Last Updated on October 3, 2024

Mexico industrial manufacturing has experienced significant growth over the years, positioning the country as a key player in the global manufacturing landscape. With a favorable business environment, supportive government policies, and a skilled workforce, the manufacturing industries in Mexico have become an attractive destination for companies looking to establish or expand their operations.

Growing Manufacturing Industries in Mexico [2023] Share on XMexico’s economy is growing at a consistent pace. According to Dallas Federal Reserve, Mexico's economy expanded for the eighth consecutive quarter due to domestic consumption and industrial activity. The third quarter's real GDP grew 3.6 percent, surpassing the previous quarter's gains of 3.4 percent and analyst expectations of 3.2 percent. Growing manufacturing industries in Mexico are helping to spur this growth.

Part of the reason for this success is the proximity to the United States, like the manufacturing border city of Matamoros (where Novalink is located) which allows factories there to take advantage of strong trade agreements like USMCA, but also to absorb the manufacturing business needs of large industries in the US.

When people consider Mexico manufacturing, the prevailing thought is toward the Mexico textile manufacturing industry. However, this is just one of many growing manufacturing industries in Mexico. In this article, we will explore the various industries that drive Mexico's manufacturing growth and delve into the factors contributing to their success.

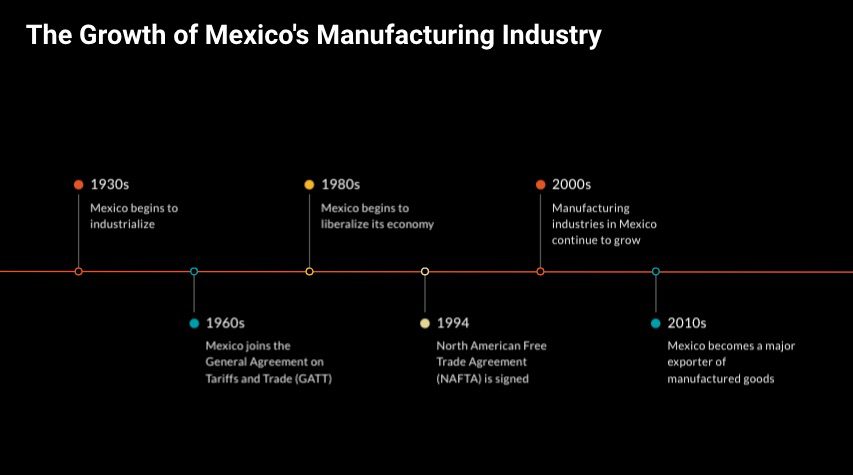

Historical Perspective

Manufacturing Industries in Mexico have evolved significantly since the country's industrialization efforts began in the mid-20th century. With a focus on attracting foreign investment and promoting export-oriented manufacturing, Mexico gradually developed a competitive advantage in various sectors. Key milestones in the country's manufacturing journey include the establishment of the Maquiladora program in the 1960s and the signing of the North American Free Trade Agreement (NAFTA) in 1994, which further bolstered Mexico's position as a manufacturing powerhouse.

Government Initiatives and Policies

The Mexican government has played a crucial role in supporting the growth of manufacturing industries in Mexico. It has implemented various initiatives and policies to attract investment, enhance competitiveness, and foster innovation. One program is the Jóvenes Construyendo el Futuro (Young People Building the Future) job training program.

Jóvenes Construyendo el Futuro

Overview

Jóvenes Construyendo el Futuro (Young People Building the Future) is a Mexican government program that provides job training and employment opportunities for young people between the ages of 18 and 29. The program was launched in 2019 and is administered by the Mexican Secretariat of Labor and Social Welfare (STPS).

To be eligible for the program, young people must meet the following requirements:

- Be between the ages of 18 and 29

- Have a basic education (primary school or equivalent)

- Not be enrolled in a formal education program

- Not be employed

Once accepted into the program, young people are placed in a job training position at a private or public company, organization, or government agency. They receive a monthly stipend of 6,310 Mexican pesos (approximately $320 USD) and health insurance through the Mexican Institute of Social Security (IMSS).

The training positions offered through the program cover a wide range of fields, including:

- Culture and sports

- Administrative

- Sales

- Services

- Agriculture

- Trades

- Industry

- Science and technology

- Health

The program is designed to help young people develop the skills and experience they need to enter the workforce. It is also intended to reduce youth unemployment and poverty in Mexico.

