Manufacturing in Mexico Guide

Developed from NovaLink's 30 years of expertise in nearshore manufacturing and backed by extensive research spanning hundreds of websites, articles, and industry studies

Manufacturing in Mexico Guide: Expert Insights for Nearshore Success

This comprehensive guide covers every critical aspect of manufacturing in Mexico, including:

- Costs and Financial Incentives: Uncover cost structures, tax advantages, and government incentives designed to attract manufacturers.

- Manufacturing Locations and Site Selection: Explore top regions for manufacturing and discover how to choose the ideal site for your business.

- Industries in Focus: Delve into the thriving sectors in Mexico, from automotive to electronics, aerospace, textiles, and more.

- Logistics, Supply Chain, and Operations: Learn about Mexico’s world-class infrastructure and proximity to the U.S. market.

- Workforce and Labor: Gain insights into Mexico’s skilled labor force, labor laws, and workforce availability.

- Government Regulations and Compliance: Navigate Mexico’s regulatory framework with ease.

- Partnerships and Collaboration: Discover how working with NovaLink can simplify your entry into Mexico and maximize your success.

- Business Models and Strategies: Assess the most effective approaches to setting up or scaling operations.

- Sustainability and Environmental Impact: Learn how Mexico is prioritizing green manufacturing practices.

Each section is packed with insights, practical advice, and proven strategies that reflect NovaLink’s dedication to helping businesses thrive in Mexico’s dynamic manufacturing environment. Whether your goal is to reduce costs, streamline operations, or expand your global footprint, this guide will serve as a roadmap for success.

Let NovaLink be your trusted partner in making the most of Mexico’s unique advantages. Ready to begin or relocate your manufacturing operations to Mexico? This guide will show you how.

Table of Contents

- History of Manufacturing in Mexico

- Industries in Focus

- Manufacturing Locations and Site Selection

- Costs and Financial Incentives

- Partnerships and Collaboration

- Business Models and Strategies for Manufacturing in Mexico

- Workforce and Labor: The People Powering Manufacturing in Mexico

- Logistics, Supply Chains and Operations

- Government Regulations and Compliance

- Sustainability and Environmental Impact in Manufacturing in Mexico

History of Manufacturing in Mexico

Manufacturing in Mexico has a rich history rooted in its strategic location, abundant resources, and skilled workforce. The industry gained momentum in the mid-20th century with the establishment of the Border Industrialization Program (BIP) in 1965. This program, designed to address unemployment along the U.S.-Mexico border, laid the foundation for the maquiladora system, enabling foreign companies to establish factories that processed imported raw materials for re-export. Over time, Mexico’s manufacturing sector diversified, moving beyond textiles and simple assembly to encompass advanced industries such as automotive, aerospace, electronics, and medical devices.

The Role of Maquiladoras

Maquiladoras, or maquilas, are manufacturing facilities that operate under favorable trade agreements, particularly the United States-Mexico-Canada Agreement (USMCA). These factories import raw materials and components duty-free, process them, and export finished goods. Maquiladoras are particularly concentrated along the U.S.-Mexico border, though they have expanded into the country’s interior. Their benefits include cost savings on labor and materials, proximity to the U.S. market, and streamlined customs processes. Over the decades, maquiladoras have become a cornerstone of Mexico’s manufacturing industry, driving economic growth and attracting significant foreign direct investment (FDI).

Growth of Manufacturing in Mexico Over the Last 20 Years

In the past two decades, Mexican manufacturing has grown exponentially in size and complexity. The country has transitioned from being a low-cost assembly hub to a global leader in high-value manufacturing. Key factors driving this growth include:

- Trade Agreements: Mexico’s extensive network of free trade agreements (FTAs) with over 50 countries provides access to major markets, reducing tariffs and fostering cross-border commerce.

- Skilled Workforce: Mexican workers, renowned for their technical skills and work ethic, support industries such as automotive and aerospace in achieving world-class production standards.

- Nearshoring Trends: In response to global supply chain disruptions and rising costs in Asia, companies have increasingly turned to Mexico as a nearshore solution offering shorter lead times and lower transportation costs.

- Government Support: Mexican policies and incentives, including tax breaks and infrastructure investments, have encouraged manufacturing cluster growth.

Mexico is the Leading Trading Partner of the United States

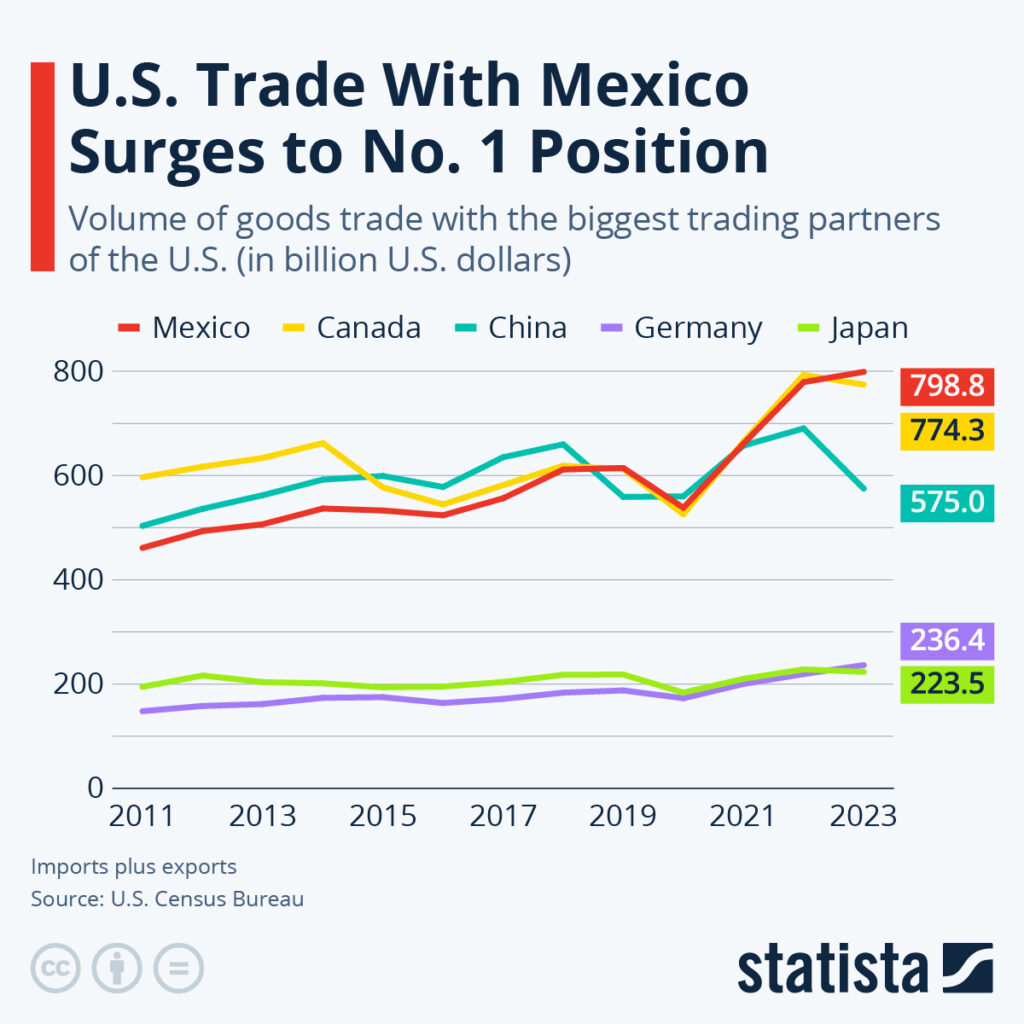

The growth of Mexico’s manufacturing sector has propelled the country to become the United States’ top trading partner. In 2024, trade between the two nations exceeded $839 billion, underscoring their economic importance. Factors contributing to this achievement include:

- Proximity: Mexico’s geographical location allows for rapid goods transportation and seamless collaboration between companies on both sides of the border.

- Integrated Supply Chains: The close economic relationship has fostered highly integrated supply chains, particularly in the automotive, electronics, and machinery sectors.

- Regulatory Frameworks: Agreements such as the USMCA ensure mutually beneficial trade practices and foster investment.

Mexico Manufacturing Industries in Focus

When it comes to manufacturing, Mexico has earned its place as a global leader, and it’s not just by chance. This country’s industrial backbone spans a wide range of sectors, each thriving thanks to a unique combination of location, skilled labor, and trade advantages. Whether you’re talking about the cars we drive, the medical devices that save lives, or the cutting-edge electronics powering our world, Mexico is at the center of it all.

In this section, we’ll explore the industries that are shaping Mexico’s manufacturing landscape and driving its economic growth. From automotive giants to aerospace pioneers, and even a surprising comeback in textiles, there’s a lot to uncover. Let’s dive into the top industries making waves and why they’re choosing Mexico as their base of operations.

Automotive: Revving Up Success in Mexico

Let’s be honest—when you think about cars, Mexico might not be the first place to mind. But it should be. Why? Mexico is an automotive powerhouse. Global brands like GM, Ford, and Volkswagen call it their manufacturing home, churning out millions of vehicles annually. What makes it such a magnet for automakers?

