Last Updated on February 12, 2025

When people talk about manufacturing in Mexico, they often rely on outdated information or plain misinformation. Some still picture low-quality production lines, while others assume hidden costs make it just as expensive as manufacturing in the U.S. But the reality? Mexico has become one of the most competitive manufacturing hubs in the world. If you're considering shifting operations south of the border, it's time to clear up the most common misconceptions about manufacturing in Mexico. Let's get into it.

1."The Quality Just Isn’t There"

This one lingers from decades-old perceptions, but it couldn’t be further from the truth. Mexico’s manufacturing sector has evolved, with many factories following the same ISO and Six Sigma quality standards as their U.S. and European counterparts. Major brands like Tesla, BMW, and Samsung don’t set up shop in Mexico for subpar results—they do it because the quality meets global expectations.

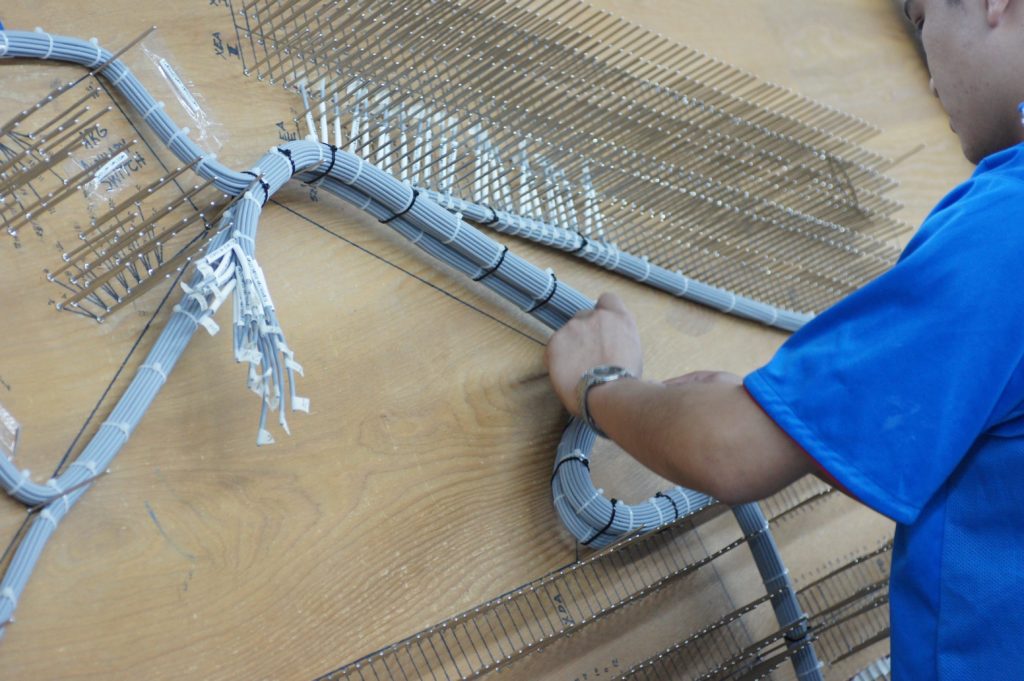

And it’s not just about big-name manufacturers. The Maquiladora, a young and talented worker population with a mean age of 26 years, has demonstrated the capacity to construct sophisticated products for manufacturing in Mexico. Because the lower cost of production, an assumption is made that the goods must also be poor quality, but this far from the truth: Mexican workforce, because of the high rate of education and skill in production, have expertise comparable to that of U.S. employees.

2. "Hidden Costs Make It Just as Expensive as the U.S."

On paper, lower wages in Mexico make manufacturing costs look far cheaper. But among misconceptions about manufacturing in Mexico is hidden expenses—import taxes, logistics, or compliance—that could eat into savings.

Here’s the reality: Mexico’s trade agreements and nearshoring benefits make it one of the most cost-effective options in the world. Under the USMCA (formerly NAFTA), many goods qualify for duty-free trade between Mexico, the U.S., and Canada. This means no surprise tariffs that can wreck your bottom line.