As of January 2024, more than 3 million young people participated in the Jóvenes Construyendo el Futuro program. The program has been praised for its potential to help young people improve their lives and contribute to the Mexican economy.

JCF Benefits for the Mexican Manufacturing Industry

JCF can benefit the Mexican manufacturing industry in several ways:

Addressing Skill Gaps:

- Developing a skilled workforce: By providing on-the-job training in manufacturing settings, JCF can help address the industry's need for skilled workers in areas like CNC machining, welding, automation, and quality control.

- Bridging the education-industry gap: The program connects young people directly with manufacturers, allowing them to acquire practical skills relevant to real-world industry needs, potentially filling the gap between theoretical education and practical application.

- Increasing diversity in the workforce: JCF targets young people who may not have pursued traditional education paths, bringing fresh perspectives and talent to the industry.

Boosting Productivity and Innovation:

- Enhanced skills: Participants gain technical and soft skills like teamwork, problem-solving, and communication, contributing to a more productive and efficient workforce.

- Innovations in ideas and perspectives: Integration of young talent can bring innovative ideas and approaches to manufacturing processes, leading to potential improvements and advancements.

- Potential for higher quality and output: With a more skilled and engaged workforce, manufacturers can potentially see an increase in quality and output, boosting overall competitiveness.

Addressing Specific Challenges:

- Labor shortages: As Mexico's manufacturing sector grows, JCF can mitigate labor shortages by providing a pipeline of trained and interested individuals.

- Attracting young talent: The program can help make manufacturing careers more appealing to young people, who may traditionally gravitate towards other sectors.

- Reducing turnover: By providing valuable work experience and potential career paths, JCF can lower employee turnover in the industry.

Government Incentives for Reshoring in Mexico

By strategically aligning with the global trend of reshoring, leveraging Mexico's proximity to the U.S., benefiting from favorable trade agreements like the USMCA, and tapping into cost advantages, companies can position themselves for sustained success. This white paper explores the nuanced details of government incentives in Mexico. It will provide a comprehensive guide for businesses navigating reshoring opportunities. Fill out the form to receive the white paper today.

Manufacturing Industries in Mexico That Are Thriving

In this section, we will look at some of the thriving manufacturing industries in Mexico. We will discuss the factors that contribute to their success, and we will highlight some of the major companies operating in these industries.

Key Industrial Clusters

Mexico boasts several robust manufacturing hubs that are pivotal to its industrial landscape. These economic centers include Monterrey, CDMX, Guadalajara, Queretaro, and Guanajuato. Each of these locations offers low labor costs, skilled workers, and accessible trade routes, making them ideal for manufacturing operations.

Electronics and Electrical Equipment

Mexico has also experienced a significant increase in the production of electronics and electrical equipment. The country offers several advantages for manufacturers in this sector, including proximity to key markets, a skilled workforce, and a strong supplier base. Furthermore, Mexico has been successful in attracting foreign direct investment in electronics manufacturing, driven by favorable government policies, research and development incentives, and the presence of specialized technology parks.

Owing to the skills of the Maquiladora, electronic component manufacturing such as circuit boards, wire harnesses, computers and consumer electronics is one the largest growing manufacturing industries in Mexico. Companies looking for an alternative to their manufacturing operations in China are finding Mexico contract manufacturing partners that can produce the same, and in many cases better, electronic components.

Key Electronics Manufacturing Companies in Mexico

Mexico has rapidly evolved into a significant player in electronics manufacturing, earning regions like Guadalajara the nickname "Mexico's Silicon Valley." This area alone exports approximately $150 billion worth of electronics annually.

Primary Manufacturers and EMS Providers

Several big names in the electronics manufacturing industry have established operations in Mexico, including:

- Plexus: Known for its diverse manufacturing capabilities.

- IMI (Integrated Micro-Electronics, Inc.): Specializes in various electronic components.

- IKOR: Focuses on electronic design and manufacturing services.

- Flex Ltd.: A prominent provider of design, engineering, and manufacturing solutions.

- V-TEK: Offers packaging and processing services for electronic components.

- Sanmina: Renowned for end-to-end manufacturing solutions.

- JABIL: Provides comprehensive electronics design and manufacturing services.