- Location, location, location: Being right next to the U.S. means short supply chains and quick turnarounds.

- Skilled labor: Mexico’s workforce isn’t just affordable; it’s incredibly competent, especially in high-precision areas like auto assembly and component manufacturing.

- Trade benefits: The USMCA has supercharged cross-border automotive trade, making it easier and cheaper to produce cars here.

And let’s not forget—cars built in Mexico don’t just stay in North America. They hit roads worldwide, a testament to the country's auto sector quality and competitiveness.

Medical Devices: Saving Lives and Cutting Costs

Think about it—every surgical tool, every hospital monitor, and every pacemaker needs to come from somewhere. That somewhere is Mexico. Here’s why medical device manufacturing thrives there:

- Regulatory alignment: Mexico’s standards align with the U.S. FDA, simplifying compliance.

- Specialized clusters: Cities like Tijuana have become hubs for medical device production, attracting expertise and fostering innovation.

- Cost savings without compromise: Companies save significantly on labor and overhead while maintaining high quality demanded by the healthcare sector.

It’s not just about cutting costs; it’s about delivering life-saving technology faster and more efficiently.

Aerospace: Shooting for the Stars

Aerospace manufacturing in Mexico might sound ambitious, but it’s happening—big time. From jet engines to landing gear, Mexico is becoming a critical part of global aerospace supply chains. Why?

- Expertise: With over 60,000 aerospace engineers graduating annually, the talent pool is deep.

- Supportive ecosystems: Aerospace clusters in cities like Queretaro and Chihuahua provide a collaborative environment for R&D and production.

- Proximity to markets: Just like automotive, being close to the U.S. is a massive advantage for this high-tech industry.

And here’s the kicker: Mexico’s aerospace industry is projected to grow by double digits over the next decade. That’s not just a trend—it’s a trajectory.

Electronics: The Next Big Thing

Mexico is rapidly emerging as a hub for electronics manufacturing. Whether it’s TVs, smartphones, or advanced components, the country is making its mark. Why?

- Strategic location: Quick shipping to the U.S. means tech companies can respond to market demands faster.

- Skilled workforce: From engineers to assembly line workers, Mexico has the human capital to handle complex production.

- Cost-effective production: Let’s face it, labor and operating costs are a fraction of in the U.S. or Asia.

With companies like Samsung and LG already here, the stage is set for even more growth in the coming years.

Key Statistics of Mexico's Electronics Industry

Mexico's electronics industry is a powerhouse, contributing globally. Here are some key statistics and insights to consider.

- Annual Exports: The industry boasts billions in annual exports, highlighting Mexico's critical role in the global electronics market.

- Position in the U.S. Market: Mexico is a leading supplier, ranking as the second-largest source of electronic products to the United States.

- Cost Efficiency: Manufacturing electronics in Mexico offers average cost savings of 15-20% compared to the United States, making it an attractive option for companies looking to optimize expenses.

Leveraging a mature industry

With over 730 manufacturing plants dedicated to audio and video equipment, telecommunications, and computer parts, Mexico is the largest exporter of flat-screen TVs globally. It is also the third-largest computer exporter and ranks eighth in global electronics production. Its top-grossing products include:

- Integrated circuits

- Computer CPUs and memory chips

- Network switches and routers

- Audio and video equipment

- Various electronic appliances and circuit boards

These figures underscore Mexico's established and dynamic electronics industry, making it a pivotal player on the global stage.

What Are the Top Electronic Products Exported by Mexico?

Mexico plays a significant role in the global electronics market, with a wide array of high-demand products. Here are the leading electronics exports from the country:

- Semiconductors and Integrated Circuits: Key components essential for electronic devices.

- Central Processing Units (CPUs) and Memory Chips: These vital components are crucial for computers and other digital devices, ensuring optimal performance and efficiency.

- Networking Equipment: Including items like network switches and routers, which facilitate data communication and connectivity across the globe.

- Audio and Visual Equipment: From cutting-edge televisions to innovative sound systems, Mexico produces a wide range of audio and video goods.

- Home Appliances: Electronic appliances that bring convenience to everyday life—ranging from microwaves to refrigerators—also form a significant part of Mexico's exports.

- Circuit Boards: Serving as the backbone of all electronic devices, these boards are integral to the assembly and operation of various gadgets and machines.

These products highlight Mexico's manufacturing capabilities and underscore its importance as a global electronics supplier.

Textiles: A Comeback Story

Textile manufacturing in Mexico has seen a resurgence, thanks to nearshoring trends. Why the shift?

- Speed to market: With fashion cycles shorter, brands need suppliers who can keep up. Mexico delivers.

- High-quality output: Forget the old stereotypes—Mexican textiles are world-class.

- Proximity matters: Shipping from Mexico to the U.S. takes days, not weeks, making it a no-brainer for brands looking to streamline logistics.

In a world where fast fashion rules, Mexico proves it can keep pace without cutting corners.

Mexican Industries to Watch in 2030

If you’re thinking long-term, keep an eye on these rising stars:

- Renewable energy: With its abundant sun and wind, Mexico is poised to become a clean energy leader.

- E-commerce logistics: As online shopping booms, so does the need for warehouses and distribution centers. Mexico has an abundance of both.

- Pharmaceuticals: With a skilled workforce and competitive costs, this sector is set to soar. The country is home to 20 of the 25 largest pharmaceutical companies in the world, including Merck, Schering Plough, Boehringer Ingelheim, Pfizer, Bayer, AztraZeneca, GlaxoSmithKline, and Roche.

There are several large national companies, such as Liomont, Sanfer, Silanes, Hormona, Rimsa, Arlex, Probiomed and Ophia.

Regulations, production practices, and certifications have all contributed to this boost.

Between today and 2030, Mexico’s GDP is projected to grow an average of 2.4 percent per year, reaching over $1.8 trillion. - The University of Denver

Manufacturing Locations and Site Selection

When it comes to manufacturing in Mexico, location isn’t just a pin on the map—it’s the foundation for success. From bustling cities known for aerospace innovation to regions where costs are as lean as your production goals, picking the right spot makes all the difference. But how do you choose a location that checks all the boxes? Let’s walk through it step by step.

The Top 3 Industries Thriving in Mexico’s Manufacturing Hubs

Mexico is a manufacturing powerhouse, with industries that have truly found their groove here:

- Automotive: Cities like Monterrey and Saltillo are home to a dense network of suppliers and assembly plants, making them ideal for automotive operations.

- Aerospace: The Bajío region, particularly Querétaro, is a hotbed for aerospace innovation, offering a skilled workforce and world-class facilities.

- Electronics: Guadalajara is often dubbed the “Silicon Valley of Mexico,” thriving as a center for tech manufacturing and R&D.

Each of these sectors has deep roots in Mexico’s manufacturing ecosystem, supported by a mix of free trade agreements, skilled labor, and infrastructure designed to keep things running smoothly.

Mexico is a manufacturing hub – not just for the US, but for companies around the world. In fact, the country’s recent 3.9% increase in industrial activity can mainly be attributed to this industry, which offers superior, cost-effective capabilities across many sectors. Working capital cycles here are short and small batch production is often utilised, resulting in agility and the ability for goods to make it to market quickly.

Meanwhile, shipping issues and costs are often eliminated as North America can be easily reached with ground transport. Goods shipped from here benefit from supply chain diversification, too, as transit times are cut, and risks are reduced. - HSBC

How to Choose the Right Manufacturing Location in Mexico

Choosing the right location isn’t as simple as pointing to a city on a map. It’s about aligning your business goals with what each region has to offer. Start by considering these factors:

- Proximity to Major Markets: If exporting to the U.S. is a priority, border cities like Matamoros or Ciudad Juárez might make sense.

- Workforce Availability: For labor-intensive operations, regions like the central states often have an abundance of skilled and semi-skilled workers.

- Infrastructure: Look for areas with robust transportation networks, like highways, railways, and ports. Veracruz, for example, is a key hub for maritime shipping.

The Best Mexican States for Low-Cost Manufacturing Operations

For businesses focused on cost efficiency, states like Tamaulipas (just across the bridge from Brownsville, Texas), Guanajuato, and Zacatecas offer lower labor costs without sacrificing quality. These areas balance affordability with access to skilled workers, making them perfect for industries like textiles, consumer goods, and agriculture equipment.

How Far Away is Brownsville?

Refer to the list below to determine how far away Brownsville is from most major U.S. cities.

City

Albuquerque

Atlanta

Boston

Chicago

Dallas

Denver

Detroit

Houston

Kansas City

Las Vegas

Los Angeles

Minneapolis

New York

Oklahoma City

Phoenix

San Diego

Seattle

St. Louis

Distance

992 mi

1,145 mi

2,196 mi

1,489 mi

559 mi

1,218 mi

1,744 mi

353 mi

1,101 mi

1,557 mi

1,632 mi

1,537 mi

1,982 mi

755 mi

1,259 mi

1,606 mi

2,436 mi

1,193 mi

The Most Cost-Effective Mexican Cities for Manufacturing Expansion

Expanding your operations doesn’t have to mean breaking the bank. Cities like Saltillo, Mexicali, and San Luis Potosí offer competitive costs on everything from labor to utilities. Plus, their strategic locations mean reduced shipping expenses for cross-border trade.