Plus, manufacturing in Mexico significantly reduces shipping times and costs compared to China or Southeast Asia. You’re not waiting weeks for cargo ships or dealing with unpredictable tariffs.

3. "Only Large Corporations Benefit From Nearshoring"

Think nearshoring is just for the likes of Ford and General Motors? Think again. Mexico’s manufacturing ecosystem is built for companies of all sizes.

Small and mid-sized businesses can take advantage of nearshore manufacturing programs, which let them operate in Mexico without establishing a legal entity. This means you can start production quickly without dealing with local bureaucracy, labor laws, or compliance headaches.

The Six Types of Mexico Shelter Companies

Are you aware that there are six types of shelter companies, each with advantages and disadvantages?

Contract Manufacturing Shelter

A Contract Manufacturing Shelter is ideal for companies that want to manufacture in Mexico without setting up a legal entity. You'll partner with a local contract manufacturer, who produces your products to your specifications. This type of shelter company is appropriate for businesses that want to test the Mexican market or need temporary manufacturing capacity.

Joint Venture Shelter

A Joint Venture Shelter involves partnering with a local Mexican company to create its own legal entity. This type of shelter company is suitable for businesses that want to share risks and rewards with a local partner. This is done by leveraging their expertise and knowledge of the Mexican market.

Wholly Owned Subsidiary Shelter

A Wholly Owned Subsidiary Shelter allows you to establish a fully owned Mexican subsidiary, giving you complete control over your operations. This type of shelter company is ideal for businesses that want to integrate Mexican operations into their global strategy.

Free Trade Zone Shelter

A Free Trade Zone Shelter operates within a designated free trade zone in Mexico, offering duty-free imports and exports, as well as other tax benefits. This type of shelter company is suitable for businesses that import and export goods regularly.

IMMEX Shelter

An IMMEX shelter is a special program that allows you to temporarily import goods and materials duty-free, as long as they're re-exported or transformed into a final product. This type of shelter company is ideal for businesses that need to import goods for assembly or manufacturing. IMMEX shelters are better suited for companies that wish to manufacture in Mexico long-term and partner with a company like NovaLink.

Service-Based Shelter

A Service-Based shelter provides administrative and operational support, such as human resources, accounting, and logistics, allowing you to focus on your core business activities. This type of shelter company is suitable for businesses that want to outsource non-core functions and streamline their operations.

And if you don’t need a full-scale factory? Kitting services and contract manufacturing offer flexible solutions so businesses can scale up or down based on demand. You don’t have to be a multinational to make Mexico work for you.

4. "Aren’t Workers Exploited in Mexico?"

This is one of the biggest misconceptions about manufacturing in Mexico. Some assume that workers are underpaid and stuck in poor conditions, but that’s not the full picture.

Yes, like any country, there are factories that cut corners. But the reality is that many Mexican manufacturers prioritize fair wages, safe workplaces, and strong labor protections. The United States-Mexico-Canada Agreement (USMCA) has reinforced labor rights, setting stricter standards for wages and working conditions.

Here’s something you might not know: export-sector workers in Mexico earn 40% more than those in non-export jobs. And companies with foreign investment? They pay about 26% higher than the domestic average manufacturing wage.

On top of that, Mexico has strict labor laws, and companies that ignore them risk fines or legal trouble. Understanding local regulations is crucial, but for businesses that follow the rules, Mexico offers a stable and well-regulated workforce.

5. "Won't They Steal My Idea?"

In contrast to the Chinese, Mexico takes intellectual property rights very seriously and has implemented new guidelines and laws to ensure that the rights of intellectual property are protected.

The USMCA revised the original NAFTA to provide 21st-century legal protections. In addition to recognizing the benefits of effective intellectual property protection to the North American economy, the USMCA also included provisions to strengthen Mexico’s IP policy framework.

As defined in Chapter 20 of the new trade agreement, The USMCA provided for an improved variety of regulations regarding intellectual property. The chapter includes protection for trademarks, trade secrets, and online copyright enforcement. Together, the past 25 years have created a clear competitive advantage for Mexico and a roadmap for the protection of intellectual property in Latin America.