- Molex: Specializes in electronic interconnectors.

These organizations represent a mix of Original Equipment Manufacturers (OEMs) and specialized suppliers, positioning Mexico as a crucial hub for the global electronics supply chain.

Why Mexico?

Mexico's strategic position, skilled workforce, and favorable trade agreements have made it an attractive destination for electronics manufacturing. Coupled with robust logistics and proximity to the United States, these factors contribute to the growing presence of the industry in the country.

Where are the Main Electronics Manufacturing Clusters in Mexico?

Mexico boasts significant electronics manufacturing clusters, with distinct specialties spread across various regions of the country.

Western Mexico

- States Included: Baja California, Sonora, Chihuahua, Jalisco, and Aguascalientes.

- Specialties:

- Aerospace Components: High precision parts and assemblies.

- High-Tech Manufacturing: Advanced technology products and systems.

- IT and Electronic Sub-Assembly: Key components for electronics and information technology industries.

Eastern Mexico

- States Included: Coahuila, Mexico City, Nuevo León, Querétaro, and Tamaulipas.

- Specialties:

- Computer Parts: Essential components for computing devices.

- Home Appliances: Manufacturing of major household electronics.

- Consumer Goods: Electronics intended for everyday consumer use.

Shared Specialties

In both regions, you'll find expertise in creating parts for:

- Automotive Components: Electronics systems and parts for vehicles.

- Telecommunications Equipment: Key components for communication technology.

These clusters make Mexico a hub for diverse and advanced electronics manufacturing, catering to various global industries.

Medical Device Manufacturing

Mexico's medical device manufacturing sector has witnessed significant growth in recent years. The country offers a favorable business environment, a large pool of skilled labor, and proximity to the United States, a major market for medical devices. With the increasing demand for healthcare products and advancements in medical technology, Mexico has become an attractive destination for manufacturers in this sector. The government has implemented initiatives to support research and development, innovation, and regulatory compliance in the medical device industry.

Mexico is the second largest manufacturer of medical devices in Latin America. Chihuahua, Tamaulipas, and Baja California are the states with the most significant production. Much like the electronics industry, the medical device manufacturing industry is labor-intensive and highly complex, perfect for the skilled Mexican labor force. According to Fortune business insights, the global medical device market is expected to reach $799 billion by 2030 and Mexico expects to be an important resource in this growth.

Which Medical Device Manufacturing Companies Operate in Mexico?

Mexico boasts a robust medical device industry, home to hundreds of manufacturers contributing significantly to the global market. The nation is a hub for both complex and everyday medical devices, exporting billions of dollars worth of products annually.

Some of the major players in the industry include internationally recognized corporations. These companies are instrumental in driving innovation and maintaining high-quality standards for medical devices produced in Mexico.

Notable Medical Device Manufacturers in Mexico:

- GE Healthcare: Renowned for its advanced imaging and diagnostic equipment.

- Medtronic: A leader in medical technologies and therapeutic solutions.

- Siemens Healthineers: Specializes in medical imaging and laboratory diagnostics.

- Cardinal Health: Known for a wide range of medical and laboratory products.

- Tyco Healthcare: Focuses on surgical and medical supplies.

Other Prominent Medical Device Companies in Mexico:

- Becton Dickinson: Provides medical devices and laboratory equipment.

- 3M Health Care: Offers products across wound care, infection prevention, and other medical fields.

- Stryker Corporation: Specializes in surgical and medical devices.

- Kimberly-Clark Health Care: Produces healthcare products for infection control and surgical solutions.

- Boston Scientific: Innovates in medical devices used in interventional medical specialties.

- Johnson & Johnson: A global healthcare leader with a range of medical products.

Mexico’s position as a significant player in the medical device industry is underscored by the presence of these global giants, each contributing to the country’s reputation as a reliable manufacturing and export hub.

Automotive Manufacturing

One of the most prominent sectors driving Mexico's manufacturing growth is the automotive industry. Over the past two decades, Mexico has become a major automotive manufacturing hub, attracting leading global automakers and suppliers. The country's strategic location, competitive labor costs, and well-established supply chain networks have been instrumental in this success. Additionally, free trade agreements with key markets, such as the United States and Canada, have further facilitated the growth of Mexico's automotive exports.