Matamoros, Tamaulipas

Matamoros, one of the Manufacturing Border Cities in Mexico, officially known as Heroica Matamoros, is a city in the northeastern Mexican state of Tamaulipas. It is located on the southern bank of the Rio Grande, directly across the border from Brownsville, Texas, in the United States. Matamoros is the second largest city in the state of Tamaulipas. As of 2016, Matamoros had a population of 520,367. In addition, the Matamoros–Brownsville Metropolitan Area has a population of 1,387,985 making it the 4th largest metropolitan area on the Mexico–US border. Matamoros is one of the fastest growing cities in Mexico, and has one of the fastest growing economies in the country. The economy of the city is significantly based on its international trade with the United States through the NAFTA agreement, and it is home to one of the most promising industrial sectors in Mexico, mainly due to the presence of maquiladoras.

How to Conduct a Site Analysis for Manufacturing in Mexico

Conducting a thorough site analysis can feel overwhelming, but it doesn’t have to be. Start with the basics:

- Evaluate Workforce Skills: Are there local training programs to support your industry?

- Inspect Infrastructure: Are roads and ports up to snuff?

- Review Incentives: Some states offer tax breaks or subsidies to attract manufacturers.

- Consider Local Regulations: Are they business-friendly, or will they slow you down?

Taking the time to dig into these details can save you headaches down the road.

Government Incentives for Reshoring in Mexico

By strategically aligning with the global trend of reshoring, leveraging Mexico's proximity to the U.S., benefiting from favorable trade agreements like the USMCA, and tapping into cost advantages, companies can position themselves for sustained success. This white paper explores the nuanced details of government incentives in Mexico. It will provide a comprehensive guide for businesses navigating reshoring opportunities. Fill out the form to receive the white paper today.

Why Mexico’s Geographic Location Makes It a Manufacturing Powerhouse

Mexico’s location is a big part of why it’s so attractive for manufacturers. Think about it: it shares a border with the world’s largest consumer market—the United States—making logistics faster and cheaper. Plus, with access to both the Pacific and Atlantic Oceans, global trade is a breeze. Whether you’re shipping to Europe, Asia, or the Americas, Mexico offers a logistical advantage few countries can match.

In the end, manufacturing in Mexico isn’t just about finding a factory space—it’s about building a strategy that works for your business. Whether you’re drawn to the aerospace hubs in Querétaro, the low-cost regions of Puebla, or the bustling border cities, the right location is out there. All it takes is a little planning and a clear vision of where you’re headed.

Costs and Financial Incentives

If you're exploring manufacturing in Mexico, there's a lot to unpack about the costs and financial benefits. From cutting supply chain expenses to leveraging Mexico's trade agreements, the numbers can work in your favor—if you know how to play the game. Let’s break it down.

Essential Start-Up Costs to Consider Before Manufacturing in Mexico

Manufacturers looking to reduce operating costs while maintaining high-quality production can benefit from manufacturing in Mexico. Understanding the essential start-up costs for manufacturing in Mexico is crucial for a successful venture. When setting up manufacturing operations in Mexico, businesses must account for the following expenses.

Setting Up and Acquiring Facilities

Costs of real estate

One of the most important steps in manufacturing operations is securing an appropriate facility. The following are involved:

- The cost of purchasing land or leasing property varies significantly by location, with Monterrey, Guadalajara, and Mexico City commanding higher prices. Manufacturing cities in the northern part of the country near Texas, like Matamoros, are less expensive.

- If constructing a new facility or renovating an existing one, expenses include materials, labor, and building code compliance.

Infrastructure and Utilities

It is indeed crucial to set up utilities for manufacturing operations to be efficient. Manufacturing in Mexico processes require reliable and efficient utility services such as electricity, water, gas, and wastewater management.

In order to maximize manufacturing productivity, utilities need to be set up. Here are some reasons why:

- Reliable Power Supply: A stable electricity supply is critical for running machinery and equipment, ensuring consistent production and minimizing downtime.

- Water and Gas Supply: Access to clean water and gas is necessary for various manufacturing processes, such as cleaning, heating, and powering equipment.

- Wastewater Management: Proper wastewater management is essential for environmental compliance and preventing production disruptions.

- Cost Savings: Efficient utility setup can help reduce energy and water consumption, leading to cost savings and minimizing waste.

- Compliance: Ensuring utilities are set up correctly helps manufacturers comply with environmental and safety regulations.

NovaLink Nearshore Manufacturing can assist with setting up utilities and ensuring manufacturing operations are efficient. As a result of outsourcing utility management to NovaLink, manufacturers can focus on their core operations while taking advantage of NovaLink's expertise in managing utility services.

Compliance With Legal and Regulatory Requirements

Licenses and permits

The following permits and licenses are required for manufacturing in Mexico:

- Business Registration: Formal registration of the business with Mexican authorities.

- Environmental Permits: Compliance with environmental regulations to minimize ecological impact.

- Health and Safety Certifications: Ensuring the facility meets occupational health and safety standards.

Regulations on Imports and Exports

Companies importing raw materials or exporting finished products from Mexico should follow these steps:

- Understanding customs duties and value-added tax (VAT) costs.

- Utilizing trade agreements like the USMCA to minimize tariffs and streamline cross-border trade.

Mexico's IMMEX Program: Avoiding the VAT

VAT is a tax collected on a product during stages of its manufacturing production, from the beginning of the production until the point of sale. How much a manufacturing company pays in VAT depends on the cost of the product, less the cost of previously taxed materials used in its production. The current rate of VAT for manufacturing materials is 16%.

How Does IMMEX Provide Cost Savings for the VAT?

The IMMEX program, in conjunction with the USMCA treaty signed in 2019, allows a VAT tax exemption, the entire 16%, for all temporary imported equipment, tools, and materials used in production while in a manufacturing facility in Mexico.

Costs of Labor

Recruiting and training

In Mexico, labor is one of the most important start-up costs:

- Recruitment costs, including advertising vacancies and hiring services.

- Ensure the workforce is skilled and efficient by implementing comprehensive training programs.

- Mexican labor laws mandate certain benefits, such as social security, housing funds, and profit-sharing, which can increase labor costs.

- Labor Regulations: Companies are required to comply with Mexico's labor laws, which can be complicated and time-consuming.

- Labor Costs: Manufacturing operations often require a large workforce, which increases labor costs.

- High employee turnover can lead to additional recruitment and training costs, while retention strategies, such as bonuses or incentives, can also raise labor costs.

- Depending on the location and industry, companies may have to negotiate with unions, which can affect labor costs.

Machinery and Equipment

Leasing and Purchasing

It can be difficult to acquire essential machinery and equipment for manufacturing in Mexico if you try to acquire it on your own rather than working with a nearshore partner like NovaLink, for the following reasons:

- Investing in state-of-the-art machinery to ensure high quality and productivity.

- Manufacturers incur significant setup costs when preparing production lines, tooling, and equipment. Low volumes or short runs lead to higher setup costs per unit due to a smaller number of units.

- A cost advantage is gained when production volume increases due to economies of scale. Fixed costs (such as machinery, labor, and overhead) can be spread over a larger number of units to reduce per-unit costs. Short-run or low-volume productions do not fully realize economies of scale, resulting in higher production costs.

- Purchases of materials in small quantities can be more expensive per unit than bulk purchases. Discounts are often offered by suppliers for larger orders, which reduces material costs. Low-volume or short-run productions may not qualify for these discounts, resulting in higher materials costs.

- A cost-effective production process requires efficient labor utilization. The time spent on setup, changeovers, and coordination between production runs may exceed the actual time spent on manufacturing in low-volume or short-run productions. Labor costs per unit increase as a result of this inefficiency.

- Manufacturing processes often generate waste and scrap, which increases production costs. In low-volume or short-run productions, waste per unit produced may be higher than in larger production runs. As a result, waste disposal and material losses result in higher per-unit costs.

- In addition to having an idea for a product, it's essential to have a clear understanding of the product concept, design specifications, target market, and manufacturing requirements before engaging with a nearshore manufacturing company. It may be difficult for the manufacturer to provide accurate guidance or support without a well-defined plan.

- In order to manufacture a product, it is crucial to assess its feasibility in terms of technical requirements, market demand, regulatory compliance, and production costs. If you engage with a nearshore manufacturing company prematurely without conducting feasibility studies, you might end up with unrealistic expectations or potential setbacks down the road.

Logistics and Supply Chain Management

Raw Material Sourcing

Raw material sourcing that is reliable and cost-effective:

- Reducing transportation costs and lead times by building relationships with local suppliers.

- Navigating import regulations and tariffs for materials that are unavailable locally for international suppliers.

Network of distribution

Creating an efficient distribution network:

- Costs associated with shipping finished products to domestic and international markets.

- Raw materials and finished goods are stored in warehouses at a cost.

Cost Summary

The following key areas must be carefully evaluated and budgeted for when setting up manufacturing operations in Mexico:

- Facility Acquisition and Setup

- Legal and Regulatory Compliance

- Labor Costs

- Equipment and Machinery

- Supply Chain and Logistics

When these costs are properly planned and allocated, businesses will have a smooth and efficient entry into the Mexican manufacturing sector, maximizing their long-term profitability and success.

