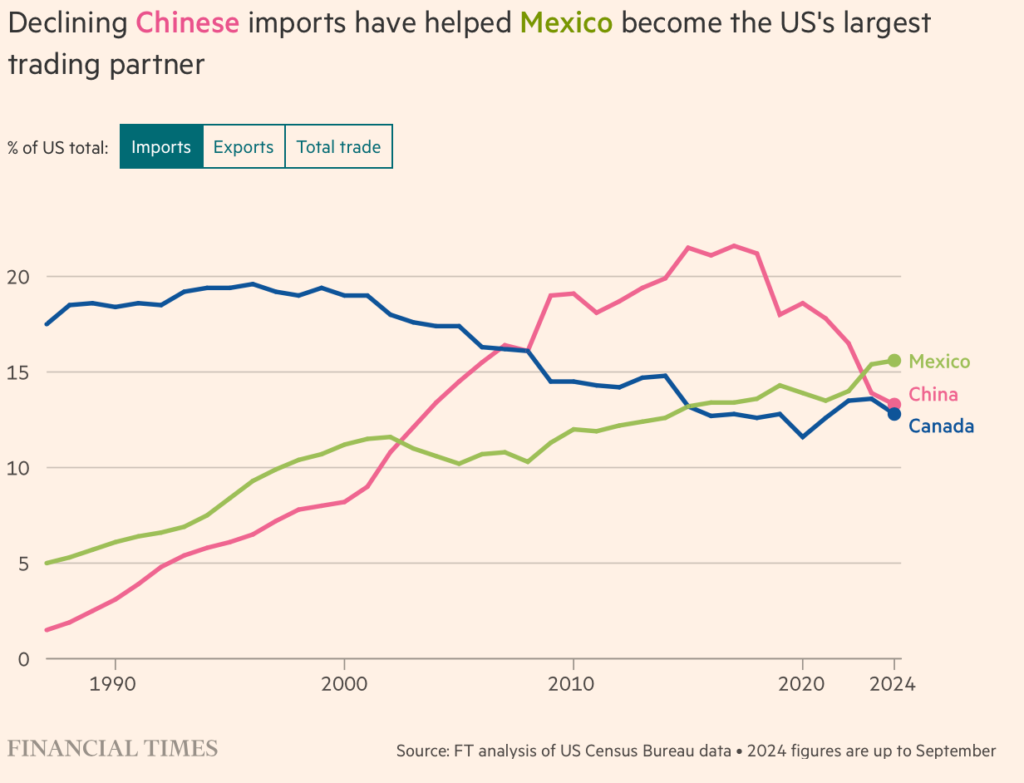

It’s no secret that U.S. tariffs on China have shaken the global supply chain—but here’s what might surprise you: the biggest winner isn’t a new Asian hub or a domestic revival. It’s Mexico. And Mexico’s manufacturing sector isn’t just picking up the slack—it’s redefining the game.

So, what’s behind this sudden pivot? A combination of political tension, economic strategy, and old-fashioned geography. When tariffs began to hammer Chinese imports, businesses didn’t just take the hit. They started looking for ways to stay competitive without losing their minds—or their margins. And guess what? They found an answer right across the border.

Why Are U.S. Companies Moving Manufacturing to Mexico?

Let’s start with the obvious: tariffs. With some Chinese goods facing up to 145% in extra duties, the math isn’t hard. For many businesses, producing in China simply stopped making sense. The costs weren’t just creeping up—they were spiking.

But moving production isn’t just about dodging taxes. There’s also the question of distance. Getting products from Asia to the U.S. means weeks on the ocean, warehouse juggling, customs headaches, and a whole lot of hoping nothing goes wrong. And lately? Things have gone very wrong—pandemic bottlenecks, Red Sea shipping disruptions, and political uncertainty in the Taiwan Strait.

The cost of shipping from China to the East Coast of USA is US$3,000-$4,000 for a 20ft container and $4,000-$6,000 for a 40ft container. The cost of shipping from China to the West Coast of USA is US$2,000-$3,000 for a 20ft container and $3,000-$5,000 for a 40ft container. - UBest Shipping

Mexico, on the other hand, offers a different kind of peace of mind. It’s close. It’s plugged into USMCA. And it’s getting better at everything from electronics to textiles.