Every major automobile manufacturing in the world, including companies from Japan and Europe, have manufacturing operations in Mexico. Chrysler, GM, Ford, BMW, Toyota, Nissan, Audi and Volkswagen all currently have assembly in Mexico plants. According to the International Trade Administration, over one million people in Mexico work for the automotive industry, making Mexico the sixth-largest passenger vehicle manufacturer in the world. The assembly of automobiles is not the only industry for Mexico, as they are also major producers of automotive parts & electronics, particularly wiring.

The Mexican Automotive Industry Association estimates that Mexico will become the fifth-largest worldwide vehicle producer of all types, not just passenger vehicles, by 2025.

International Trade Association

Mexico's Automotive Industry Parts Production & Labor Force

Mexico's automotive industry encompasses not only vehicle assembly but also the manufacturing of various automotive parts. Skilled labor, along with cost-effective production, has made Mexico a go-to destination for these companies. The close geographical proximity to the United States provides logistical advantages, enabling just-in-time delivery.

Mexico is on track to become the world’s third largest auto part manufacturer, surpassing Japan, in the midst of the global supply chain reorganization, thanks to an increase in regional content mandated by USMCA and the nearshoring boom that the country is experiencing.

Auto part production in Mexico surpassed US$106.6 billion in 2022, an increase of 12.65 percent compared with 2021, according to INA. Meanwhile, production in Japan continues to decline. This is true also in Germany and South Korea, according to Francisco González, Executive President, INA.

Mexico Business News

Primary Automotive Manufacturing Clusters in Mexico

To understand where the primary automotive manufacturing clusters are located, consider the following key regions:

- Coahuila

- San Luis Potosí

- Baja California

- Nuevo León

- Jalisco

- Sonora

- Guanajuato

Within these regions, particular emphasis can be found in Hermosillo, Sonora, and Saltillo, Coahuila, often referred to as the Detroit of Mexico. These areas are pivotal for the automotive industry's growth, offering a blend of robust infrastructure and a skilled workforce.

By strategically positioning manufacturing clusters in these regions, companies can leverage Mexico's advantages to optimize production efficiency and reduce logistical costs.

Aerospace Manufacturing

An emerging industry in Mexico is aerospace and defense manufacturing. The country has been able to leverage its skilled labor force, competitive costs, and proximity to the United States to attract global aerospace companies. Several multinational corporations have established manufacturing facilities and engineering centers in Mexico, contributing to the growth of the sector. The Mexican government has also been proactive in promoting aerospace and defense through targeted investments, infrastructure development, and the establishment of aerospace clusters.

The aerospace industry is slated for tremendous growth in the next 3-4 years. According to Mexico Now, Mexico's aerospace exports reached US$9.4 billion in 2023, up 16% from last year, according to the Department of Commerce. The foreign sales increased from US$6.6 billion in 2020 to US$6.7 billion in 2021 to US$8.1 billion in 2022.

Mexico has improved its aerospace manufacturing capabilities, moving from production of components, small parts, and harnesses, to manufacturing of airframes, flight surfaces, small drones, and flight control and avionic assemblies.

International Trade Administration

Aerospace Manufacturing Companies in Mexico

Mexico has established itself as a significant player in the aerospace industry, with around 300 manufacturing companies operating within the country. These companies cover a range of operations, including Original Equipment Manufacturers (OEMs) and Tier 1, 2, and 3 suppliers.

Key Locations and Major Players

Queretaro Hub: A notable hotspot for aerospace activity, Queretaro hosts a plethora of major companies in the sector. The region is a base for international giants involved in diverse aspects of aerospace manufacturing, from assembly to component production.

Diverse Operations Across the Country: Beyond Queretaro, aerospace companies are spread throughout Mexico, contributing to a robust supply chain that supports the global aerospace industry. These companies engage in various stages of the manufacturing process, including design, engineering, and production of critical aerospace components.

Main Aerospace Manufacturing Clusters in Mexico

Mexico has become a hub for aerospace manufacturing, with several key states leading the way. Here are the primary regions where you can find significant aerospace industry activity:

- Queretaro: Known for its robust aerospace sector, Queretaro hosts several prominent global aerospace companies and offers specialized training through local universities.

- Sonora: This state is a major player in aerospace manufacturing, particularly noted for its production capabilities and skilled workforce.