Slashing Supply Chain Costs: Closer is Cheaper

One of the biggest wins with nearshore manufacturing in Mexico is reducing supply chain costs. Shipping from Asia can be slow and expensive—think long transit times, customs delays, and hefty freight fees. Mexico, on the other hand, is practically next door to U.S. businesses. Faster delivery means fewer disruptions and happier customers. Who doesn’t want that? Plus, you’ll save on inventory holding costs since shorter lead times let you operate at leaner stock levels.

Tax Incentives That Sweeten the Deal

Did you know Mexico offers some of the most favorable tax perks for manufacturers? Programs like IMMEX (Industria Maquiladora y de Servicios de Exportación) let you import raw materials tax-free if you export finished goods. The companies eligible to benefit from the IMMEX program must export finished products worth at least US $500,000. Their export revenues must also account for at least 10% of their annual sales.

Add to that VAT exemptions for export-oriented companies, and you’ve got a recipe for significant savings.

The Core Tax Benefits

Maquiladoras offers several core tax advantages that can significantly impact a company's bottom line:

- Income Tax Reduction: Maquiladoras can benefit from reduced income tax rates, which are often lower than those in their home countries.

- Value Added Tax (VAT) Exemptions: Exemptions on VAT for raw materials, machinery, and equipment can translate into substantial savings.

- Duty-Free Imports and Exports: Companies can import raw materials and export finished goods without paying customs duties.

Want to qualify? Ensure your paperwork is in order—those tax benefits are worth the extra effort.

Depreciation Benefits

Machines and equipment are also eligible for accelerated depreciation in Mexico.

In other words, manufacturers will be able to deduct their capital investment costs more quickly.

This leads to lower taxable income and additional cash flow for reinvestment.

Incentives such as this are particularly valuable to companies that require significant initial investment in advanced manufacturing technologies.

Following the release of measures to develop the Istmo de Tehuantepec Free Trade Zone, published in June 2023, the Mexican Government published the Decree to keep promoting and developing the nearshoring phenomenon to Mexico where eligible Mexican companies will be entitled to apply deductions described in the Decree for corporate income tax purposes. The rationale of the Decree is to direct incentives to key export sectors of the Mexican economy to boost competitiveness, innovation and investment in technology aimed at generating jobs and increasing direct foreign investment. - White and Case

Economic Zones: A Haven for Manufacturers

Mexico has established several Special Economic Zones (SEZs) to attract foreign investment and stimulate regional development. These zones offer additional incentives and benefits to manufacturers, making them highly attractive locations for operations.

These zones provide:

Skilled workforce: Proximity to technical schools and training programs.

Streamlined regulations: Simplified procedures for setting up and operating a business.

Infrastructure and utilities: Access to modern facilities, transportation networks, and essential services.

Yucatán Special Economic Zone

A hub for tourism, manufacturing, and logistics in southeastern Mexico.

Tijuana Industrial Park

A major manufacturing hub on the US-Mexico border.

Guadalajara Industrial Park

A significant center for technology and manufacturing companies.

Monterrey Industrial Park

A key location for manufacturing, logistics, and aerospace companies.

Watch Out for Hidden Costs

It’s not all sunshine and savings, though. Manufacturing in Mexico comes with its share of pitfalls. Labor costs are low, but what about hidden extras—like infrastructure upgrades, language barriers, or unexpected regulatory fees? Partnering with a local expert can help you avoid surprises. Think of it as an insurance policy for your investment.

10 Hidden Costs of Not Moving Manufacturing to Mexico

You probably take into account labor rates, logistics, and regulations when considering a shift in manufacturing operations.

Have you considered the cost of not moving?

In particular, not moving manufacturing to Mexico could mean more than just losing out on competitive labor rates: it could be a financial and operational blind spot that silently drains your business.

Paying Premium Labor Costs

If you’re manufacturing in the U.S. or other high-cost countries, labor is likely eating up a big chunk of your budget. In Mexico, wages are significantly lower for comparable skill sets, allowing companies to reduce costs without sacrificing quality. Staying put means paying premium prices for labor—money that could’ve been invested in innovation or growth.

High Taxes and Tariffs

You know what’s worse than paying taxes? Paying taxes and tariffs. Many companies overlook Mexico's trade agreements, like the United States-Mexico-Canada Agreement (USMCA), which simplifies cross-border trade. If your operation isn’t benefiting from these agreements, you’re probably overpaying for tariffs and import/export fees.

Missing Out on Proximity to the U.S.

China might be the go-to manufacturing hub for some, but what happens when you need to ship something quickly? Mexico’s proximity to the U.S. shortens shipping times and reduces freight costs. Without that geographical advantage, you’re stuck with expensive air freight or waiting weeks for ocean shipments.

Supply Chain Disruptions

Global supply chains are no strangers to chaos—pandemics, port closures, and geopolitical tensions can grind your operations to a halt. Relocating manufacturing to Mexico means you’ll remain vulnerable to disruptions. With Mexico, nearshoring simplifies your supply chain, bringing it closer to home and reducing risks.

Losing the Competitive Edge

Imagine your competitors slashing costs by manufacturing in Mexico. They can offer lower prices, faster turnaround times, or reinvest in research and development. Meanwhile, you’re stuck in a catch-up game, paying higher costs and missing out on opportunities to innovate or scale.

Overpaying for Energy

Energy costs might not be the first thing on your mind, but they should be. In some regions, electricity and fuel expenses are far higher than in Mexico. Not taking advantage of these lower energy rates could mean your overhead costs stay unnecessarily inflated.

Employee Turnover Expenses

Retaining employees in high-cost labor markets is expensive—training, benefits, and recruitment costs can add up fast. Mexico’s labor force is affordable, highly skilled and dedicated, meaning lower turnover and less hassle finding reliable talent.

Compliance Costs

Operating in countries with stringent environmental and labor regulations often leads to hefty compliance expenses. While Mexico certainly has standards, they’re often more business-friendly, allowing companies to focus on growth instead of getting bogged down in red tape.

Missed Growth Opportunities

Let’s be real: every dollar spent on inflated costs is a dollar not spent on growing your business. By not relocating manufacturing to Mexico, you’re maintaining the status quo. This is while your competitors invest in technology, expand their product lines, or enter new markets.

Losing Favor with Eco-Conscious Consumers

Consumers pay more attention to company carbon footprint. By manufacturing closer to your Mexico customer base, you can reduce shipping emissions and show your commitment to sustainability. Sticking with distant production hubs might not just cost you financially—it could cost you customers, too.

Currency Exchange Rates

Currency exchange rates can significantly impact labor costs for foreign companies operating in Mexico. When foreign companies establish operations in Mexico, they often need to pay their workforce in Mexican pesos. This means they must exchange their home currency (e.g., US dollars, euros, or others) into pesos to cover payroll expenses. Fluctuations in the exchange rate can increase or decrease labor costs when converting foreign currencies into Mexican pesos.

Crunching ROI Numbers

How do you know if nearshoring is worth it? Start by comparing labor, shipping, and tax savings to your setup and transition costs. Include expenses for legal compliance and facility setup. If the ROI feels murky, consider the intangibles: shorter lead times, better control, and improved customer satisfaction. Sometimes the numbers only tell part of the story.

Why Outsourcing Manufacturing to Mexico Makes Sense

Modern businesses are constantly seeking ways to optimize their operations and gain a competitive edge. Mexico is one of the countries that have gained considerable traction in recent years when it comes to outsourcing manufacturing. As a result of its strategic location, skilled labor force, cost advantages, and favorable trade agreements, Mexico offers numerous advantages to companies looking to streamline their production processes.

Mexico’s Low-Cost Production: The Profit Booster

Labor costs in Mexico are a fraction of those in the U.S. or Europe, but the value doesn’t stop there. High productivity levels and skilled workers make the country a goldmine for manufacturers looking to maximize profits. Combine that with affordable utilities and competitive raw material prices, and you’ve got a recipe for success.

Why Trade Agreements Make Mexico Ideal

Mexico’s extensive trade agreements, like USMCA, ensure low tariffs and streamlined cross-border trade. This eliminates high import/export taxes, making Mexico manufacturing even more attractive. Plus, proximity means fewer political and logistical risks than far-flung suppliers.

Source: National Association of Manufacturers. NAM Releases USMCA State Data Sheets

USMCA

According to Investopedia, USMCA is “…a trade deal between the three nations which was signed on November 30, 2018. The USMCA replaced the North American Free Trade Agreement (NAFTA), which had been in effect since January of 1994. Under the terms of NAFTA, tariffs on many goods passing between North America’s three major economic powers were gradually phased out.”

There are many reasons why USMCA is significant, but the most important reason is the ability to save money for US businesses. Tariffs have been reduced between the nations; investments have been encouraged in North American industrial buildings, and international markets have been opened. The USMCA provides duty-free treatment for goods that qualify under its rules of origin, which avoid two percent tariffs.