With the implementation of some of the USMCA’s intellectual property commitments, Mexico’s score in the 2024 IP Index improved. In the most recent edition in 2024, Mexico demonstrated a noteworthy improvement in the Index. The US Chamber of Commerce issued an overall score of 59.98%.

6. "Mexico Only Does Low-Skilled Assembly Work"

Sure, Mexico has a strong history in assembly, but today’s reality is far more advanced. The country is a leader in high-tech manufacturing, especially in aerospace, medical devices, and automotive innovation.

Consider this:

- Mexico is the seventh-largest global producer of automobiles, with companies like BMW, Audi, and Toyota investing billions in high-tech facilities.

- The country produces critical aerospace components for Boeing and Airbus, requiring extreme precision and technical expertise.

- Mexico has become a key player in electronics manufacturing, with companies like Foxconn and Samsung relying on its skilled workforce.

So, while assembly work is still part of the picture, Mexico’s manufacturing sector is much more sophisticated than people assume.

Mexico today has over 200 companies producing advanced materials at relatively high volumes. Producers of advanced materials are grouped in clusters in the State of Mexico and the Bajio region of central Mexico. Nanotechnology is a critical component in the production of advanced materials in Mexico. - International Trade Administration

Misconceptions About Manufacturing in Mexico: Outdated or Inaccurate Information

The misconceptions about manufacturing in Mexico persist, but they’re just that—misconceptions. From high-quality production and cost savings to advanced industries and a skilled workforce, Mexico offers businesses a strategic advantage that’s hard to ignore.

Mexico has a thriving and sophisticated manufacturing sector that is capable of producing high-quality goods with the latest technology and modern facilities. By overcoming these misconceptions and recognizing the capabilities of Mexican manufacturers, companies can tap into a wealth of opportunities and benefits that Mexico has to offer. By doing so, they can enhance their global competitiveness and achieve success in a rapidly changing and increasingly interconnected world.

FAQs about Misconceptions of Manufacturing in Mexico

Q1: Is it true that manufacturing in Mexico is only suitable for low-skilled labor-intensive industries?

A1: No, it is a misconception that manufacturing in Mexico is limited to low-skilled labor-intensive industries. Mexico offers a skilled and diverse workforce across various sectors, including automotive, aerospace, electronics, medical devices, and more. It is capable of supporting high-value manufacturing processes and advanced technologies.

Q2: Are all Mexican manufacturing facilities outdated and lacking modern infrastructure?

A2: No, not all Mexican manufacturing facilities are outdated or lacking modern infrastructure. Mexico has made significant investments in its manufacturing sector, resulting in state-of-the-art facilities equipped with advanced machinery, technologies, and production processes. Many companies have modernized their operations to meet global standards.

Q3: Are intellectual property concerns a significant issue when manufacturing in Mexico?

A3: While intellectual property concerns exist in various parts of the world, it is a misconception to assume that intellectual property is not adequately protected in Mexico. The country has strengthened its legal framework and enforcement mechanisms to safeguard intellectual property rights. Many manufacturing companies in Mexico prioritize IP protection to maintain trust and competitiveness.

Q4: Do Mexican manufacturers struggle with meeting quality standards and delivering on time?

A4: No, it is a misconception that Mexican manufacturers struggle with meeting quality standards and delivering on time. Mexican manufacturers have demonstrated their ability to meet and exceed international quality standards through certifications, process improvements, and a strong commitment to customer satisfaction. They also implement efficient production systems to ensure timely delivery.

Q5: Is it true that nearshoring to Mexico is not cost-effective due to hidden expenses and logistical challenges?

A5: No, it is a misconception that nearshoring to Mexico is not cost-effective due to hidden expenses and logistical challenges. While it is important to consider factors like transportation costs, tariffs, and regulatory compliance, Mexico's cost advantages, such as lower labor costs, reduced shipping expenses, and proximity to major markets, often outweigh the associated expenses, making nearshoring cost-effective.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.