- Chihuahua: With a strong industrial base and infrastructure, Chihuahua has attracted numerous aerospace manufacturers, making it a critical cluster in the country.

- Nuevo Leon: Industrially developed, Nuevo Leon provides a supportive environment for aerospace companies, bolstered by its advanced manufacturing technologies.

- Baja California: This region has a significant presence of aerospace firms, benefiting from its proximity to the United States and established supply chains.

These states collectively support Mexico's growing reputation as a leader in the aerospace industry, offering comprehensive facilities and skilled talent pools.

Textiles and Apparel

Mexico has a long-standing tradition of textile and apparel production, dating back to pre-colonial times. While the industry has faced challenges due to competition from low-cost Asian manufacturers, Mexico has managed to adapt and modernize its textile and apparel sector. The country now focuses on producing high-value and specialized textiles, such as technical textiles and automotive fabrics. Additionally, Mexico benefits from preferential trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), which provides a competitive advantage for the export of textiles and apparel.

Demand for Specialized Products

Recent trends show an increasing demand for technical textiles, industrial fabrics, and specialty apparel. This shift towards high-value products is a key driver in the industry's evolution.

Innovation in the Fashion Sector

Innovation is also playing a crucial role. For instance, Yucatán has become home to Mexico’s first design, innovation, and prototyping lab for the fashion industry, established through state government investment. This lab aims to foster creativity and technological advancement, ensuring the sector remains competitive on a global scale.

Market Projections for the Textile Manufacturing Market in Mexico

The textile manufacturing market in Mexico is poised for significant growth. Experts predict an increase of USD 3.98 billion from 2021 through 2026, with a compound annual growth rate (CAGR) of 4.13%. This promising outlook underscores the sector's potential and the impact of strategic initiatives and investments.

By focusing on specialized textiles and leveraging innovation and trade agreements, Mexico’s textile industry is well-positioned for sustained growth and global competitiveness.

Prominent Textile Manufacturers in Mexico

Mexico hosts a vibrant textile industry with several prominent companies making their mark. Leading the charge are well-known apparel manufacturers that have established substantial operations in the country. Additionally, Mexico is home to companies specializing in cutting-edge textile technologies.

Key Apparel Manufacturers:

- Delta Apparel: Known for producing high-quality clothing items.

- Grupo Denim: A major player in the denim and casual wear market.

- Levi Strauss & Co.: Renowned for their iconic denim products.

Specialized Textile Producers:

- Airbag Manufacturers: Companies like UTT focus on producing safety-critical materials.

- Performance Fabric Providers: Carolina Performance and Toray Industries excel in creating advanced specialty fabrics.

Mexico's textile manufacturing landscape is diverse, encompassing both traditional apparel manufacturing and innovative technical textiles, making it a hub for various sectors within the industry.

Main Textile Manufacturing Clusters in Mexico

Mexico's textile industry is robustly clustered in several key regions, particularly in the central and northeastern parts of the country. Here’s an overview of the main textile hubs:

- Puebla - Traditionally known for its strong textile heritage and remains a significant player.

- Mexico City and the State of Mexico - These areas are also central to textile production, contributing considerably to the industry.

- Hidalgo and Tlaxcala - Located close to Mexico City, they are notable for their concentration of textile manufacturing firms.

- Jalisco and Queretaro - Important regions that support extensive textile operations, bolstering Mexico’s industry presence.

- Coahuila and Sonora - These states in the north have developed significant textile clusters, enhancing the industry’s distribution network.

- Guanajuato, Nuevo Leon, and San Luis Potosi - These regions are integral to the textile sector, housing numerous manufacturing plants and facilities.

Textile Manufacturing in Mexico Key Takeaways

- Puebla leads as a central hub.

- Mexico City, along with the State of Mexico, remains vital.

- Hidalgo, Tlaxcala, Jalisco, and Queretaro feature prominently in textile production.

- Northern states like Coahuila and Sonora play a significant role.

- Guanajuato, Nuevo Leon, and San Luis Potosi are crucial to the industry’s infrastructure.

By focusing on these regions, it becomes evident that Mexico boasts a well-distributed and efficient textile manufacturing landscape.

Appliance Manufacturing Industry in Mexico

Mexico has emerged as a significant player in the global appliance manufacturing industry, establishing itself as a hub for production, innovation, and export. Thanks to its strategic location, skilled labor force, trade agreements, and cost-effective manufacturing processes, the country continues to attract top appliance manufacturers.