The USMCA has also significantly strengthened U.S. supply chains. COVID-19 and increasing competition with China have highlighted the vulnerability of relying on Chinese supply chains. According to the Brookings Institute:

“The significance of USMCA is clear. Canada and Mexico are the United States’ largest export markets: 23 percent of U.S. exports go to Canada and Mexico (versus 5 percent to China), over 70 percent of Mexican exports are sent to the U.S. and Canada, and 62 percent of Canadian exports are to the U.S. and Mexico. Trade among the countries provides key inputs into regional supply chains’ value added (40 percent U.S. value add versus 5 percent China). “

Qualifying for Tax Reductions

Want those juicy tax cuts? Keep your operations export-oriented and compliant with Mexican labor and environmental laws. Hiring local experts or working with a shelter company can simplify the process, ensuring you don’t miss out on savings.

Wrapping It Up: Undeniable Cost and Financial Benefits

Manufacturing in Mexico offers undeniable cost and financial benefits. From lower labor and logistics expenses to generous tax incentives, the country is a haven for businesses looking to grow efficiently. Sure, there are challenges, but with proper planning, the advantages far outweigh the risks. Ready to move? The numbers don’t lie—Mexico’s the place to be.

Partnerships and Collaboration

Manufacturing in Mexico isn't just about finding a factory and calling it a day. It's about building relationships that'll make your business thrive. You know what? The right partnership can be the difference between a smooth operation and a total headache. So, let's chat about how to nail this crucial aspect of manufacturing in Mexico.

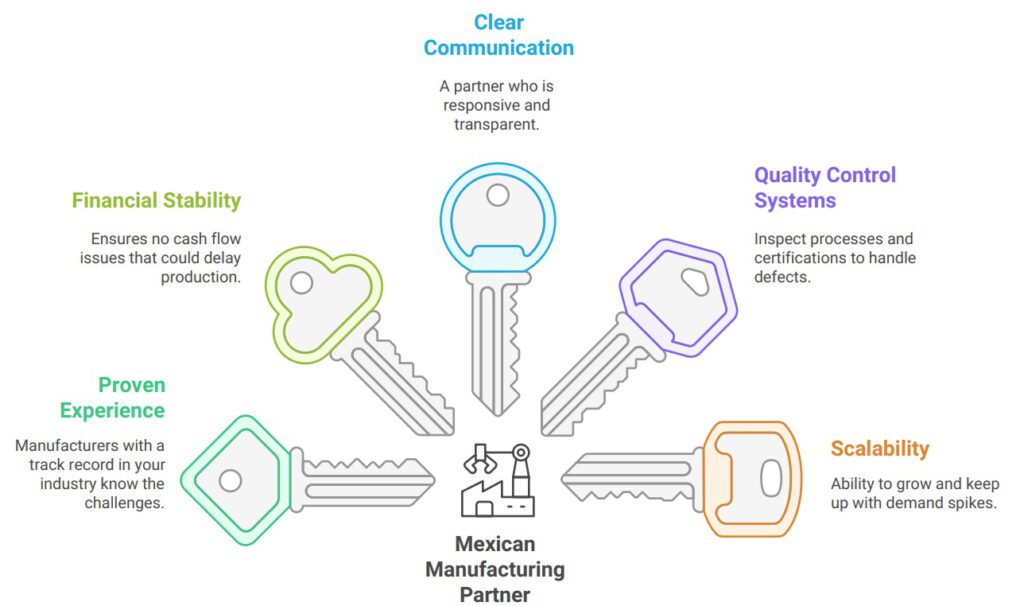

Choosing the Right Partner: What Really Matters?

Not all manufacturers in Mexico are created equal. Some have state-of-the-art facilities but struggle with communication. Others are great at production but can’t handle logistics. So, what should you look for?

5 Must-Have Qualities in a Mexican Manufacturing Partner

A strong partner isn’t just a vendor—they’re an extension of your business. They should make your life easier, not more complicated.

Getting It in Writing: How to Structure Contracts

A handshake won’t cut it. You need a contract that protects both sides and sets clear expectations. Here’s what it should cover:

- Pricing & Payment Terms – Define costs clearly, including raw materials, labor, and additional fees.

- Production Timelines – Outline deadlines and penalties for delays.

- Quality Standards – Include specific benchmarks and inspection protocols.

- Intellectual Property Protection – Ensure your designs, patents, and trade secrets are legally safe.

- Exit Strategy – What happens if things don’t work out? Spell out the termination process.

Mexican manufacturing contracts don’t have to be complicated, but they do need to be thorough. Having a local attorney review everything is always a smart move.

Thinking Long-Term: How to Build Lasting Supplier Relationships

A good supplier relationship isn’t just about business—it’s about trust. Here’s how to strengthen it over time:

- Visit Their Facility – Nothing builds rapport like face-to-face interaction. Plus, you’ll get a firsthand look at their operations. Due to Mexico's location, this is easy to accomplish.

- Be Transparent About Expectations – The more they understand your business goals, the better they can support you.

- Invest in Their Growth – If your supplier needs new equipment or training to meet your needs, consider co-investing. It’s a win-win.

- Maintain Regular Communication – Monthly check-ins keep things running smoothly and help you catch issues before they become major problems.

- Pay Fairly and Promptly – Reliable payments mean your orders get priority. It’s that simple.

Long-term success in manufacturing in Mexico isn’t about chasing the lowest price. It’s about working with partners who can help you deliver quality products on time—every time.

Questions That Matter: How to Vet a Manufacturing Partner in Mexico

Before signing any agreements, ask the tough questions:

- Who are your existing clients? (Reputable manufacturers should have references.)

- What’s your defect rate? (A vague answer is a red flag.)

- How do you handle production delays? (Every factory faces hiccups—what matters is how they respond.)

- What’s included in your pricing? (Avoid surprise costs.)

- How do you manage workforce turnover? (High turnover can impact consistency.)

The right partner should be able to answer these questions without hesitation. If they can’t, keep looking.

Case Study: Seats Incorporated

NovaLink began working with Seats, Inc., an OEM and contract manufacturer of seating, in 2017. A unique challenge faced Seats: an abundance of business, but not enough resources to handle it. To learn how NovaLink was able to resolve Seats’ issue in just 10 weeks, please download the case study.

Finding the Right Manufacturing in Mexico Team For Success

Manufacturing in Mexico can be a game-changer—but only if you team up with the right people. Take your time, ask the right questions, and focus on long-term success. The best partnerships aren’t just about business; they’re about trust, reliability, and mutual growth. Find the right partner, and you’ll set yourself up for years of smooth operations and steady profits.

Business Models and Strategies for Manufacturing in Mexico

When it comes to manufacturing in Mexico, the business model you choose can make or break your operation. Whether you're a newcomer eyeing Mexico for the first time or a seasoned manufacturer looking to transition closer to home, understanding the available strategies is key. Let’s break it down step-by-step.

What’s the Deal with the Shelter Manufacturing Model?

Think of the Mexican shelter manufacturing model as your shortcut to hassle-free operations. Here’s how it works: a local shelter company essentially “hosts” your business under their umbrella. They handle all the bureaucratic headaches—permits, compliance, taxes—so you can focus on what you do best: manufacturing.

This model is popular for a reason. It gives companies a soft landing in Mexico without needing to set up a legal entity. That means you can start operating faster and reduce risks tied to navigating unfamiliar regulatory landscapes. Plus, shelter companies often come with deep local expertise, which can save you a ton of time and money.

But here’s the catch: you’ll pay a fee for those services. So, it’s perfect for companies that want to hit the ground running but might not suit businesses looking for absolute autonomy.

The Six Types of Mexico Shelter Companies

Did you know that there are six different types of shelter companies, each with its unique benefits and advantages?

Contract Manufacturing Shelter

A Contract Manufacturing Shelter is ideal for companies that want to manufacture in Mexico without setting up a legal entity. You'll partner with a local contract manufacturer, who produces your products to your specifications. This type of shelter company is appropriate for businesses that want to test the Mexican market or need temporary manufacturing capacity.

Joint Venture Shelter

A Joint Venture Shelter involves partnering with a local Mexican company to create its own legal entity. This type of shelter company is suitable for businesses that want to share risks and rewards with a local partner. This is done by leveraging their expertise and knowledge of the Mexican market.

Wholly Owned Subsidiary Shelter

A Wholly Owned Subsidiary Shelter allows you to establish a fully owned Mexican subsidiary, giving you complete control over your operations. This type of shelter company is ideal for businesses that want to integrate Mexican operations into their global strategy.

Free Trade Zone Shelter

A Free Trade Zone Shelter operates within a designated free trade zone in Mexico, offering duty-free imports and exports, as well as other tax benefits. This type of shelter company is suitable for businesses that import and export goods regularly.

IMMEX Shelter

An IMMEX shelter is a special program that allows you to temporarily import goods and materials duty-free, as long as they're re-exported or transformed into a final product. This type of shelter company is ideal for businesses that need to import goods for assembly or manufacturing. IMMEX shelters are better suited for companies that wish to manufacture in Mexico long-term and partner with a company like NovaLink.

Service-Based Shelter

A Service-Based shelter provides administrative and operational support, such as human resources, accounting, and logistics, allowing you to focus on your core business activities. This type of shelter company is suitable for businesses that want to outsource non-core functions and streamline their operations.