Mexico’s Manufacturing Sector: Ready for the Spotlight

Let me be blunt: Mexico’s manufacturing reputation has come a long way from the old days of just assembling parts. Today, we’re talking about full-scale production, advanced robotics, aerospace clusters, and highly trained engineers turning out products that meet global standards.

You’ll find key industries thriving here:

- Automotive: Major OEMs like GM, Ford, and Tesla suppliers already operate in Mexico.

- Electronics: TV sets, medical devices, and consumer gadgets are rolling out faster than ever.

- Textiles & Apparel: From fast fashion to durable goods, the sector is leaner and more agile than its overseas rivals.

And the government isn’t sitting idle. Industrial parks are expanding. Trade incentives are maturing. Energy infrastructure is being modernized—slowly, sure, but it's happening.

The Tariff Advantage: More Than Just Avoiding Costs

Here’s the thing about tariffs: they’re not just a penalty. They’re a signal. When the U.S. hits China with duties, it’s not only discouraging imports—it’s encouraging alternatives. And Mexico isn’t just an alternative. It’s a strategic shift.

Being close to the U.S. means shorter lead times, real-time oversight, and fewer middlemen. You don’t have to plan for months in advance or pad timelines to account for ocean freight chaos. You can respond faster to market trends, customer feedback, and, well—unexpected stuff. That agility is gold.

Plus, working in Mexico supports resilience. If there’s anything the past few years taught us, it’s that resilience matters. Companies that were too dependent on single-source suppliers or rigid logistics? They paid the price. Those who diversified or nearshored? They stayed nimble.

How NovaLink Makes the Move Easier

Now, we’ll be real with you—setting up in Mexico isn’t just snapping your fingers and magically relocating operations. There’s red tape. There are cultural nuances. There’s the challenge of finding the right workforce and supply network.

That’s where a nearshore manufacturing partner like NovaLink makes a difference.

NovaLink helps companies:

- Find the right facility (without building from scratch)

- Navigate import/export compliance

- Connect with vetted suppliers and labor

- Cut launch times significantly—often by months

- Provide operational support so you can focus on growing, not troubleshooting

And the biggest kicker? You’re not starting over. You’re building smarter. NovaLink brings decades of know-how in helping U.S. companies settle into northern Mexico—especially now that tariffs are changing the calculus.

Isn’t It Risky to Bet on Mexico?

Fair question. But here’s the reality: every manufacturing location has risks. China’s facing political strain. Vietnam’s getting saturated. The U.S. is expensive. Mexico? It’s not perfect—yes, there are issues with energy and infrastructure in some areas—but many of the major industrial zones are safe, stable, and growing.

And if we’re being honest, the proximity alone gives companies more control than they’d ever have halfway around the globe.

What’s Next for Mexico’s Manufacturing Growth?

Expect more expansion. More automation. More U.S. companies—especially mid-sized ones—reconsidering what "global" really means. As supply chains keep evolving, the phrase "Made in Mexico" is no longer a fallback. It's becoming a first choice.

And while tariffs are what lit the fire, the momentum is now being driven by something bigger: a new way of thinking about efficiency, geography, and sustainability.

If your business is still relying on China or navigating the maze of Asia-based logistics, it might be time to rethink the map. Mexico’s not just nearby—it’s ready.

Conclusion

The U.S.–China tariff standoff didn’t just shift trade balances. It shook loose old assumptions and opened new doors. Mexico’s manufacturing rise isn’t a fluke—it’s a response. A smart, steady, and increasingly popular one.

If you’re looking for shorter shipping times, easier oversight, and cost savings that go beyond avoiding tariffs, partnering with a firm like NovaLink could be your fastest route to long-term stability.

Because while the trade wars might come and go, smart supply chain decisions? Those stick.

FAQs

How are U.S. tariffs affecting Mexico’s manufacturing sector?

They’re making Mexico a more attractive alternative for U.S. companies looking to reduce costs and shorten their supply chains.

Is it hard to set up manufacturing in Mexico?

It can be—but working with a partner like NovaLink simplifies everything from legal setup to workforce recruitment.

What kinds of products are commonly made in Mexico now?

Automobiles, electronics, textiles, furniture, medical devices, and more. The diversity is expanding fast.

Are there still benefits to manufacturing in China?

For some industries, yes—but the logistical, political, and financial drawbacks are growing. Mexico often provides better overall value.

Can NovaLink help with compliance and logistics?

Yes, that’s one of their biggest strengths. They handle the details so your company can hit the ground running.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.