What Trends Are Shaping the Appliance Manufacturing Industry in Mexico?

The appliance manufacturing sector in Mexico is undergoing a significant transformation driven by technological advancements and consumer demand for smarter devices. Modern appliances are increasingly integrated with smart technology, enabling features like remote control, automation, and energy efficiency.

Key Trends:

- Smart Devices Revolution: One of the most notable trends is the incorporation of smart technologies into everyday appliances. This shift caters to the growing consumer appetite for interconnected, user-friendly home environments.

- Rapid Market Growth: The smart home appliance market is expected to experience a remarkable compound annual growth rate (CAGR) of 48% from 2021 to 2026. This growth is driven by the increased adoption of smart devices, which enhance convenience and functionality for users.

- Rising Consumer Expectations: Today's consumers are not just looking for basic functionalities. They seek high-tech features such as voice control, AI-driven learning capabilities, and seamless integration with other smart home systems.

- Increased Production Capacity: In response to the burgeoning demand for smart appliances, manufacturers in Mexico are ramping up their production capacities. They are investing in advanced manufacturing techniques to ensure they can deliver the latest innovations in home appliances.

By embracing these trends, manufacturers in Mexico are positioning themselves to meet the evolving needs of tech-savvy consumers and to compete globally in the rapidly expanding smart appliance market.

Which Appliance Manufacturing Companies Have Operations in Mexico?

Mexico hosts a variety of prominent appliance manufacturing companies, each bringing innovation and quality to the forefront. Key players in this sector include:

- Sony: Known for its cutting-edge electronics and home entertainment systems.

- Whirlpool: A global leader in home appliances, specializing in washers, dryers, and kitchen appliances.

- GE (General Electric): Offers a wide range of home appliances, from refrigerators to microwaves.

- Zuo: Offers stylish and functional home furnishings and accessories.

- Amana: Provides reliable and affordable kitchen and home appliances.

- Danby: Known for its compact appliances, perfect for smaller living spaces.

- Ethan Allen: Renowned for high-quality furniture and home décor.

- EMZ: Specializes in electric motors and components used in various appliances.

- Siemens: Delivers advanced home appliances, including efficient dishwashers and washing machines.

- Diehl Controls: Focuses on electronic control systems for household appliances.

These companies leverage Mexico's strategic location and skilled workforce to produce world-class appliances for domestic and international markets.

Where are the key appliance manufacturing clusters in Mexico?

Mexico is a major hub for appliance manufacturing, with several regions standing out for their concentration of industry activity. Here's a breakdown of the key clusters:

Nuevo Leon

- Industrial Dominance: A significant portion, approximately 41%, of all appliances produced in Mexico originate from this bustling region. Nuevo Leon stands as a powerhouse in appliance manufacturing.

Saltillo

- Strategic Location: Situated in Coahuila, Saltillo is another pivotal area, benefiting from its strategic location and skilled workforce.

Queretaro

- Rapid Growth: Known for its rapid industrial development, Queretaro is becoming a vital zone for appliance production thanks to its modern infrastructure and favorable business climate.

Guanajuato

- Manufacturing Strength: This area is recognized for its robust manufacturing base, making it a key player in the appliance sector.

San Luis Potosi

- Emerging Hub: San Luis Potosi is quickly emerging as an important cluster for appliance manufacturing, drawing investment due to its logistical advantages and growing industrial ecosystem.

Tamaulipas

- Cross-Border Advantage: Close to the U.S. Border, Tamaulipas leverages its geographic advantage to boost its significance in the appliance manufacturing landscape.

These clusters are essential to Mexico's role as a leading manufacturer of appliances, driven by strategic location, skilled labor, and robust infrastructure.

Renewable Energy Equipment

With the growing global emphasis on renewable energy, Mexico has seen an increase in the production of renewable energy equipment, such as solar panels and wind turbine components. Major manufacturing clusters for renewables are located in areas such as Tamaulipas, Querétaro, and Jalisco, which have benefitted from proximity to markets and trade infrastructure.

Solar energy equipment manufacturing has especially expanded. Major companies including JinkoSolar, Canadian Solar, and JA Solar have opened factories in Mexico. The country now has dozens of solar module and panel production facilities.