How to Start a Manufacturing Operation in Mexico (Without Losing Your Mind)

Starting from scratch in Mexico might sound intimidating, but it’s not as complicated as you think—if you’ve got a roadmap.

Here’s a simple step-by-step guide:

- Do Your Homework: Research regions based on your industry. Automotive? Check out Bajío. Electronics? Think about Tijuana or Monterrey.

- Choose a Business Model: Shelter? Joint venture? Wholly owned subsidiary? Each comes with pros and cons.

- Find the Right Partners: You’ll need reliable suppliers, legal advisors, and possibly a shelter provider.

- Secure Permits and Licenses: Mexico has specific labor, environmental, and trade regulations you’ll need to follow.

- Set Up Your Facility: Look for an industrial park or free trade zone to maximize benefits like tax breaks.

- Hire and Train Local Staff: Mexico’s workforce is skilled and hardworking, but you’ll need to invest in training to align with your processes.

Sure, it’s a bit of a process, but you don’t have to go it alone. Plenty of firms like NovaLink specialize in guiding businesses through the setup stage, some as fast as 30 days.

Making the Switch: Offshore to Nearshore Manufacturing in Mexico

If you’re transitioning from offshore manufacturing—say, in Asia—Mexico offers a lot more than just proximity. Let’s be honest: shipping delays, tariffs, and geopolitical uncertainty have made offshore manufacturing a headache. Nearshoring to Mexico solves a lot of those problems.

Here’s how to make the switch smoothly:

- Audit Your Supply Chain: Figure out what parts of your process can be relocated without disrupting operations.

- Build Relationships Early: Start networking with local suppliers and logistics providers before you move.

- Understand Trade Agreements: Mexico is part of USMCA, which gives it a huge edge over other countries.

- Embrace Incremental Transitioning: Start small—maybe shift one product line at first—before going all in.

Transitioning isn’t without its challenges, but the reduced shipping costs and faster turnaround times often outweigh the growing pains.

Moving Manufacturing to Mexico Can Save Time and Paperwork

Additionally, moving manufacturing to Mexico can save time and paperwork, which will ultimately result in significant cost savings. For these reasons, U.S. goods and services trade with Mexico totaled an estimated $577.3 billion in 2021.

Reduction in Legal Liability

A foreign investor doing business in Mexico through a Mexican subsidiary has traditionally been protected from liability for the debts and obligations of the Mexican subsidiary.

Knowledge of Mexico Business Practices

Manufacturing companies often make the mistake of assuming they know enough about Mexico to do it on their own. The majority of shelter manufacturers can assist you in cutting through the red tape in starting your manufacturing operation by providing analyses, site visits, classifications, permits, factory setup, and training. Also, Mexico's industrial capabilities make choosing a location for a manufacturing operation less difficult; most places in the country have some sort of industrial facility, although some locations are more suitable than others.

Quick Setup Model

There are many factors that influence this, such as equipment, training and sourcing materials. However, some companies who are interested in starting manufacturing in Mexico can do so within a month. Since many shelter manufacturing companies are incorporated in Mexico, and hold current maquiladora permits, there is no legal aspect to this process.

Protection of Intellectual Property

Intellectual property theft is a tremendous problem in China. The new USMCA agreement strengthens intellectual property rights even further in Mexico, with one of its main objectives to protect the Intellectual Property Rights of products between the United States, Mexico, and Canada. In accordance with the Office of the United States Trade Representative:

“The United States, Mexico, and Canada have reached an agreement on a modernized, high-standard Intellectual Property (IP) chapter that provides strong and effective protection and enforcement of IP rights critical to driving innovation, creating economic growth, and supporting American jobs.”

By enforcing these rights, it becomes very difficult, if not impossible, for companies manufacturing in Mexico to have their intellectual property rights stolen.

Why the U.S. is Looking South

You’ve probably noticed that a lot of American companies are moving their operations to Mexico. It’s not just a trend—it’s a calculated strategy.

Here’s why:

- Cost-Effective Labor: While wages are rising in Asia, Mexico offers a skilled workforce at competitive rates.

- Proximity: Let’s face it—being a two-hour flight from your factory beats waiting weeks for shipments to cross the Pacific.

- Supply Chain Stability: Mexico’s close ties to the U.S. mean fewer surprises and disruptions.

- Government Incentives: Mexico actively courts foreign manufacturers with tax breaks and support programs.

Building a Resilient Future-proof Operation

So, what’s the takeaway? If you’re considering manufacturing in Mexico, the possibilities are endless—whether you’re leaning towards a turnkey shelter model or planning to go all-in with a standalone operation. Sure, it takes effort to get started, but with the right strategy, the rewards are well worth it.

And remember, this isn’t just about saving money or shortening lead times. It’s about building a resilient, future-proof operation. After all, isn’t that what every company wants?

Workforce and Labor: The People Powering Manufacturing in Mexico

If you're considering manufacturing in Mexico, labor is one of the biggest factors. And rightly so. The workforce isn’t just a cost line on a spreadsheet—it’s the backbone of your entire operation. So, what does Mexico bring to the table? A highly skilled, cost-effective, and reliable labor force that makes manufacturing here a global advantage. Let’s break it down.

Labor Costs: How Mexico Stacks Up Against North America

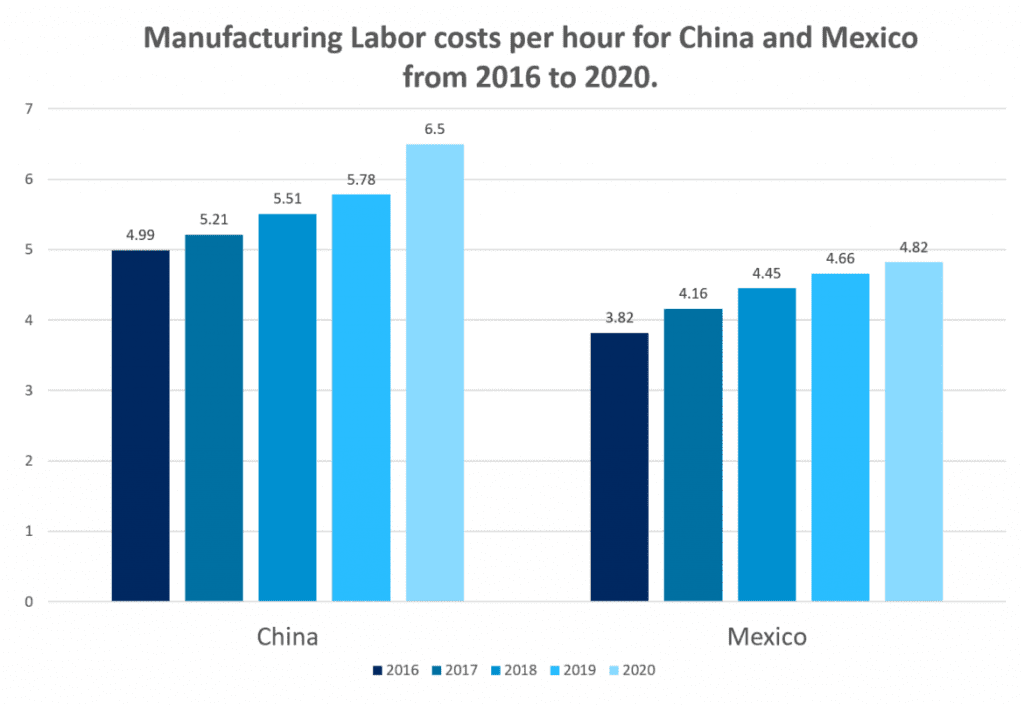

Let’s address the elephant in the room: cost. Labor in Mexico is significantly cheaper than in the U.S. and Canada. Depending on the industry and skill level, wages can be 40–70% lower than in the U.S., while still offering high levels of expertise. According to a recent study, Mexico's average labor cost per hour is around $4.50, compared with China's $6.50. In industries with high labor costs, this can result in substantial savings.

That’s not just a way to cut costs—it’s a way to reinvest in quality, training, and innovation.

But it’s not just about wages. Employee benefits, social security contributions, and overall labor costs in Mexico remain highly competitive compared to other nearshoring options. When you factor in logistics savings and trade agreements like USMCA, the financial case for moving production south gets even stronger.

The Skilled Hands and Sharp Minds Behind the Work

Low costs don’t mean low quality. Mexico's workforce is known for precision, adaptability, and technical know-how. Whether it’s automotive, aerospace, electronics, textiles, or medical devices, Mexicans are well-trained in industry-specific skills. Many have years of experience working with global brands and know international manufacturing standards.