Wind turbine manufacturing has also benefited from growth in the Mexican market. International firms like Siemens, Vestas, and Acciona have opened wind equipment production plants across Mexico. There is a strong domestic supply chain for wind towers, turbines, and other components.

According to industry data, as of November 2023, Trade.gov estimates that Mexico's power generation equipment market will increase 1.05% from 2022-2023, while exports from the United States to Mexico are expected to increase 0.93%.

Market penetration of renewables in Mexico's energy mix has been increasing. This has encouraged expanded domestic production capacity to supply growing demand. The government aims to double renewable energy capacity by 2030.

Kitting, Packing, and Sorting: The Unsung Heroes

Beneath the surface, kitting, packing, and sorting services quietly shine as indispensable contributors to the efficiency and quality of diverse manufacturing sectors within Mexico. These services serve as the backbone, skillfully organizing components, managing inventory, and guaranteeing that end-products are delivered to consumers in impeccable condition. Mexico's strategic position and skilled labor pool make it an ideal source for these essential services, further bolstering the manufacturing landscape.

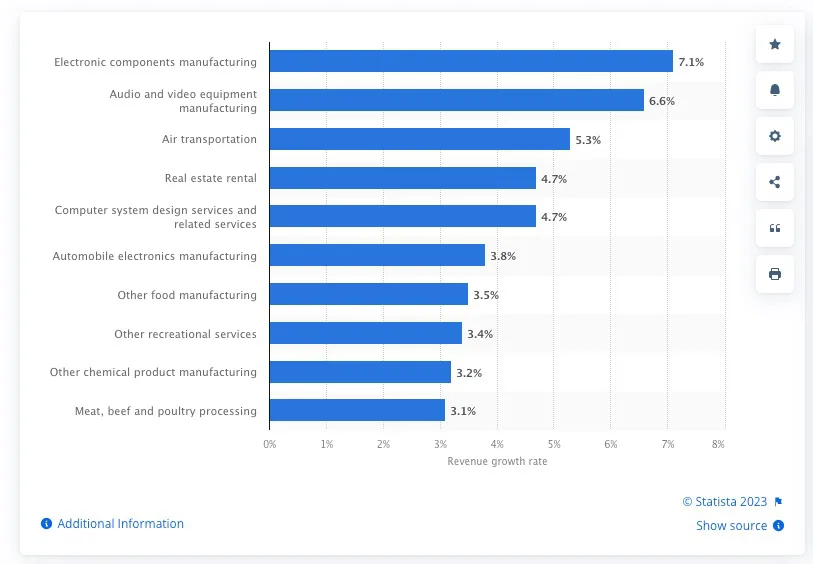

Fastest growing industries by revenue growth in Mexico between 2019 and 2020

Opportunities and Challenges for Manufacturing Industries in Mexico

Foreign investors looking to enter Mexico's manufacturing sector can find numerous opportunities for growth and success. The country's favorable business environment, skilled labor force, and established supply chain networks make it an attractive destination. Additionally, Mexico's participation in free trade agreements opens up access to key markets, enhancing the export potential for manufacturers. However, there are also challenges to consider, such as security concerns, regulatory compliance, and the need for continuous innovation to remain competitive in the global market.

Opportunities

Sustainability and Innovation

Mexico's manufacturing industry is increasingly focused on sustainable practices and innovation. Companies are adopting environmentally friendly manufacturing processes, investing in renewable energy sources, and implementing waste reduction strategies. Moreover, Mexico encourages innovation and technological advancements in manufacturing through collaboration between industry and academic institutions. This collaborative approach fosters research and development, the adoption of new technologies, and the creation of a skilled workforce capable of driving innovation in the sector.

According to Mexico’s Energy Transition Law (Ley de Transición Energética) and General Climate Change Law (Ley General de Cambio Climático), Mexico’s goal is 35 percent of electricity from clean energy sources by 2024, which includes power regeneration from renewable and non-renewable sources such as nuclear and efficient cogeneration.

International Trade Association

Workforce and Education

Mexico boasts a skilled and competitive labor force, particularly in the manufacturing industry. The government has implemented various training programs and initiatives to ensure the availability of skilled workers for the manufacturing sector. Additionally, partnerships between industry and educational institutions have been established to align curricula with the needs of the manufacturing industry. These collaborations provide students with practical skills and work experience, enhancing their employability and meeting the demands of the evolving manufacturing landscape.