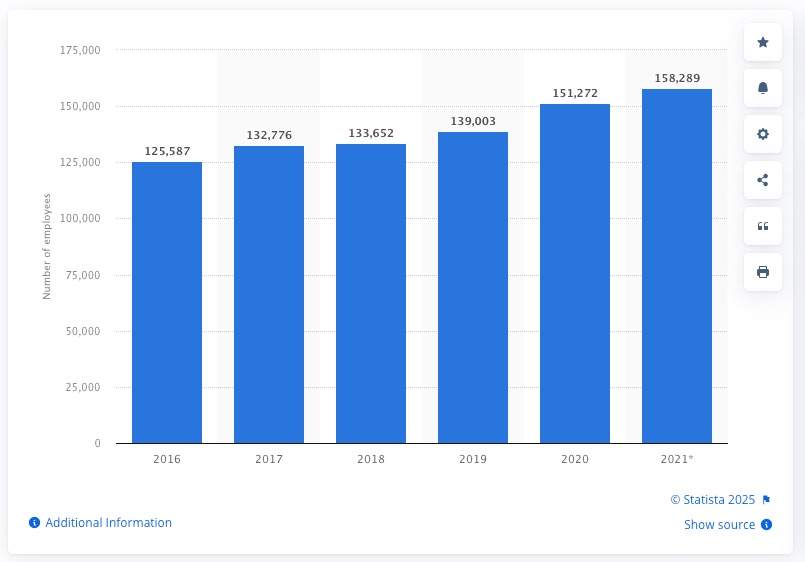

Mexico has been a secret weapon for tech companies developing pools of talent outside the U.S. for decades. In the last ten years, Mexico has seen significant growth in STEM education and graduates an average of 130,000 engineers and technicians annually. - TechCrunch

Here’s a key advantage: manufacturing in Mexico isn’t just about repetitive assembly-line work. Workers are known for problem-solving, quality control, and technical expertise. That’s a game-changer for companies that need reliable production without high turnover or rework.

Mexico Can Help Fill the Skills Gap Void

The problem of finding workers for manufacturing companies may be solved beyond the southern border of the United States. It is possible for American manufacturing companies to fill production gaps with the skilled labor pool in Mexico.

In the past, international labor has been an important component of economic growth and development for employers. Manufacturers can use workers from other companies, such as Mexico, to supplement their existing workforce and fill skill gaps, both for high-level professionals and skilled workers. Furthermore, the USMCA treaty makes it even easier for US companies to access Mexican skilled labor.

“Mexico enjoys a low unemployment rate, a highly educated workforce with multiple generations of manufacturing experience, and an economically active demographic with a median age of 30 years. Today, Mexico is second only behind Canada among countries with the largest percentage of employment per capita in creative industries. Mexico also graduates more engineers per capita on an annual basis than the United States. In the manufacturing sector, the average wage is about $2 an hour in Mexico, vs. about $20 per hour in the U.S. This pool of skilled workers in Mexico is a benefit for foreign companies looking to reduce labor costs but keep a high level of quality standards for their products.” - Baker-Tilley

Matching Your Production Needs with Mexico’s Workforce

Every industry has unique labor requirements, and Mexico offers a diverse talent pool to fit different manufacturing needs.

- Automotive & Aerospace: Skilled engineers and technicians trained in lean manufacturing, Six Sigma, and advanced production techniques.

- Electronics: Precision assembly workers with experience in circuit boards, wiring, and high-tech components.

- Textiles & Apparel: Artisans and skilled operators for the cut-and-sew, dyeing, and finishing processes.

- Medical Devices: Workers trained in cleanroom production and FDA-compliant manufacturing.

One of the biggest advantages is? Mexico’s workforce is highly trained and adaptable. Many manufacturers develop customized training programs to upskill workers based on specific production needs.

Universities & Technical Schools: The Pipeline for Future Talent

Mexico doesn’t just have a workforce—it has a talent pipeline. Universities, polytechnic institutes, and technical training centers work hand-in-hand with industry to ensure students graduate with job-ready skills.

- Engineering Powerhouses: Schools like Monterrey Institute of Technology (ITESM) and UNAM produce top-tier engineers, many with hands-on manufacturing experience before they graduate.

- Technical Training Centers: Institutions like CONALEP and Universidad Tecnológica focus on specialized vocational programs tailored to industrial needs.

- Industry Partnerships: Many schools collaborate with manufacturers on apprenticeship programs, ensuring a steady flow of skilled workers into the labor market.

For companies setting up long-term operations, engaging with local universities and training centers can help build a customized workforce pipeline—a strategy used successfully by top manufacturers like BMW, Honeywell, and Siemens in Mexico.

Managing Legal and Regulatory Issues

The H-2A Program: An Overview

Businesses must navigate complex visa programs to hire Mexican workers legally. H-2A and H-2B visas are commonly issued to agricultural and non-agricultural seasonal workers. In order to avoid legal issues, employers must strictly comply with U.S. immigration laws. Working with a nearshore manufacturing partner can expedite these challenges.

Labor Laws and Wages

Employers must also comply with labor laws protecting foreign workers, especially in Mexico. A positive work environment requires fair pay, safe working conditions, and compliance with labor regulations. Having Mexican workers or any foreign workforce can be beneficial to a business, but they must be treated with dignity and respect. Wage and labor laws not only protect employees, but also safeguard the employer's reputation and legal standing, contributing to a harmonious and productive workplace.

Addressing Cultural and Language Barriers

Communicating effectively

Hiring Mexican workers can be challenging due to language barriers. Investing in language training programs can facilitate effective communication between employees and supervisors. An interpreter or bilingual staff can also assist in bridging this gap.

Cultural Differences: Understanding

The integration of Mexican workers into the workforce requires cultural sensitivity. Harmony and productivity can be fostered by understanding and respecting cultural differences.

Why Mexico’s Workforce is a Competitive Advantage in Global Manufacturing

When you step back and look at the full picture, Mexico’s labor force is one of the biggest reasons manufacturers shift operations south. It’s not just about cost savings—it’s about getting the right mix of skill, reliability, and scalability.

Here’s what sets Mexico apart:

- Work Ethic & Reliability – High productivity, a strong work culture, and low turnover rates.

- Technical Expertise – Skilled labor across multiple industries, with specialized training programs.

- Competitive Costs – Substantially lower than in the U.S. and Canada, without sacrificing quality.

- Education & Training – A strong pipeline of engineers, technicians, and specialized labor.

- Proximity to the U.S. – A bilingual workforce and time zone alignment make collaboration easy.

Schutt Sports Case Study

Schutt Sports needed a partner that could help them cut operations costs from a main line in their manufacturing operations: refurbishing and reconditioning football helmets for a variety of clients, including high schools, major college football programs, and the NFL. In addition, Schutt also required a large labor force for this extensive refurbishing & assembly in Mexico operation that could scale up and reduce for their seasonal production.

If you’re looking for cost-effective, high-quality manufacturing, you won’t find a better workforce than Mexico's. Skilled. Hardworking. Industry-ready. That’s the real competitive edge.

Logistics, Supply Chains and Operations

Setting up manufacturing in Mexico is a smart move—lower costs, skilled labor, and easy access to the U.S. market. But getting products from point A to point B? That’s where things get tricky. Logistics and supply chain management aren’t just about moving things around; they’re about efficiency, resilience, and making sure your business runs like a well-oiled machine. Let’s discuss how to do it right.

Work Smarter, Not Harder: Streamlining Supply Chains with a Mexico-Based Partner

Partnering with an experienced logistics provider in Mexico isn’t just a convenience—it’s a necessity. Cross-border manufacturing comes with its own set of rules, from customs regulations to transportation networks, and a local expert can help you sidestep costly mistakes.

Here’s what to look for in a solid supply chain partner:

- Experience with U.S.-Mexico trade laws – Tariffs, import/export paperwork, and regulatory compliance can be a headache if you don’t have the right guidance.

- Strong transportation networks – The right partner will have established relationships with trucking and rail companies to ensure smooth movement across the border.

- Technology-driven tracking – Real-time data on shipments prevents bottlenecks and costly delays.

Think of it this way: an excellent logistics partner is like a GPS for your supply chain. They help you navigate the twists and turns so you can stay on the fastest route.

Supply Chain Questions You Should Answer Before Manufacturing in Mexico

You should always ask prospective manufacturing partners for specific supply chain metrics to make sure they’re capable of producing your product. Here are a few questions you should ask before reshoring manufacturing to Mexico:

- Turnover rate: Is your partner able to sustain a labor pool for his projects and increase them when needed?

- Factory costs: Is there some unforeseen overhead you may not have expected or need to plan for?

- Transportation costs: Again, with regards to location, what are the average costs and expenses related to the transportation of your goods to market?

- Port of Entry time for crossing trailers: If you have decided on a shelter manufacturing partner, what is the average time it takes for your goods to be transported across the border into the U.S.?

Speed to Market: Why Mexico’s Proximity to the U.S. Gives You an Edge

One of the biggest perks of manufacturing in Mexico? It’s next door. That means you’re not dealing with long lead times and shipping uncertainties associated with Asia sourcing.

- Faster delivery times - Monterrey to Texas shipment takes days, not weeks. Compare that to ocean freight from China, which can take over a month.

- Lower inventory costs – Faster turnaround means you don’t have to stockpile excess inventory, freeing up cash flow.

- Flexibility – Need to adjust production? You’re not locked into long shipping schedules, giving you more agility to respond to market demand.

Time is money, and Mexico’s close proximity keeps you ahead of the game.