Supply Chain Integration

Mexico's strategic location and well-established transportation infrastructure have made it an integral part of global supply chains. The country's proximity to the United States, combined with efficient logistics networks, allows for seamless integration into North American and global markets. Manufacturers in Mexico benefit from reduced transportation costs, shorter lead times, and increased flexibility in responding to customer demands. Furthermore, Mexico's participation in free trade agreements ensures preferential access to a wide range of markets, further strengthening its position as a manufacturing hub.

Challenges

Competition from Other Low-Cost Countries

While Mexico offers cost advantages, it faces competition from other low-cost manufacturing countries, particularly in Asia. To remain competitive, Mexican manufacturers must continually optimize their operations.

Infrastructure Challenges

Although improving, Mexico faces infrastructure challenges, including transportation and logistics. Investments in infrastructure development are necessary to ensure efficient supply chains.

Technology and Skills

Staying competitive in today's manufacturing landscape requires continuous technological advancements and a highly skilled workforce. Manufacturers in Mexico need to invest in both technology and employee training to keep up with industry trends.

Security Concerns

Certain regions in Mexico face security challenges, which can affect the operation of manufacturing facilities. Ensuring the safety of employees and assets is a top priority for businesses operating in these areas.

Conclusion: Manufacturing Industries in Mexico Experiencing Remarkable Growth

Mexico's manufacturing industry has experienced remarkable growth across various sectors, positioning the country as a global manufacturing powerhouse. From automotive and electronics to aerospace, medical devices, and textiles, Mexico offers numerous opportunities for investment and expansion. The supportive government policies, skilled workforce, regional clusters, and supply chain integration all contribute to the success of Mexico's manufacturing sector. With a focus on sustainability, innovation, and collaboration between industry and education, Mexico is well-positioned for continued growth and success in the manufacturing industry.

FAQs on Growing Manufacturing Industries in Mexico

What is the Fastest Growing Manufacturing Industry in Mexico?

The manufacturing landscape in Mexico is evolving rapidly, with the electronic components sector leading the charge. This industry is currently experiencing remarkable growth, outpacing other manufacturing sectors in the country.

The rise can be attributed to increasing demand for electronic devices and components worldwide. Companies such as Flex and Jabil have established significant operations in Mexico, further fueling this expansion. State-of-the-art facilities are being developed to meet the global demand for quality and innovation.

In summary, Mexico’s fastest growing manufacturing industry is undoubtedly electronic components, driven by global demand and substantial investment in advanced production capabilities.

What are the main export markets for Mexican manufacturers?

Mexican manufacturers have a diverse range of export markets. The United States is the largest export market for Mexican goods, followed by Canada and various countries in Latin America and Europe. The automotive industry, in particular, relies heavily on exports to the United States, while the electronics and aerospace sectors export to global markets.

What government incentives are available for foreign investors?

The Mexican government offers various incentives to attract foreign investment in the manufacturing sector. These incentives include tax benefits, customs duty exemptions, accelerated depreciation allowances, and research and development grants. Additionally, the government provides support in the form of streamlined bureaucratic processes, access to specialized training programs, and infrastructure development in industrial zones.

How is Mexico addressing sustainability in the manufacturing industry?

Mexico is actively promoting sustainable manufacturing practices in the industry. The government encourages the adoption of environmentally friendly processes, such as energy-efficient technologies and waste reduction strategies. Mexico also incentivizes the use of renewable energy sources and provides support for companies implementing sustainable practices through grants and certifications.

What are the key factors driving growth in the aerospace industry?

Several factors contribute to the growth of Mexico's aerospace industry. These include the country's skilled labor force, proximity to the United States, a large network of suppliers, and supportive government policies. The Mexican government has made strategic investments in infrastructure, research, and development to attract aerospace companies and foster innovation in the industry.

About NovaLink

As a manufacturer in Mexico, NovaLink employs a unique approach that transcends the traditional model of shelter production. More than just the location of your manufacturing, we would like to become a partner in your manufacturing in Mexico. You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. Find out how we can help you by handling the manufacturing process.

There are NovaLink facilities in the border cities of Brownsville, Texas, Matamoros, Mexico, and Saltillo, Mexico.