Why U.S. Companies Are Moving Their Supply Chains From China to Mexico

Does Mexico have supply chain issues? In spite of the fact that all exporting companies face supply chain challenges, Mexico seems to face fewer challenges than other manufacturing countries, such as China. Supply Chain Brain has a list of reasons why companies are moving their supply chains from China to Mexico.

Ground Transport

Goods can be imported from Mexico via ground transport in a matter of days or even hours. This is never an option for goods manufactured in China, from which everything must come by ocean or air. The former is very time consuming (it can often take weeks), and the latter is very expensive.

"Trusted Partner" Status for Customs

The U.S. offers two programs that help facilitate faster and easier Customs processing for U.S.-Mexico trade: FAST and C-TPAT. Initiated after 9/11, FAST is a trusted traveler/trusted shipper program that allows expedited processing for commercial carriers who have completed background checks and fulfill certain eligibility requirements (much like TSA Precheck for air travelers). FAST certification is for drivers; C-TPAT is a broader program that shippers must apply for. Once a company is certified for C-TPAT, its drivers can then apply for FAST. There are no such programs for U.S.-China trade.

A Transparent Landscape

There are also new modern options for transport that make Mexico attractive. Companies can coordinate door-to-door transportation between the U.S. and Mexico, including procurement of trucks on both sides of the border, customs clearance, insurance, financing, and reporting. This allows manufacturers to focus on their core competency, rather than logistics, and can also reduce the need for big in-house shipping and logistics teams.

Small Language Barrier

Spanish is the second-most common language spoken in the U.S., making it relatively easy to communicate with partners in Mexico (and find bilingual staff and vendors).

Spanish is the second-most common language spoken in the U.S., making it relatively easy to communicate with partners in Mexico (and find bilingual staff and vendors).

Logistics Optimization: Making the Mexico-U.S. Partnership Work for You

Strong supply chains aren't just about where you manufacture—it’s about how you move goods efficiently between suppliers, factories, and customers.

Some key logistics strategies include:

- Leveraging nearshoring hubs – Cities like Nuevo Laredo, Tijuana, and Matamoros are major trade corridors with top-tier infrastructure.

- Using trusted customs brokers – Customs clearance is one of the biggest potential roadblocks, so having an experienced broker helps avoid delays.

- Multimodal shipping – Combining truck, rail, and air freight keeps your options open, reducing risk and cutting costs.

Getting logistics right isn’t just about cutting costs—it’s about reliability. A few small changes can make a big difference in efficiency.

Distribution Center: Warehousing, Logistics and Fulfillment

NovaLink also offers warehousing and storage services for its customers. You can drop-ship products directly to your customers, and we’ll have them there in a hurry from the time the order is received at our facility. We can also ship bulk back to your operations or direct to retail.

Building a Resilient Supply Chain: Why Mexico-Based Suppliers Are Key

If the past few years have taught us anything, it’s that supply chains need to be resilient. The pandemic, global shipping disruptions, and material shortages exposed weak links in manufacturing. The good news? Mexico offers a strong supplier base to minimize risk.

Why work with Mexico-based suppliers?

- Less dependency on overseas materials – The more you source locally, the less you’re impacted by global supply chain disruptions.

- Stronger supplier relationships – Proximity means better communication and collaboration with suppliers, leading to better quality control.

- Reduced transportation risks – Sourcing from within Mexico eliminates international ocean freight unpredictability.

Further enhancing supply chain continuity is Mexico’s extensive and well-developed transportation and logistics infrastructure. Highways, railways, ports, airports, and designated special economic zones (SEZs) are at optimum operational levels, facilitating smooth and efficient logistics. Mexico’s proximity to North America and efficient logistics enable quicker turnaround times at lower costs. - Power and Motion

Supply chains are like dominoes—when one piece falls, it affects everything. The stronger your supplier network, the safer your operation.

Making the Move: Managing Logistics When Relocating Your Supply Chain to Mexico

Relocating a supply chain takes time. It takes planning, strategy, and the right partners.

Here’s how to ensure a smooth transition:

- Start with a logistics assessment – Map out your entire supply chain and identify potential bottlenecks before making the switch.

- Work with a relocation specialist – Many companies specialize in helping businesses transition to Mexico smoothly.

- Test the waters – Before moving everything, consider a phased approach where you gradually shift production and supply chain operations.

Moving your supply chain is a big decision, but with the right approach, it doesn’t have to be painful.

Cross-Border Manufacturing Agreements: Managing Risk Without Losing Sleep

No one likes surprises in supply chain agreements. The most effective way to mitigate risk? Get everything in writing clearly.

Things to remember when structuring agreements:

- Clarify terms on tariffs and duties – Trade policies can change, so ensure your contracts account for potential shifts.

- Include contingency plans – What happens if there’s a shipping delay or a supplier issue? Build backup options into your agreements.

- Protect intellectual property – Mexico has strong IP protections, but it’s always smart to include specific clauses in contracts.

A bit of legal foresight can save headaches down the road.

Conclusion: Get Logistics and Supply Chain Operations Right

Manufacturing in Mexico offers huge advantages—but only if you get logistics and supply chain operations right. Whether it’s working with the right partners, optimizing transportation, or ensuring supplier stability, every decision you make impacts efficiency, cost, and ultimately, success.

And let’s be honest: no one wants shipping nightmares or supply chain chaos. With the right strategy, you won’t have to.

Government Regulations and Compliance

When it comes to manufacturing in Mexico, the regulatory landscape is a mix of opportunity and red tape. On one hand, Mexico has streamlined trade agreements, tax incentives, and legal structures that make it an attractive destination for manufacturers. On the other, navigating labor laws, environmental regulations, and import/export requirements can get tricky—especially if you’re unfamiliar with how things work south of the border.

So, how do you stay compliant while keeping operations smooth? Let’s break it down.

Understand IMMEX (Maquiladora Program) – This allows manufacturers to temporarily import raw materials duty-free, provided they’re exported as finished goods. The catch? You must comply with strict reporting and inventory control rules.

Register Your Business Properly – Whether setting up a standalone entity or partnering with a shelter company, legal registration impacts tax obligations and liability.

Keep Up With Trade Agreements – Mexico’s free trade agreements (like USMCA) offer duty-free benefits, but only if you meet origin requirements and documentation standards.

Follow Environmental Standards – Manufacturing in Mexico involves regulations on waste disposal, emissions, and water usage. Skipping compliance can lead to hefty fines.

Hire Legal and Compliance Experts – A local consultant, nearshore manufacturing partner or attorney can save you from misinterpreting regulations and facing legal headaches down the line.

Mexican tax law distinguishes between residents and non-residents, whether they are individuals, companies or other entities treated as corporate bodies. As a general rule, residents are subject to taxation in Mexico on their worldwide income, whereas non-residents are taxed only on their income derived from Mexico. Legal entities are considered Mexican residents if they are headquartered in Mexico, meaning they have established their main business administration or place of effective management in Mexico. There are specific rules under domestic law and double taxation signed by Mexico, to determine tax residency for individuals. - Denton's

How to Ensure Compliance When Outsourcing to Mexico

Many foreign companies choose contract manufacturers in Mexico to streamline production. But outsourcing doesn’t mean offloading responsibility. Here’s how to stay compliant:

- Verify Your Partner’s Certifications – Ensure they follow ISO standards, labor laws, and environmental regulations.

- Clarify Intellectual Property Agreements – Protecting proprietary designs and processes is crucial when working with a third party.

- Stay on Top of Tax and Customs Laws – Even if you’re not physically operating in Mexico, tax obligations can still apply.

A well-structured contract with clear compliance clauses can prevent misunderstandings and legal pitfalls.

The Top Legal Challenges of Manufacturing in Mexico (and How to Solve Them)

No regulatory system is without its hurdles. Some of the biggest legal challenges foreign manufacturers face include:

- Labor disputes – Mexico’s labor unions are active, and noncompliance with labor laws can lead to strikes or legal claims. Solution? Stick to fair labor practices and maintain open communication with workers.

- Bureaucratic red tape – Permits and certifications can take time. Solution? Work with an experienced compliance team to streamline approvals.

- Tax audits – The Mexican government closely monitors businesses for tax compliance. Solution? Keep meticulous records and work with a tax professional.

How to Navigate Mexico’s Labor Laws as a Foreign Manufacturer

Mexico’s labor laws are designed to protect workers, and violating them can lead to severe penalties. Key things to keep in mind:

- Mandatory Profit Sharing (PTU) – Companies must share 10% of their taxable profits with employees.

- Limits on Temporary Contracts – Unlike in some countries, you can’t keep workers on indefinite short-term contracts.

- Overtime and Benefits – Labor laws require overtime pay, paid vacation, and other benefits.

A substantial and innovative update in USMCA is the new methods of monitoring and dispute resolution–the Rapid Response Mechanism (RRM). The RRM is the strictest and most binding tool for enforcing labor rights ever included in a trade agreement. The RRM allows the U.S. and Canadian governments to raise concerns about compliance with the labor rights in the USMCA. The United States and Canadian governments can use the RRM to request the Mexican government to initiate investigations to determine if workers were denied of freedom of association and collective bargaining rights. - Brookings Institute

Top 3 Compliance Issues When Manufacturing in Mexico